- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3311

We're Hopeful That Silitech Technology (TPE:3311) Will Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should Silitech Technology (TPE:3311) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Silitech Technology

When Might Silitech Technology Run Out Of Money?

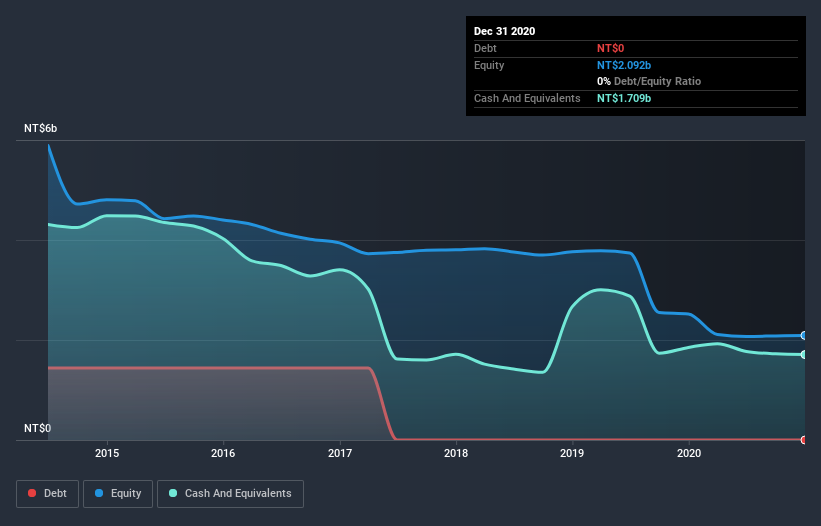

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In December 2020, Silitech Technology had NT$1.7b in cash, and was debt-free. Looking at the last year, the company burnt through NT$164m. So it had a very long cash runway of many years from December 2020. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. You can see how its cash balance has changed over time in the image below.

Is Silitech Technology's Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Silitech Technology actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. Unfortunately, the last year has been a disappointment, with operating revenue dropping 24% during the period. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Silitech Technology has developed its business over time by checking this visualization of its revenue and earnings history.

How Hard Would It Be For Silitech Technology To Raise More Cash For Growth?

Since its revenue growth is moving in the wrong direction, Silitech Technology shareholders may wish to think ahead to when the company may need to raise more cash. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Silitech Technology's cash burn of NT$164m is about 5.7% of its NT$2.9b market capitalisation. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

How Risky Is Silitech Technology's Cash Burn Situation?

As you can probably tell by now, we're not too worried about Silitech Technology's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Although its falling revenue does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. On another note, Silitech Technology has 3 warning signs (and 1 which is potentially serious) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading Silitech Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3311

Silitech Technology

Engages in the manufacture and sale of modules and rubber products in China, Malaysia, Taiwan, the United States, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026