- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2359

Solomon Technology (TWSE:2359) Has Some Way To Go To Become A Multi-Bagger

There are a few key trends to look for if we want to identify the next multi-bagger. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Although, when we looked at Solomon Technology (TWSE:2359), it didn't seem to tick all of these boxes.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Solomon Technology is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0045 = NT$28m ÷ (NT$9.7b - NT$3.6b) (Based on the trailing twelve months to June 2024).

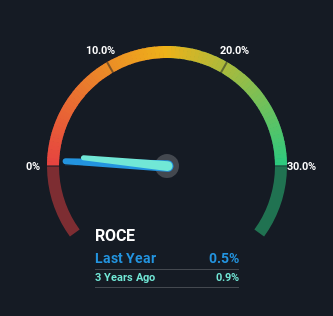

Thus, Solomon Technology has an ROCE of 0.5%. Ultimately, that's a low return and it under-performs the Electronic industry average of 7.0%.

View our latest analysis for Solomon Technology

Historical performance is a great place to start when researching a stock so above you can see the gauge for Solomon Technology's ROCE against it's prior returns. If you're interested in investigating Solomon Technology's past further, check out this free graph covering Solomon Technology's past earnings, revenue and cash flow.

So How Is Solomon Technology's ROCE Trending?

The returns on capital haven't changed much for Solomon Technology in recent years. Over the past five years, ROCE has remained relatively flat at around 0.5% and the business has deployed 22% more capital into its operations. This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 37% of total assets, this reported ROCE would probably be less than0.5% because total capital employed would be higher.The 0.5% ROCE could be even lower if current liabilities weren't 37% of total assets, because the the formula would show a larger base of total capital employed. With that in mind, just be wary if this ratio increases in the future, because if it gets particularly high, this brings with it some new elements of risk.

The Bottom Line

Long story short, while Solomon Technology has been reinvesting its capital, the returns that it's generating haven't increased. Investors must think there's better things to come because the stock has knocked it out of the park, delivering a 673% gain to shareholders who have held over the last five years. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

Like most companies, Solomon Technology does come with some risks, and we've found 2 warning signs that you should be aware of.

While Solomon Technology may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2359

Solomon Technology

Operates as an electronic components sales agency in Taiwan, Mainland China, Hong Kong, and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026