- Mexico

- /

- Metals and Mining

- /

- BMV:GMEXICO B

3 Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. stocks closing out a strong 2024 despite some recent volatility, investors are keenly observing economic indicators such as the Chicago PMI and GDP forecasts that hint at underlying challenges. Amid these dynamics, dividend stocks present an attractive option for those seeking steady income streams and potential stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.63% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.35% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.14% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Grupo México. de (BMV:GMEXICO B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Grupo México, S.A.B. de C.V. operates in copper production, cargo transportation, and infrastructure sectors globally with a market cap of MX$756.62 billion.

Operations: Grupo México's revenue segments include $3.24 billion from the Transportation Division and $242.41 million from the Infrastructure Division.

Dividend Yield: 3.5%

Grupo México's dividend payments, while increasing over the past decade, have been unreliable and volatile. Despite a low payout ratio of 49.8% and cash payout ratio of 40.6%, indicating coverage by earnings and cash flows, its dividend yield is relatively low at 3.5% compared to top-tier payers in Mexico. Recent financial performance shows growth with Q3 sales at US$4.13 billion and net income at US$820 million, supporting potential for future dividends despite past volatility.

- Delve into the full analysis dividend report here for a deeper understanding of Grupo México. de.

- The valuation report we've compiled suggests that Grupo México. de's current price could be quite moderate.

Compal Electronics (TWSE:2324)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compal Electronics, Inc., along with its subsidiaries, manufactures and sells notebook PCs, monitors, LCD TVs, mobile phones, and various components and peripherals across Taiwan, the United States, China, the Netherlands, and internationally with a market cap of approximately NT$161 billion.

Operations: Compal Electronics generates its revenue primarily from information technology products, totaling NT$872.05 billion, and additionally from the strategy integration product segment, contributing NT$51.01 billion.

Dividend Yield: 3.2%

Compal Electronics' dividend payments have increased over the past decade, though they remain volatile and unreliable. The dividends are well-covered by earnings with a payout ratio of 52.9% and a cash payout ratio of 22%. Despite this coverage, its dividend yield is lower than top-tier payers in Taiwan at 3.25%. Recent financials show net income growth to TWD 3.33 billion in Q3, indicating potential for continued dividend support despite historical instability.

- Get an in-depth perspective on Compal Electronics' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Compal Electronics is trading behind its estimated value.

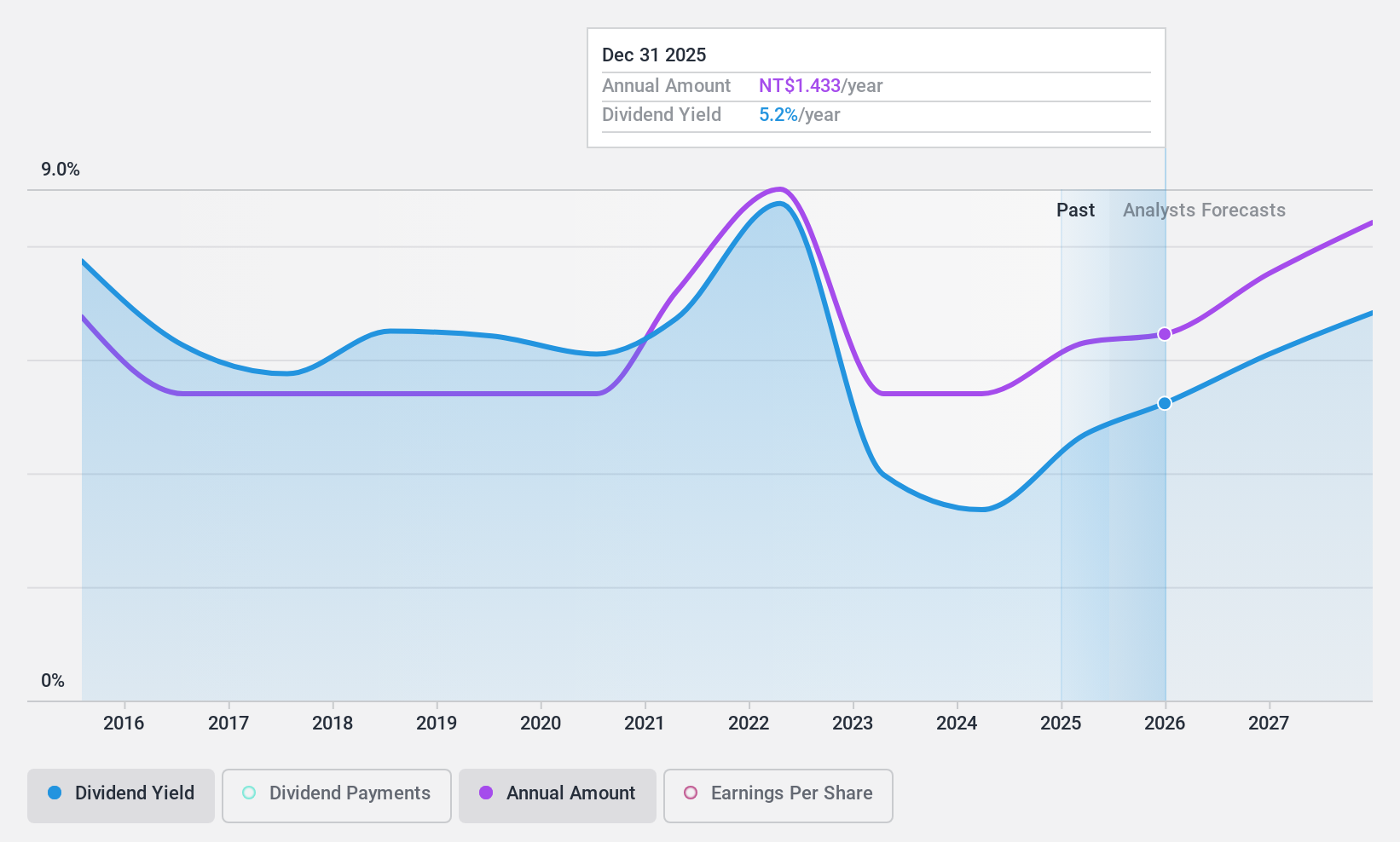

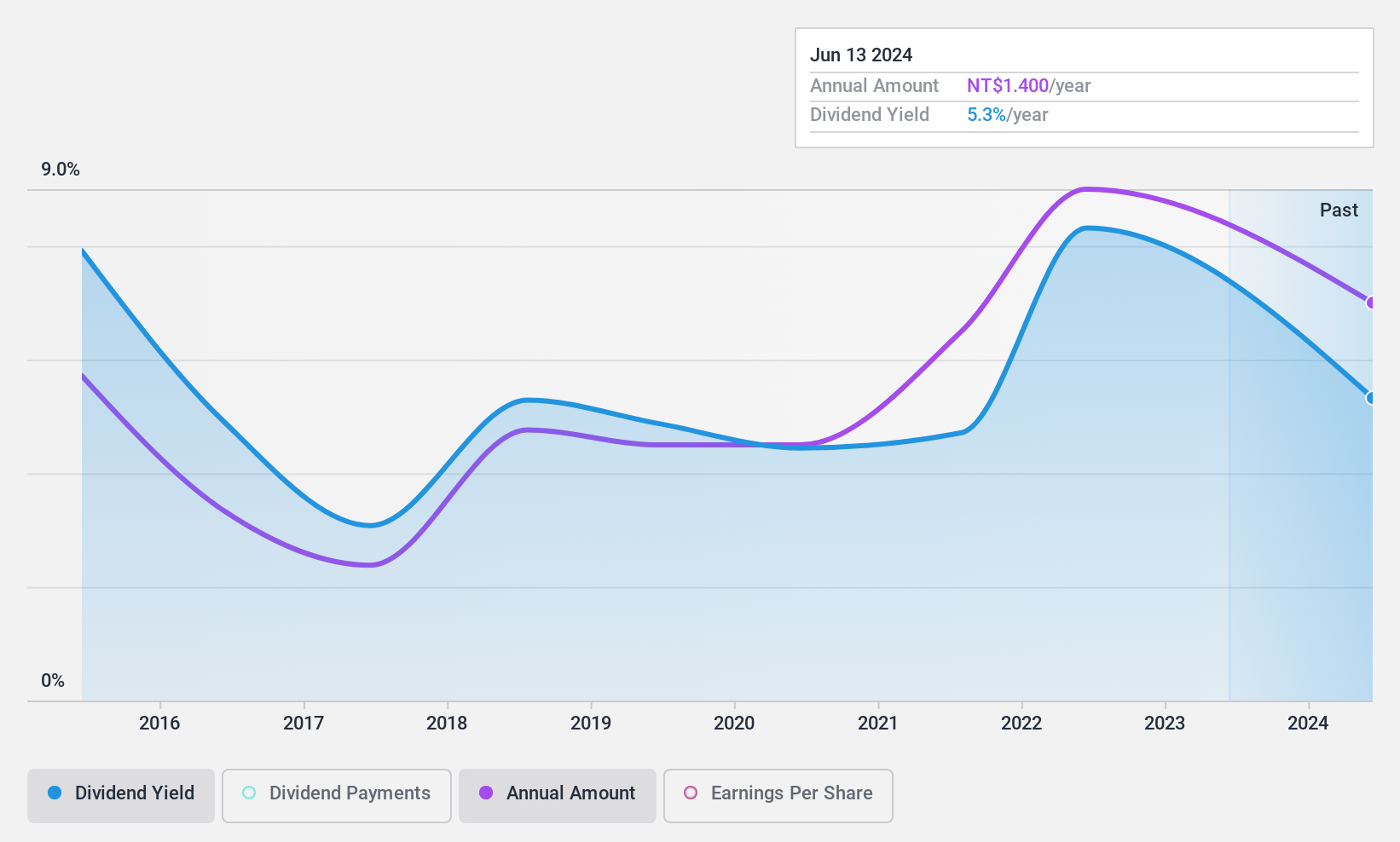

Central Reinsurance (TWSE:2851)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Central Reinsurance Corporation offers property and life reinsurance services both in Taiwan and internationally, with a market cap of NT$20.93 billion.

Operations: Central Reinsurance Corporation generates revenue of NT$22.85 billion from its reinsurance services.

Dividend Yield: 5.4%

Central Reinsurance's dividend yield of 5.35% ranks in the top 25% of Taiwan's market, but its payments are not covered by free cash flows, raising sustainability concerns. While earnings have grown annually by 9.9% over five years and dividends increased over a decade, they remain volatile and unreliable. The company reported a Q3 net income of TWD 230.06 million, down from TWD 359.51 million last year, with a low payout ratio of 42.1%.

- Click here and access our complete dividend analysis report to understand the dynamics of Central Reinsurance.

- Our valuation report unveils the possibility Central Reinsurance's shares may be trading at a discount.

Where To Now?

- Take a closer look at our Top Dividend Stocks list of 1981 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:GMEXICO B

Grupo México. de

Engages in copper production, cargo transportation, and infrastructure businesses worldwide.

Flawless balance sheet, good value and pays a dividend.