It hasn't been the best quarter for VIA Labs, Inc. (TPE:6756) shareholders, since the share price has fallen 20% in that time. But looking back over the last year, the returns have actually been rather pleasing! After all, the share price is up a market-beating 84% in that time.

View our latest analysis for VIA Labs

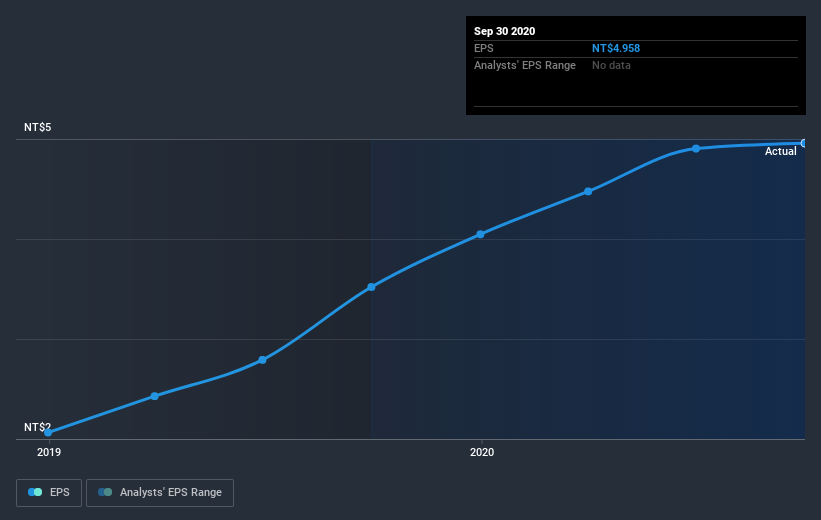

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year VIA Labs grew its earnings per share (EPS) by 41%. This EPS growth is significantly lower than the 84% increase in the share price. This indicates that the market is now more optimistic about the stock. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 56.07.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on VIA Labs' earnings, revenue and cash flow.

A Different Perspective

It's nice to see that VIA Labs shareholders have gained 85% over the last year, including dividends. Unfortunately the share price is down 20% over the last quarter. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for VIA Labs (1 can't be ignored!) that you should be aware of before investing here.

We will like VIA Labs better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading VIA Labs or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6756

VIA Labs

Engages in the programming, designing, manufacturing, and sale of USB and USB power delivery controllers for multi-functional devices and platforms in Taiwan, Hong Kong, China, Japan, Europe, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.