- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2347

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are increasingly seeking stability amidst volatility. With U.S. stocks experiencing broad-based declines and interest rate expectations shifting, dividend stocks have garnered attention for their potential to provide consistent income streams in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

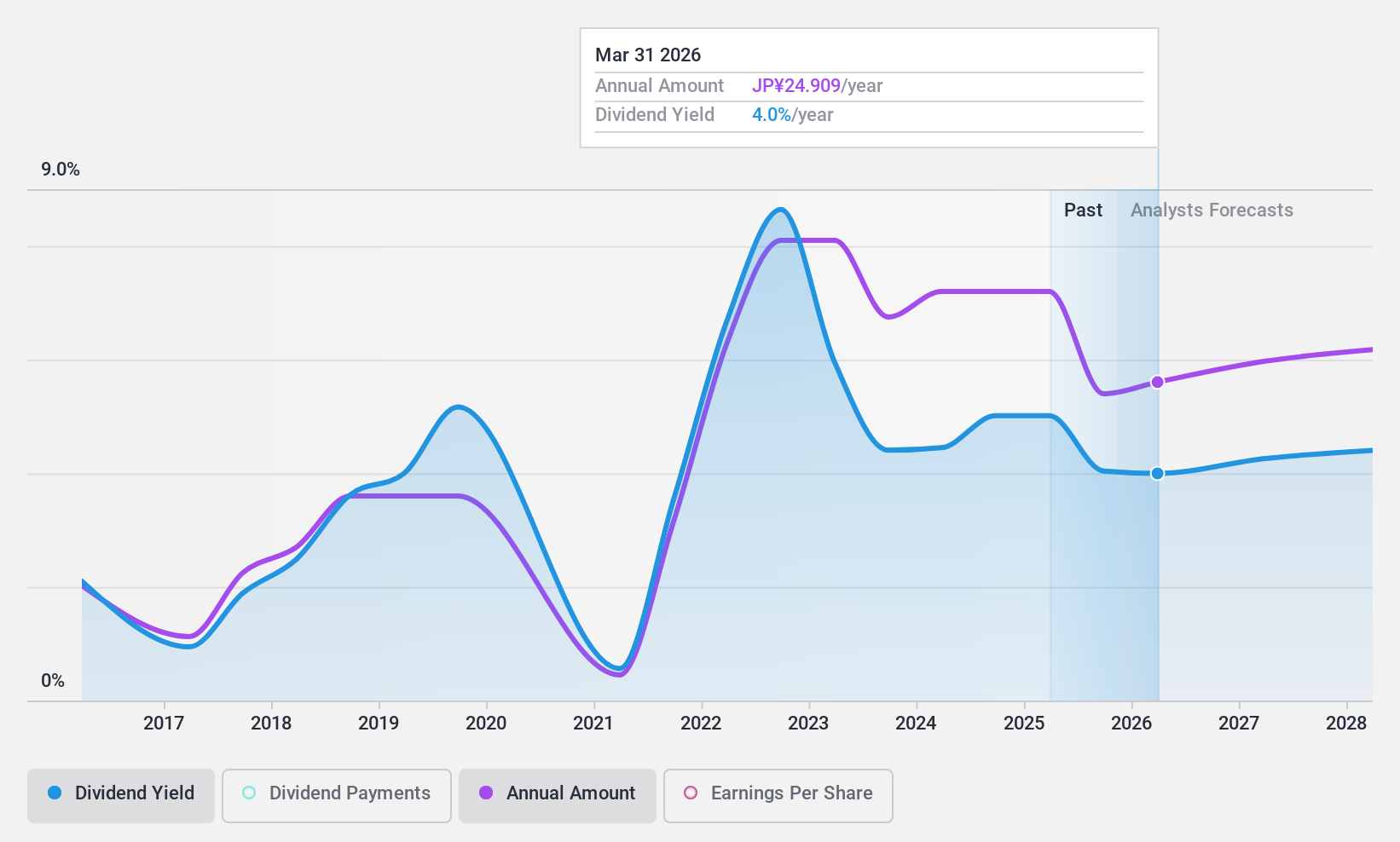

Nippon Steel (TSE:5401)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Steel Corporation operates in steelmaking and steel fabrication, engineering and construction, chemicals and materials, and system solutions both in Japan and internationally, with a market cap of ¥3.17 trillion.

Operations: Nippon Steel Corporation's revenue is derived from its operations in steelmaking and fabrication, engineering and construction, chemicals and materials, as well as system solutions across domestic and international markets.

Dividend Yield: 5.2%

Nippon Steel's dividend yield is in the top 25% of the Japanese market, supported by a reasonable payout ratio of 45.8% and cash flow coverage at 66.8%. However, dividends have been volatile over the past decade. Recent developments include a raised earnings forecast for fiscal 2024 and an increased dividend to ¥80 per share. The company is also investing $245 million in a joint iron ore project, potentially enhancing long-term growth prospects.

- Delve into the full analysis dividend report here for a deeper understanding of Nippon Steel.

- Insights from our recent valuation report point to the potential undervaluation of Nippon Steel shares in the market.

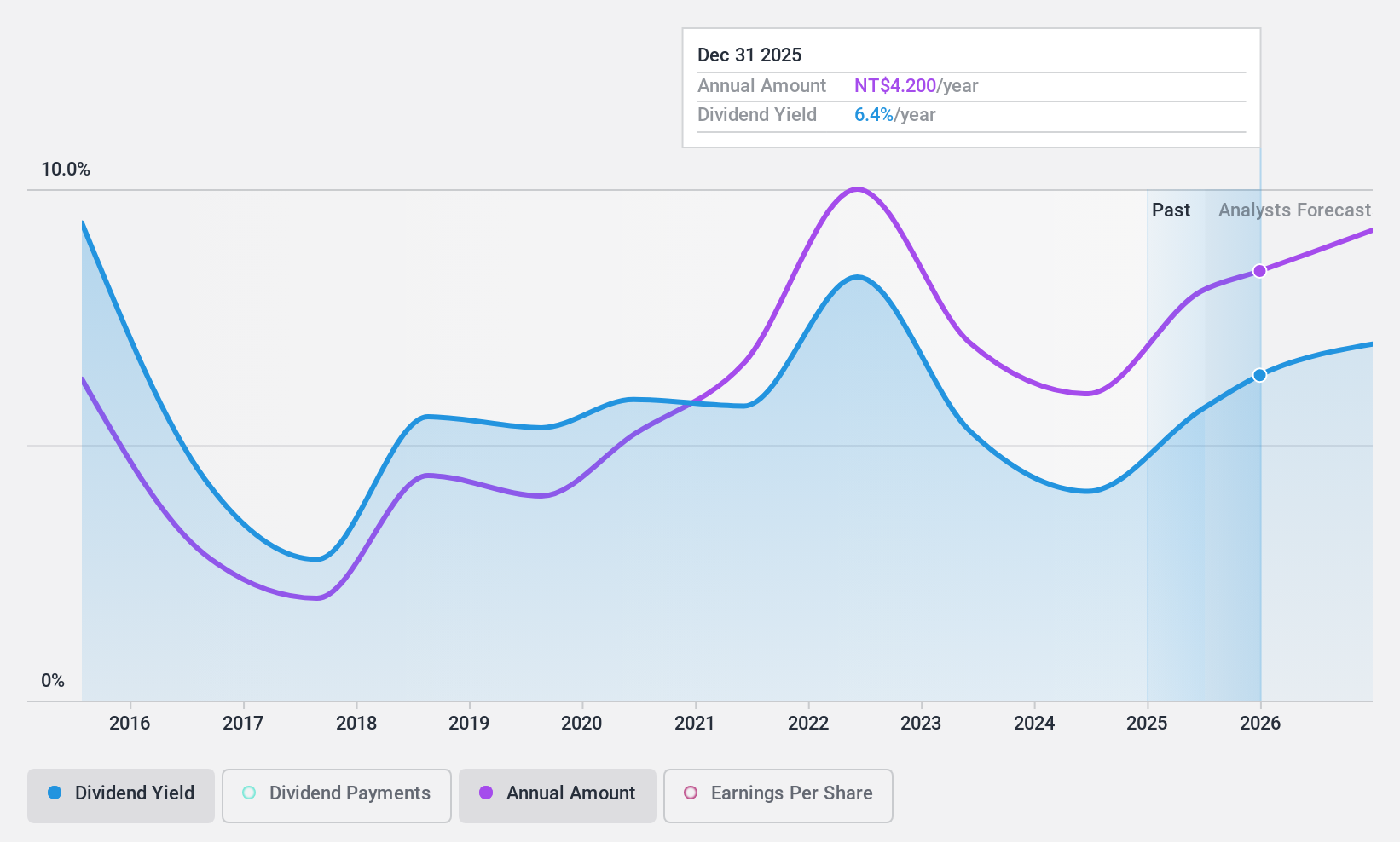

Synnex Technology International (TWSE:2347)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Synnex Technology International Corporation, along with its subsidiaries, distributes information system, communication, consumer, and semiconductor products and has a market cap of NT$120.09 billion.

Operations: Synnex Technology International Corporation's revenue is primarily derived from its Distribution Business Group, contributing NT$281.46 billion, and its Semiconductor Business Group, which adds NT$170.54 billion.

Dividend Yield: 4.1%

Synnex Technology International's dividend yield of 4.12% is below the top quartile in Taiwan, though dividends are well-covered by earnings and cash flows with payout ratios of 59.3% and 53.6%, respectively. Despite past volatility in dividend payments, recent earnings growth—11.1% year-over-year—supports sustainability. The stock trades at a favorable price-to-earnings ratio of 14.4x compared to the market's 21x, reflecting good relative value amidst stable financial performance.

- Click to explore a detailed breakdown of our findings in Synnex Technology International's dividend report.

- According our valuation report, there's an indication that Synnex Technology International's share price might be on the cheaper side.

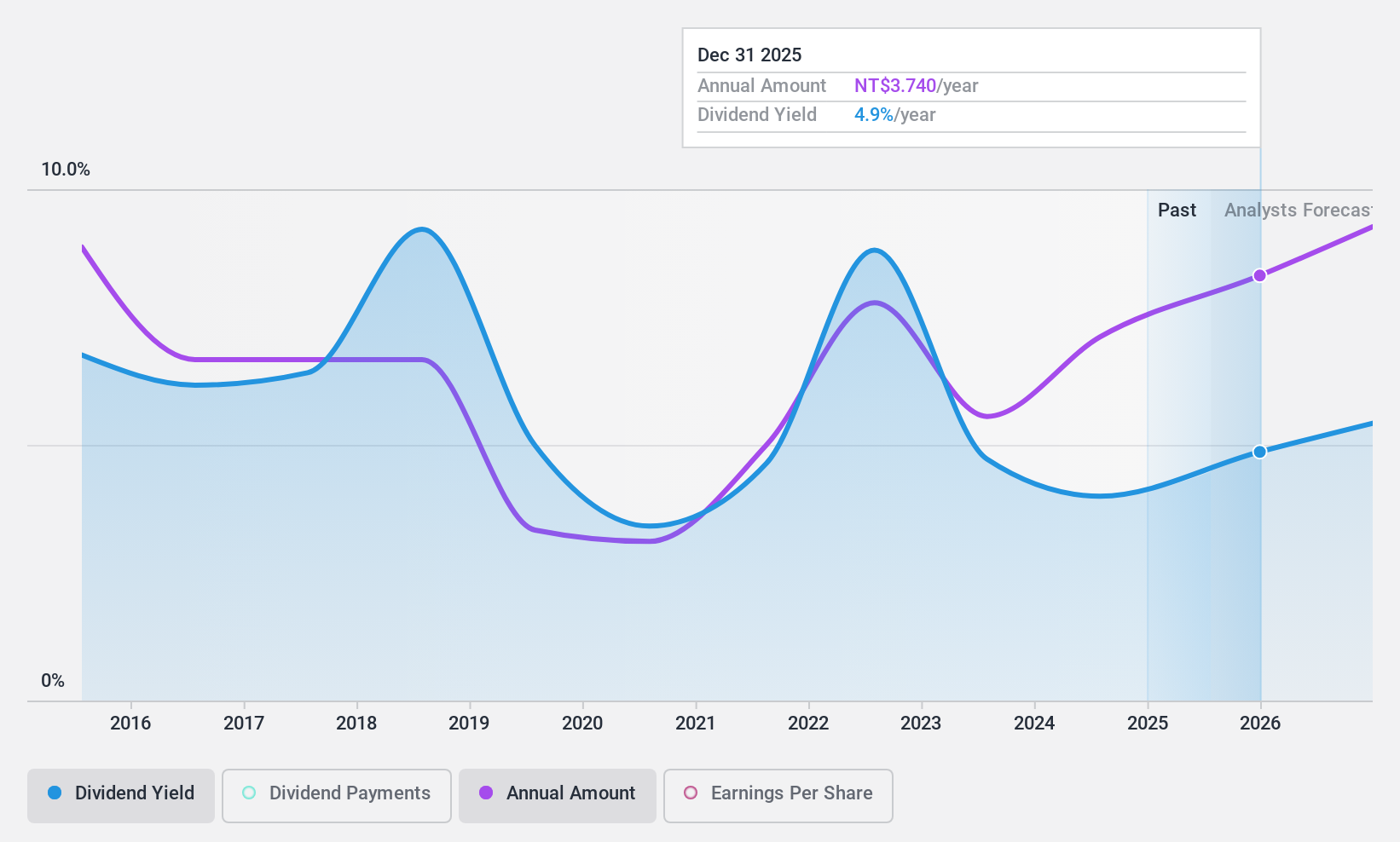

Everlight Electronics (TWSE:2393)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Everlight Electronics Co., Ltd. manufactures and sells light-emitting diodes (LEDs) in Taiwan, the rest of Asia, the United States, and internationally, with a market cap of NT$35.87 billion.

Operations: Everlight Electronics Co., Ltd.'s revenue is primarily derived from the LED Sector, contributing NT$19.02 billion, followed by the Lighting Segment at NT$787.06 million and the LCD Sector at NT$567.83 million.

Dividend Yield: 3.9%

Everlight Electronics' dividend yield of 3.95% is lower than Taiwan's top quartile, yet dividends are covered by earnings and cash flows with payout ratios of 62.9% and 57.2%, respectively. Despite a history of volatility, recent earnings growth—76.5% year-over-year—suggests improved sustainability. The stock trades at a value 30% below its estimated fair value, indicating potential relative attractiveness despite an unstable dividend track record over the past decade.

- Click here to discover the nuances of Everlight Electronics with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Everlight Electronics is priced lower than what may be justified by its financials.

Taking Advantage

- Take a closer look at our Top Dividend Stocks list of 1937 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2347

Synnex Technology International

Distributes information, communication, consumer, and semiconductor products.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives