- Taiwan

- /

- Tech Hardware

- /

- TWSE:2324

Compal Electronics (TWSE:2324) Has A Rock Solid Balance Sheet

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Compal Electronics, Inc. (TWSE:2324) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Compal Electronics

How Much Debt Does Compal Electronics Carry?

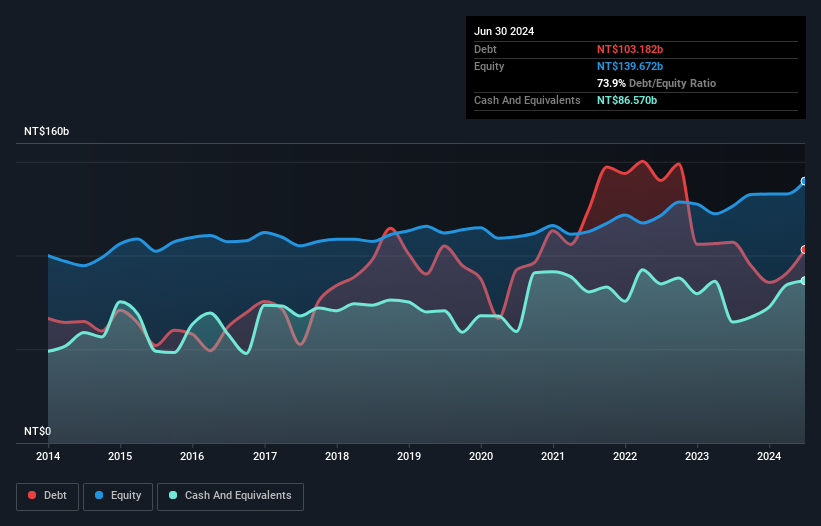

The chart below, which you can click on for greater detail, shows that Compal Electronics had NT$103.2b in debt in June 2024; about the same as the year before. However, because it has a cash reserve of NT$86.6b, its net debt is less, at about NT$16.6b.

A Look At Compal Electronics' Liabilities

According to the last reported balance sheet, Compal Electronics had liabilities of NT$303.3b due within 12 months, and liabilities of NT$24.8b due beyond 12 months. Offsetting these obligations, it had cash of NT$86.6b as well as receivables valued at NT$215.9b due within 12 months. So it has liabilities totalling NT$25.6b more than its cash and near-term receivables, combined.

Of course, Compal Electronics has a market capitalization of NT$158.6b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Compal Electronics has a low net debt to EBITDA ratio of only 0.80. And its EBIT easily covers its interest expense, being 1k times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. In addition to that, we're happy to report that Compal Electronics has boosted its EBIT by 47%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Compal Electronics can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Compal Electronics actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Happily, Compal Electronics's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Considering this range of factors, it seems to us that Compal Electronics is quite prudent with its debt, and the risks seem well managed. So we're not worried about the use of a little leverage on the balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Compal Electronics that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2324

Compal Electronics

Manufactures and sells notebook personal computers, monitors, LCD TVs, mobile phones, and other components and peripherals in Taiwan, the United States, China, the United Kingdom, Germany, Netherlands, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

From Tasers to SaaS: Axon’s Quiet Platform Transformation

Oracle: The AI Infrastructure Story Hiding in Plain Sight

Near zero debt, Japan centric focus provides future growth

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks