- China

- /

- Electronic Equipment and Components

- /

- SHSE:688002

3 High Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

In a week marked by volatility and competitive tensions in the AI sector, global markets navigated mixed signals from corporate earnings and central bank policies. As investors seek stability amidst fluctuating indices, companies with strong insider ownership often stand out as they can signal confidence in long-term growth prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Brightstar Resources (ASX:BTR) | 10.1% | 86% |

We'll examine a selection from our screener results.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raytron Technology Co., Ltd. specializes in the R&D, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China, with a market cap of CN¥22.87 billion.

Operations: Raytron Technology Co., Ltd. generates its revenue from the development and sale of uncooled infrared imaging and MEMS sensor technology in China.

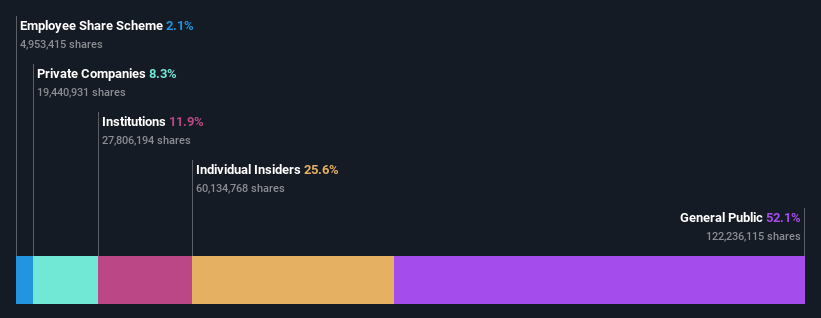

Insider Ownership: 27.3%

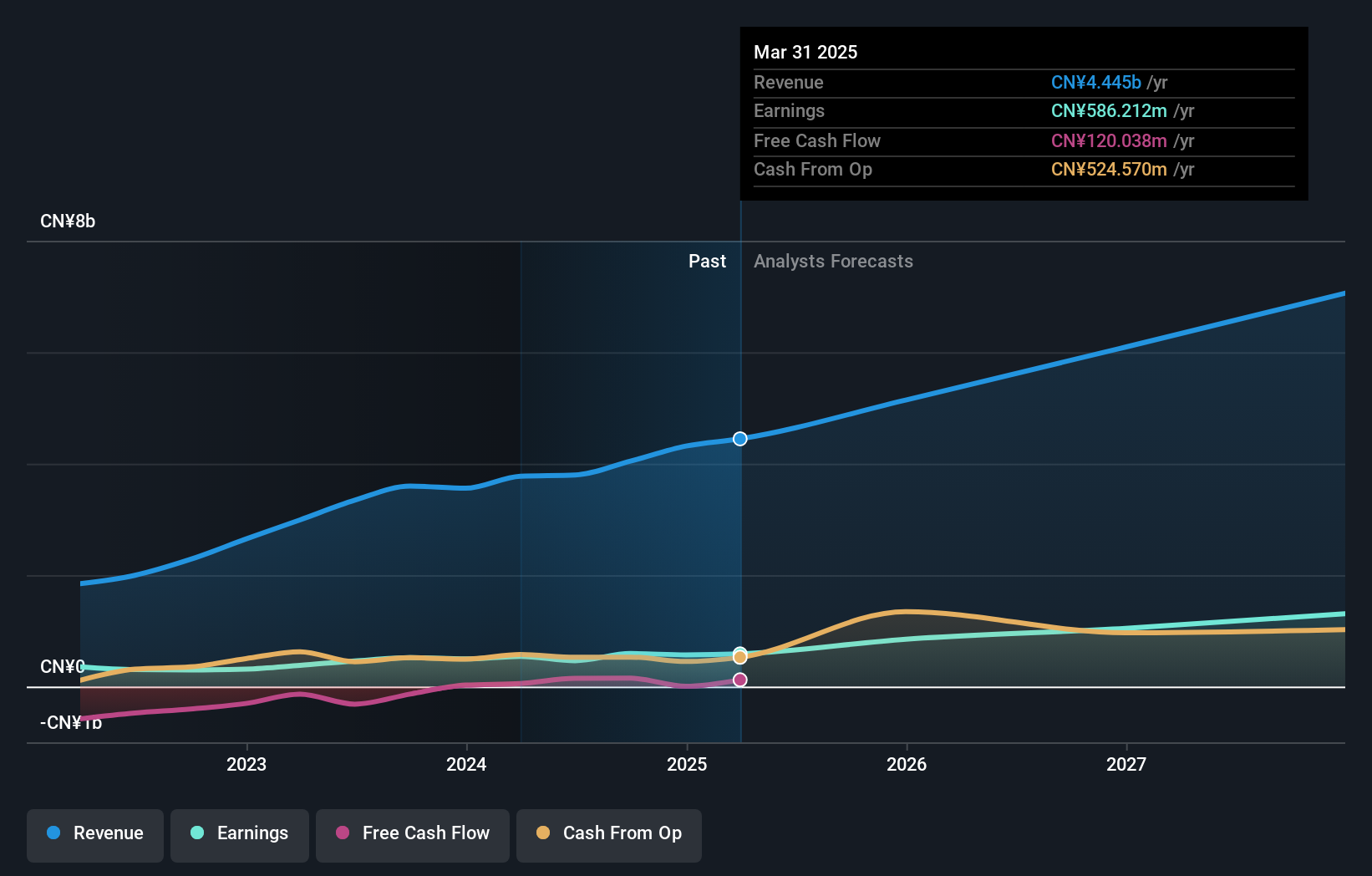

Raytron Technology Ltd. demonstrates robust growth potential with earnings projected to increase by 29.12% annually, surpassing the Chinese market's average growth rate. Despite a lower-than-industry-average Price-To-Earnings ratio of 40x, its revenue is expected to grow at 18.3% per year, slightly below the desired threshold for high growth companies. Recent activities include a share buyback program amounting to CNY 65.01 million, indicating confidence in future prospects amidst upcoming shareholder meetings.

- Dive into the specifics of Raytron TechnologyLtd here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Raytron TechnologyLtd is priced higher than what may be justified by its financials.

Changzhou Fusion New Material (SHSE:688503)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Changzhou Fusion New Material Co., Ltd. specializes in the R&D, production, and sale of conductive silver paste, electronic component paste, conductive adhesive, and semiconductor materials for the photovoltaic industry both in China and internationally, with a market cap of CN¥11.60 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, which generated CN¥12.72 billion.

Insider Ownership: 24.8%

Changzhou Fusion New Material is poised for significant growth, with earnings projected to increase by 29.31% annually, outpacing the Chinese market's average. Despite a volatile share price and profit margins declining from last year, its revenue is expected to grow at 18.8% per year, faster than the market average of 13.5%. The company trades at a Price-To-Earnings ratio of 31.1x, offering good value compared to peers and industry standards without recent insider trading activity.

- Click here to discover the nuances of Changzhou Fusion New Material with our detailed analytical future growth report.

- Our valuation report unveils the possibility Changzhou Fusion New Material's shares may be trading at a discount.

King Slide Works (TWSE:2059)

Simply Wall St Growth Rating: ★★★★★☆

Overview: King Slide Works Co., Ltd. is a Taiwanese company specializing in the R&D, design, and sale of rail kits for servers and network communication equipment, with a market cap of NT$135.80 billion.

Operations: The company's revenue segments include NT$2.16 billion from Chuanhu Company and NT$7.12 billion from Chuan Yi Company.

Insider Ownership: 14.3%

King Slide Works is positioned for growth, with revenue projected to increase by 21.1% annually, surpassing the Taiwanese market average of 11.3%. Earnings are expected to grow at 17.82% per year, slightly above the market's rate of 17.4%. The company trades at approximately 8.4% below its estimated fair value despite recent share price volatility and has not experienced substantial insider trading over the past three months, indicating stable insider confidence.

- Click here and access our complete growth analysis report to understand the dynamics of King Slide Works.

- Our valuation report unveils the possibility King Slide Works' shares may be trading at a premium.

Next Steps

- Click this link to deep-dive into the 1471 companies within our Fast Growing Companies With High Insider Ownership screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Raytron TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688002

Raytron TechnologyLtd

Engages in the research and development, design, manufacturing, and sales of uncooled infrared imagining and MEMS sensor technology in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives