- Taiwan

- /

- Tech Hardware

- /

- TWSE:2301

Asian Market Value Picks: 3 Stocks Trading At Estimated Discounts

Reviewed by Simply Wall St

In the current landscape, Asian markets are navigating a complex environment marked by global trade tensions and economic uncertainties, which have led to fluctuations in major indices. Amidst these challenges, investors are increasingly seeking opportunities in undervalued stocks that may offer potential growth despite broader market volatility. Identifying such stocks requires a keen eye for companies with strong fundamentals and resilience to external pressures.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| T'Way Air (KOSE:A091810) | ₩1829.00 | ₩3616.04 | 49.4% |

| SpiderPlus (TSE:4192) | ¥505.00 | ¥997.79 | 49.4% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥23.28 | CN¥46.26 | 49.7% |

| Nanya Technology (TWSE:2408) | NT$44.45 | NT$87.38 | 49.1% |

| Nan Ya Printed Circuit Board (TWSE:8046) | NT$176.00 | NT$349.85 | 49.7% |

| Livero (TSE:9245) | ¥1761.00 | ¥3461.62 | 49.1% |

| Insource (TSE:6200) | ¥933.00 | ¥1843.47 | 49.4% |

| Forum Engineering (TSE:7088) | ¥1237.00 | ¥2434.83 | 49.2% |

| Dive (TSE:151A) | ¥956.00 | ¥1885.49 | 49.3% |

| cottaLTD (TSE:3359) | ¥439.00 | ¥870.08 | 49.5% |

Let's uncover some gems from our specialized screener.

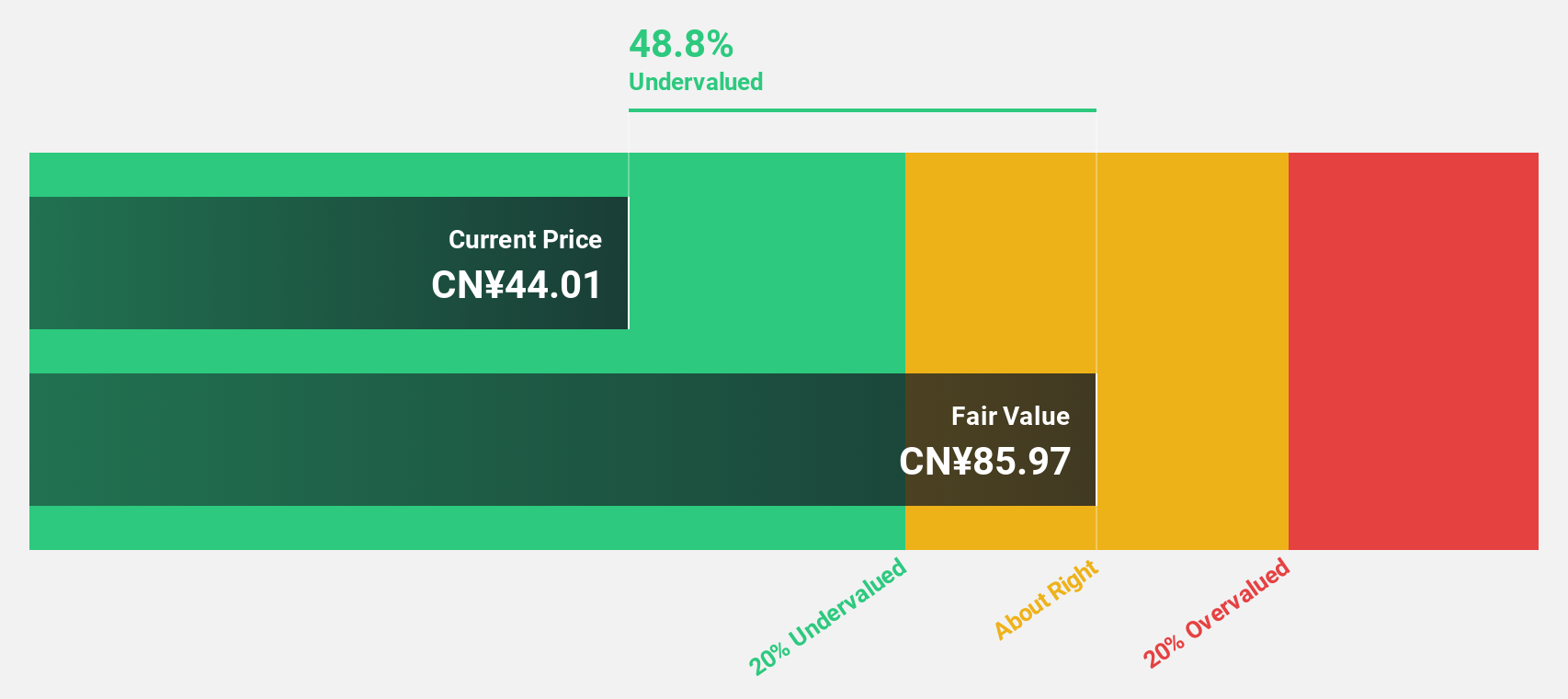

Shanghai OPM Biosciences (SHSE:688293)

Overview: Shanghai OPM Biosciences Co., Ltd. offers cell culture media and CDMO services both in China and internationally, with a market cap of CN¥6.93 billion.

Operations: Shanghai OPM Biosciences Co., Ltd. generates revenue through its provision of cell culture media and CDMO services across domestic and international markets.

Estimated Discount To Fair Value: 29.0%

Shanghai OPM Biosciences is trading at CN¥61, significantly undervalued compared to its estimated fair value of CN¥85.97, suggesting a 29% discount. Despite a volatile share price and unsustainable dividends at 0.69%, the company shows promising growth prospects with earnings expected to grow significantly by over 20% annually and revenue projected to increase by 23.8% per year, outpacing the broader Chinese market's growth rate.

- Our expertly prepared growth report on Shanghai OPM Biosciences implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Shanghai OPM Biosciences with our detailed financial health report.

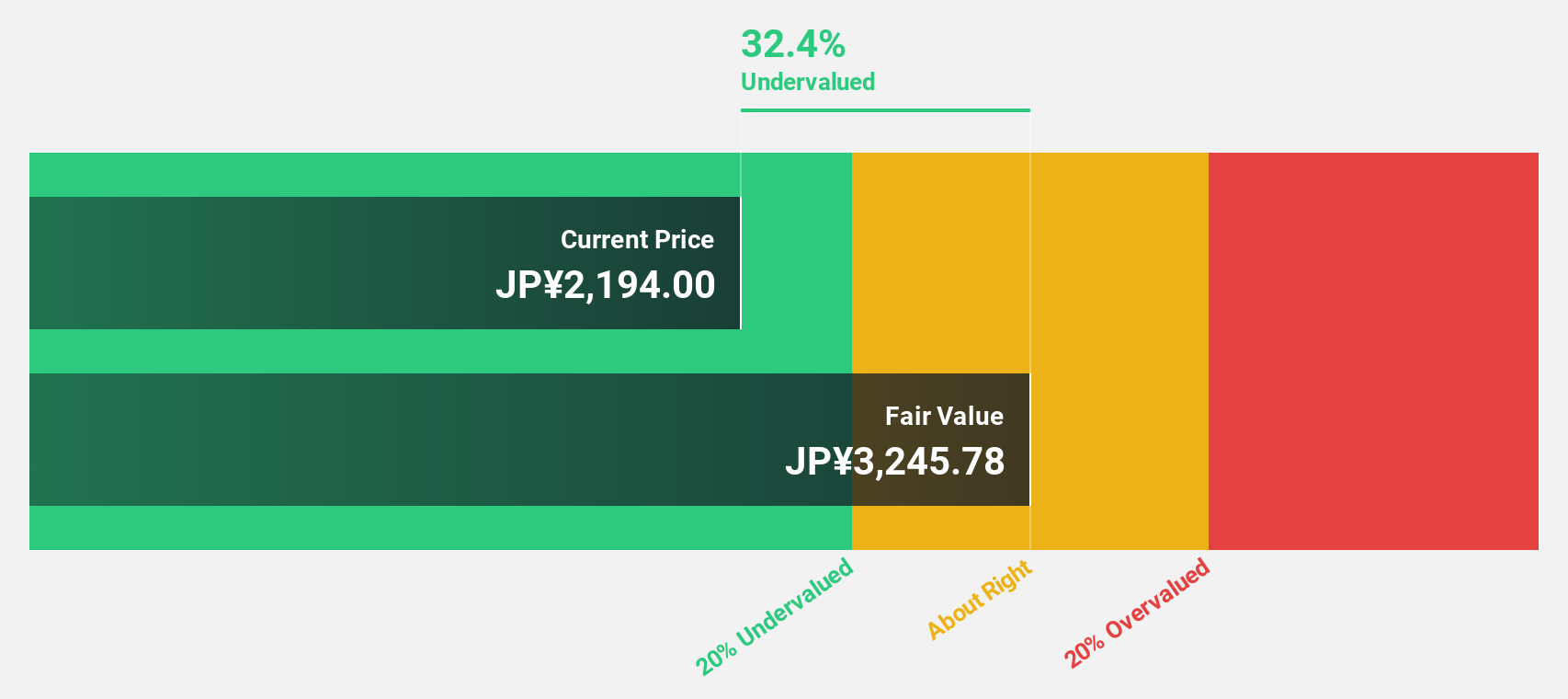

Future (TSE:4722)

Overview: Future Corporation offers IT consulting and services mainly in Japan, with a market capitalization of ¥209.63 billion.

Operations: The company's revenue segments include Business Innovation at ¥8.38 billion and IT Consulting & Services, encompassing package software and services as well as IT consulting, at ¥64.23 billion.

Estimated Discount To Fair Value: 17.7%

Future Corporation is trading at ¥2,364, approximately 17.7% below its estimated fair value of ¥2,873.76. The company's earnings are expected to grow at 15.23% annually, surpassing the Japanese market's average growth rate of 7.8%. Despite revenue growth forecasts of 10.5% per year being moderate compared to some peers, recent dividend increases from JPY 21 to JPY 23 per share highlight a commitment to returning value to shareholders amidst steady financial performance.

- Upon reviewing our latest growth report, Future's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Future with our comprehensive financial health report here.

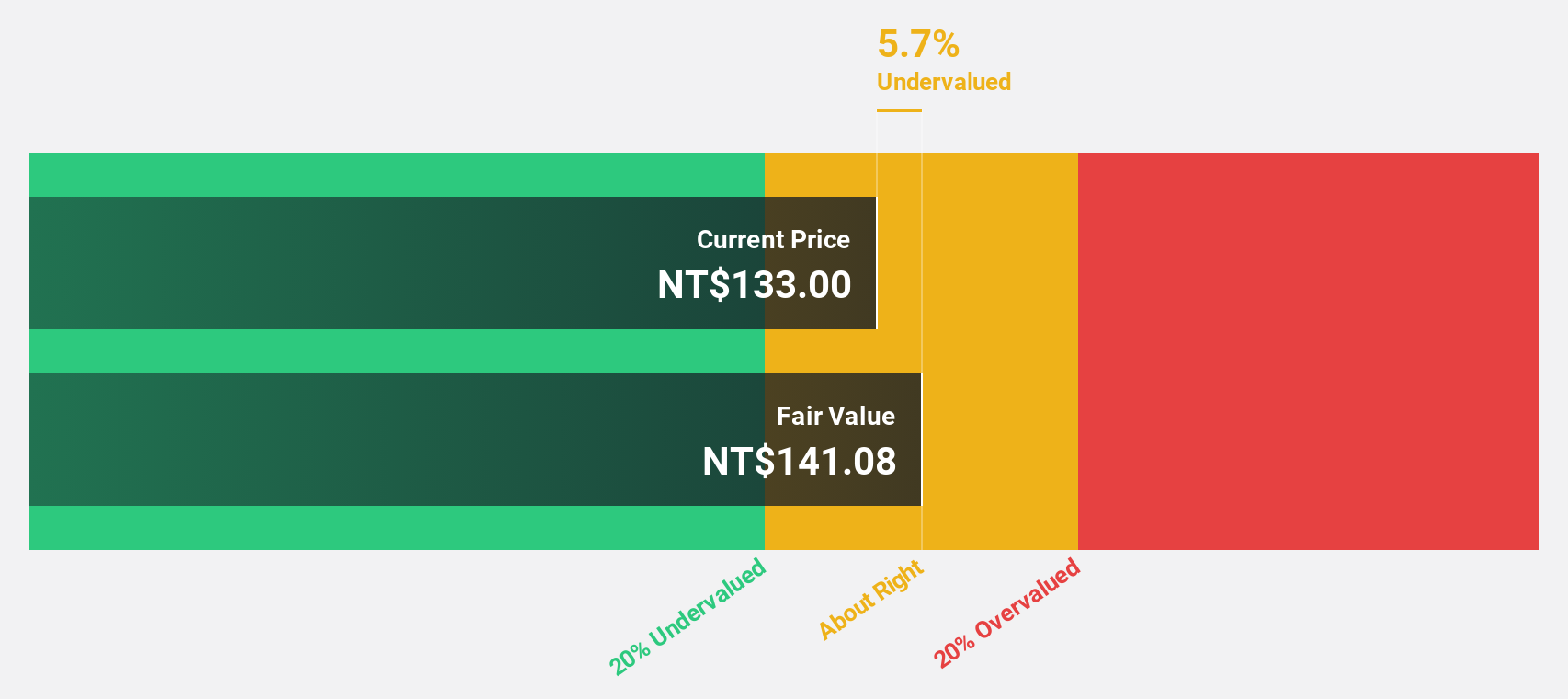

Lite-On Technology (TWSE:2301)

Overview: Lite-On Technology Corporation, with a market cap of NT$273.77 billion, operates in the research, design, development, manufacture, and sale of modules and system solutions through its subsidiaries.

Operations: Lite-On Technology Corporation generates revenue through its subsidiaries by providing modules and system solutions.

Estimated Discount To Fair Value: 11.6%

Lite-On Technology is trading at NT$121.5, approximately 11.6% below its estimated fair value of NT$137.42, suggesting it may offer value based on cash flows. Earnings are forecast to grow significantly at 20.4% annually, outpacing the Taiwan market's average growth rate of 13.3%. However, a dividend yield of 3.7% isn't well covered by free cash flows, and the company's return on equity is expected to be relatively low in three years at 19.2%.

- Our comprehensive growth report raises the possibility that Lite-On Technology is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Lite-On Technology stock in this financial health report.

Key Takeaways

- Click here to access our complete index of 270 Undervalued Asian Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2301

Lite-On Technology

Engages in the research, design, development, manufacture, and sale of modules and system solutions.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives