- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6269

Does Flexium Interconnect (TPE:6269) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Flexium Interconnect, Inc. (TPE:6269) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Flexium Interconnect

How Much Debt Does Flexium Interconnect Carry?

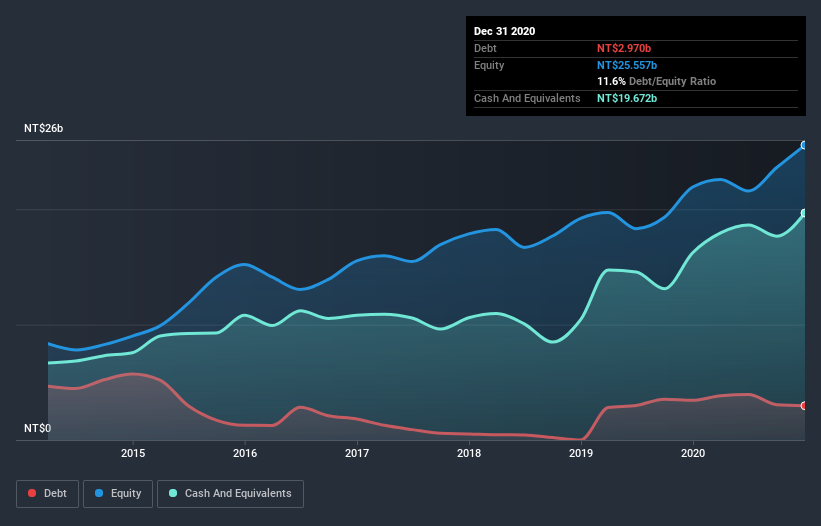

As you can see below, Flexium Interconnect had NT$2.97b of debt at December 2020, down from NT$3.44b a year prior. However, it does have NT$19.7b in cash offsetting this, leading to net cash of NT$16.7b.

How Healthy Is Flexium Interconnect's Balance Sheet?

The latest balance sheet data shows that Flexium Interconnect had liabilities of NT$13.0b due within a year, and liabilities of NT$4.19b falling due after that. Offsetting this, it had NT$19.7b in cash and NT$7.55b in receivables that were due within 12 months. So it actually has NT$10.0b more liquid assets than total liabilities.

It's good to see that Flexium Interconnect has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, Flexium Interconnect boasts net cash, so it's fair to say it does not have a heavy debt load!

But the other side of the story is that Flexium Interconnect saw its EBIT decline by 9.5% over the last year. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Flexium Interconnect can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Flexium Interconnect has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Flexium Interconnect created free cash flow amounting to 12% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Summing up

While it is always sensible to investigate a company's debt, in this case Flexium Interconnect has NT$16.7b in net cash and a decent-looking balance sheet. So we are not troubled with Flexium Interconnect's debt use. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with Flexium Interconnect , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Flexium Interconnect, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6269

Flexium Interconnect

Engages in the design, development, manufacture, and sale of flexible printed circuit boards in Taiwan, China, rest of Asia, Europe, and the Americas.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026