- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2360

3 Growth Companies With Insider Ownership As High As 26%

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, such as the S&P 500's recent advances and the European Central Bank's interest rate cuts, investors are keenly observing growth opportunities in various sectors. In this context, companies with high insider ownership often attract attention due to their potential alignment between management and shareholder interests, making them intriguing prospects for those seeking growth in today's evolving market landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Here's a peek at a few of the choices from the screener.

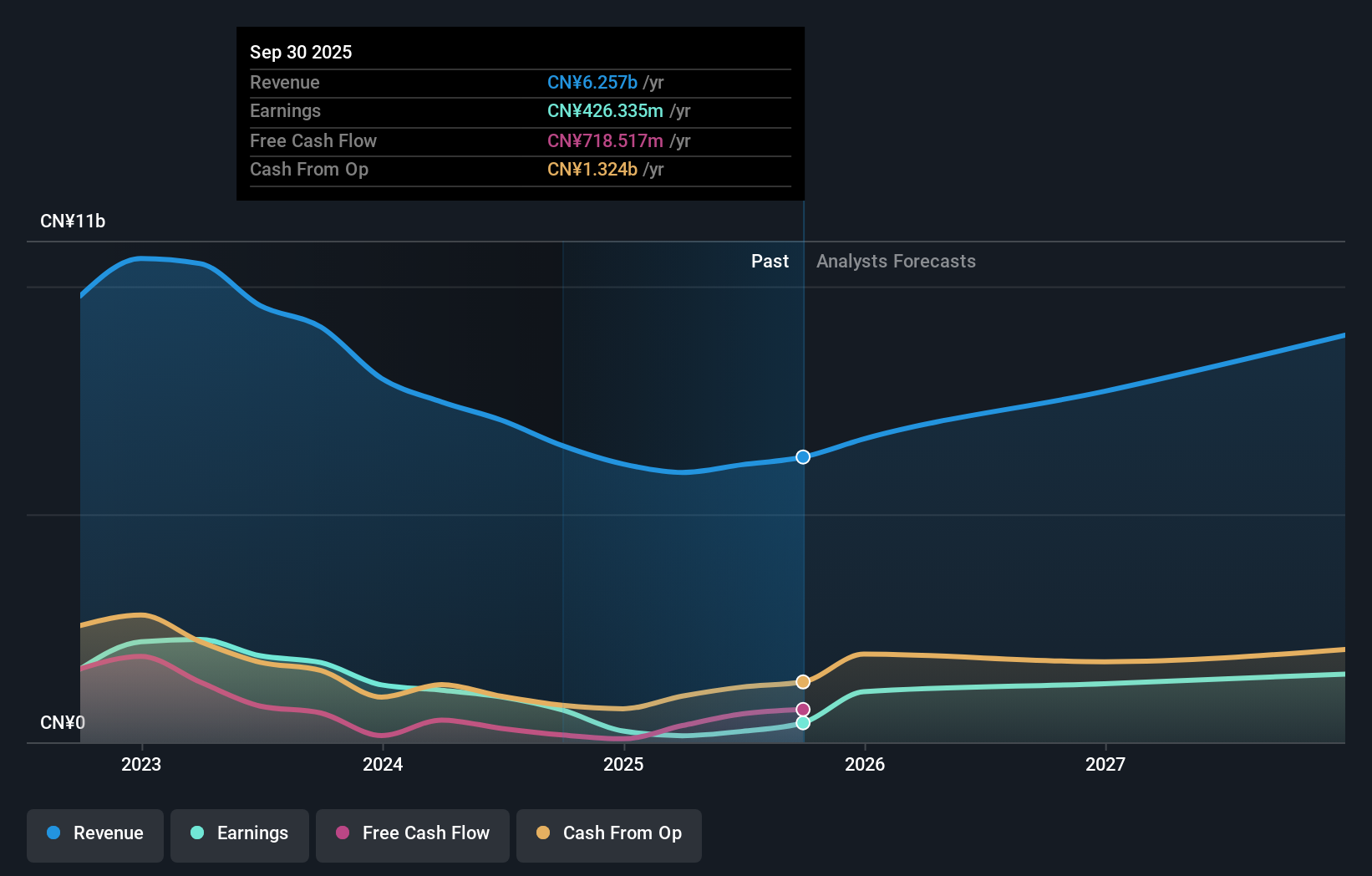

Shenzhen Fastprint Circuit TechLtd (SZSE:002436)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. manufactures and sells printed circuit boards (PCBs) both in China and internationally, with a market cap of CN¥17.60 billion.

Operations: The company's revenue segments include Semiconductor Test Boards generating CN¥1.22 billion and PCB Printed Circuit Boards contributing CN¥4.24 billion.

Insider Ownership: 26.2%

Shenzhen Fastprint Circuit Tech Ltd. demonstrates potential as a growth company with high insider ownership. Recent earnings show modest improvement, with sales reaching CNY 2.88 billion and net income at CNY 19.5 million for the half-year ended June 2024. Earnings are forecast to grow significantly, outpacing the Chinese market average, though revenue growth is slower than desired at 18.8% annually. A shareholder meeting in September discussed a three-year return plan, indicating strategic focus on shareholder value enhancement.

- Get an in-depth perspective on Shenzhen Fastprint Circuit TechLtd's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Shenzhen Fastprint Circuit TechLtd is priced higher than what may be justified by its financials.

Lepu Medical Technology (Beijing) (SZSE:300003)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lepu Medical Technology (Beijing) Co., Ltd. operates in the healthcare sector, specializing in the development and manufacturing of medical devices and pharmaceuticals, with a market cap of approximately CN¥22.91 billion.

Operations: Unfortunately, the provided text for revenue segments does not contain specific information on the breakdown of Lepu Medical Technology's revenue. Therefore, I am unable to summarize the company's revenue segments into one sentence based on the given data.

Insider Ownership: 13.7%

Lepu Medical Technology (Beijing) is positioned for growth with substantial insider ownership, supported by strategic agreements like the Clinical Trial Service Framework, enhancing its product development pipeline. Despite a recent decline in sales to CNY 3.38 billion and net income to CNY 697.24 million for H1 2024, earnings are forecasted to grow significantly at 29% annually. The company's P/E ratio of 23x suggests good value relative to the Chinese market average of 33.5x.

- Click here to discover the nuances of Lepu Medical Technology (Beijing) with our detailed analytical future growth report.

- According our valuation report, there's an indication that Lepu Medical Technology (Beijing)'s share price might be on the cheaper side.

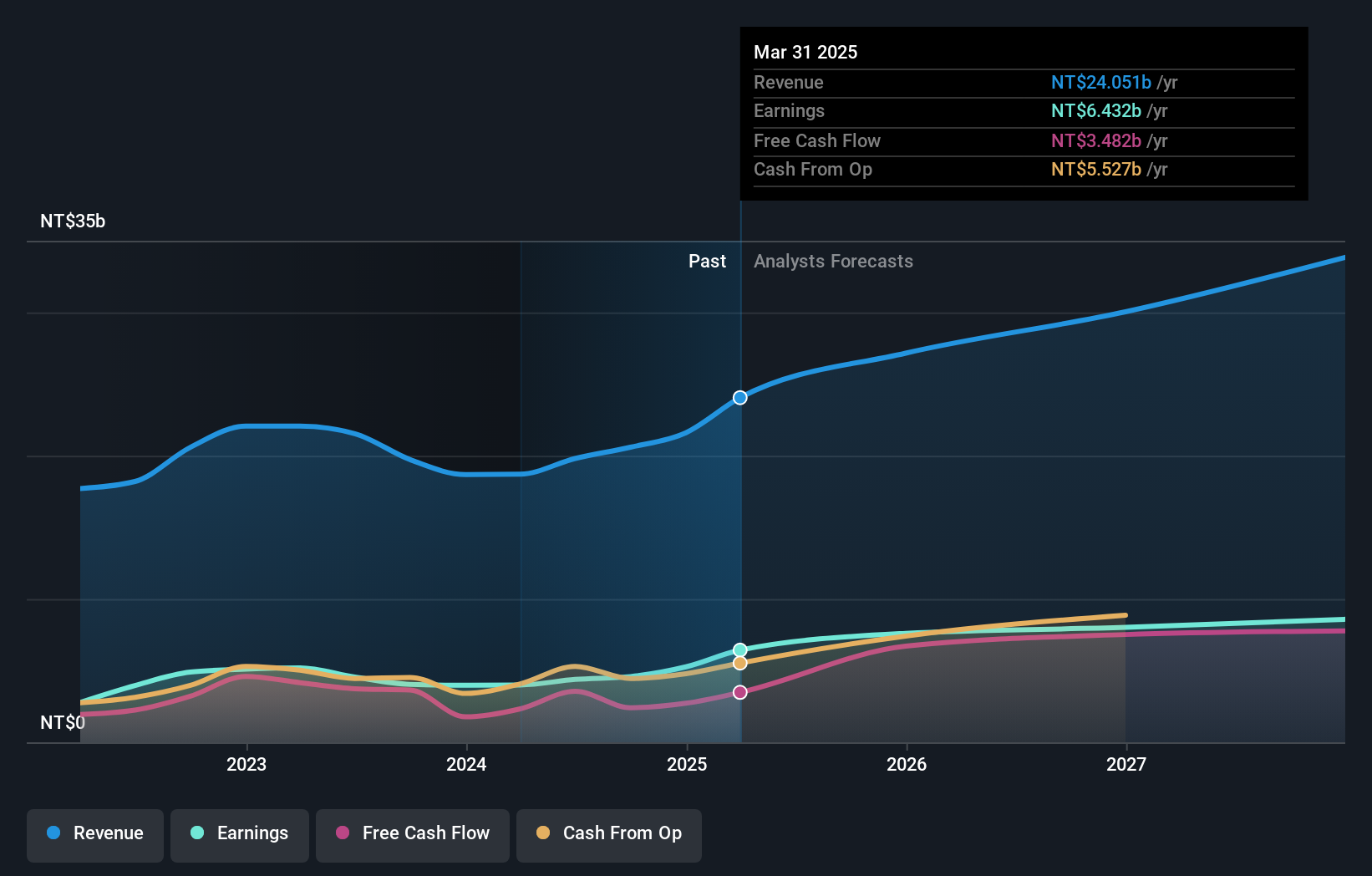

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chroma ATE Inc. is involved in the design, assembly, manufacturing, sales, repair, and maintenance of software/hardware for computers and peripherals as well as various electronic test instruments and power supplies across Taiwan, China, the United States, and other international markets with a market cap of NT$179.21 billion.

Operations: The company's revenue is primarily derived from its Measuring Instruments Business, which accounts for NT$29.52 billion, followed by Automated Transport Engineering at NT$1.58 billion.

Insider Ownership: 14.5%

Chroma ATE demonstrates potential for growth with strong insider ownership, despite a volatile share price. Earnings are projected to grow significantly at 21.7% annually, outpacing the Taiwan market's average. Recent earnings reports show robust performance, with second-quarter revenue reaching NT$5.52 billion and net income at NT$1.41 billion, both up from last year. The company actively engages in industry events like Energy Taiwan 2024 and UBS Securities Taiwan Summit 2024 to bolster its market presence.

- Take a closer look at Chroma ATE's potential here in our earnings growth report.

- Our valuation report here indicates Chroma ATE may be overvalued.

Next Steps

- Delve into our full catalog of 1486 Fast Growing Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2360

Chroma ATE

Designs, assembles, manufactures, sells, repairs, and maintains software/hardware for computers and peripherals, computerized automatic test systems, electronic test instruments, signal generators, power supplies, and telecom power supplies in Taiwan, China, the United States, and internationally.

Flawless balance sheet with high growth potential.