- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2354

Weak Financial Prospects Seem To Be Dragging Down Foxconn Technology Co., Ltd. (TWSE:2354) Stock

Foxconn Technology (TWSE:2354) has had a rough three months with its share price down 11%. To decide if this trend could continue, we decided to look at its weak fundamentals as they shape the long-term market trends. Particularly, we will be paying attention to Foxconn Technology's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Foxconn Technology

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Foxconn Technology is:

3.3% = NT$3.6b ÷ NT$110b (Based on the trailing twelve months to September 2024).

The 'return' is the income the business earned over the last year. So, this means that for every NT$1 of its shareholder's investments, the company generates a profit of NT$0.03.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Foxconn Technology's Earnings Growth And 3.3% ROE

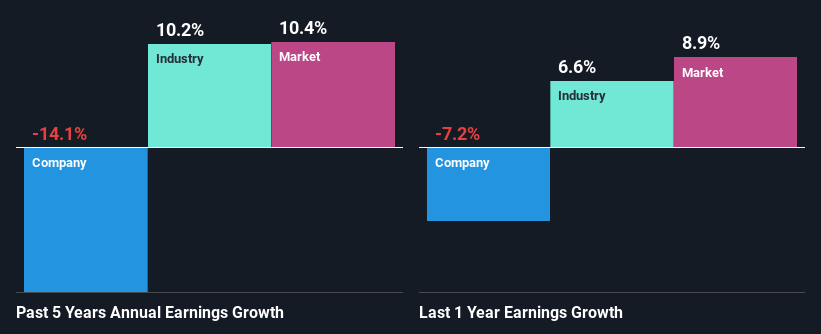

At first glance, Foxconn Technology's ROE doesn't look very promising. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 8.9% either. Therefore, it might not be wrong to say that the five year net income decline of 14% seen by Foxconn Technology was probably the result of it having a lower ROE. We reckon that there could also be other factors at play here. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

So, as a next step, we compared Foxconn Technology's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 10% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Foxconn Technology's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Foxconn Technology Efficiently Re-investing Its Profits?

Foxconn Technology's declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 54% (or a retention ratio of 46%). The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run. You can see the 3 risks we have identified for Foxconn Technology by visiting our risks dashboard for free on our platform here.

Additionally, Foxconn Technology has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 40% over the next three years. The fact that the company's ROE is expected to rise to 5.7% over the same period is explained by the drop in the payout ratio.

Summary

Overall, we would be extremely cautious before making any decision on Foxconn Technology. As a result of its low ROE and lack of much reinvestment into the business, the company has seen a disappointing earnings growth rate. Up till now, we've only made a short study of the company's growth data. You can do your own research on Foxconn Technology and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2354

Foxconn Technology

Manufactures, processes, and sells cases, heat dissipation modules, and consumer electronics products.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.