- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6431

We're Not Worried About Kuangli Photoelectric Technology's (TPE:6431) Cash Burn

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether Kuangli Photoelectric Technology (TPE:6431) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Kuangli Photoelectric Technology

How Long Is Kuangli Photoelectric Technology's Cash Runway?

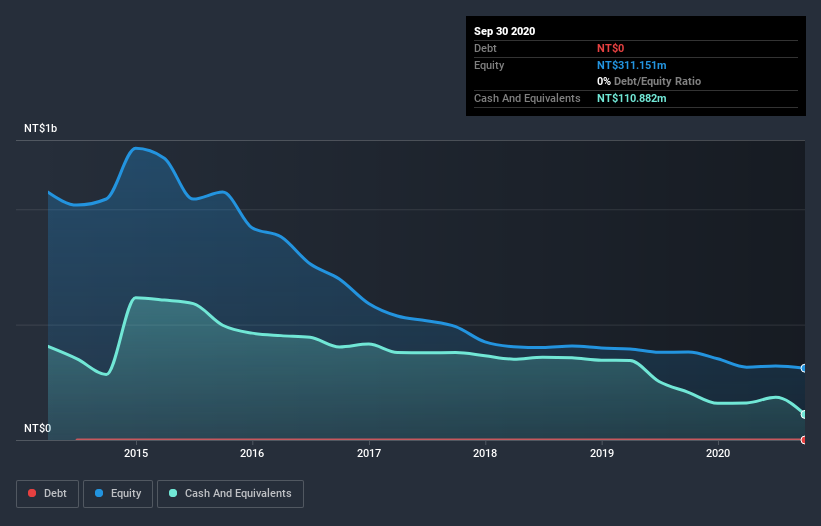

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. When Kuangli Photoelectric Technology last reported its balance sheet in September 2020, it had zero debt and cash worth NT$111m. In the last year, its cash burn was NT$34m. So it had a cash runway of about 3.2 years from September 2020. A runway of this length affords the company the time and space it needs to develop the business. You can see how its cash balance has changed over time in the image below.

How Well Is Kuangli Photoelectric Technology Growing?

It was fairly positive to see that Kuangli Photoelectric Technology reduced its cash burn by 47% during the last year. And considering that its operating revenue gained 46% during that period, that's great to see. We think it is growing rather well, upon reflection. In reality, this article only makes a short study of the company's growth data. You can take a look at how Kuangli Photoelectric Technology is growing revenue over time by checking this visualization of past revenue growth.

How Hard Would It Be For Kuangli Photoelectric Technology To Raise More Cash For Growth?

We are certainly impressed with the progress Kuangli Photoelectric Technology has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of NT$1.6b, Kuangli Photoelectric Technology's NT$34m in cash burn equates to about 2.2% of its market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

So, Should We Worry About Kuangli Photoelectric Technology's Cash Burn?

As you can probably tell by now, we're not too worried about Kuangli Photoelectric Technology's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. And even its cash burn reduction was very encouraging. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 1 warning sign for Kuangli Photoelectric Technology that investors should know when investing in the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade Kuangli Photoelectric Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kuangli Bio-Tech Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6431

Kuangli Bio-Tech Holdings

Manufactures and sells panels for cover lens used in various electronic products.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026