- Taiwan

- /

- Communications

- /

- TWSE:3062

CyberTAN Technology (TPE:3062) Has Debt But No Earnings; Should You Worry?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that CyberTAN Technology, Inc. (TPE:3062) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for CyberTAN Technology

What Is CyberTAN Technology's Net Debt?

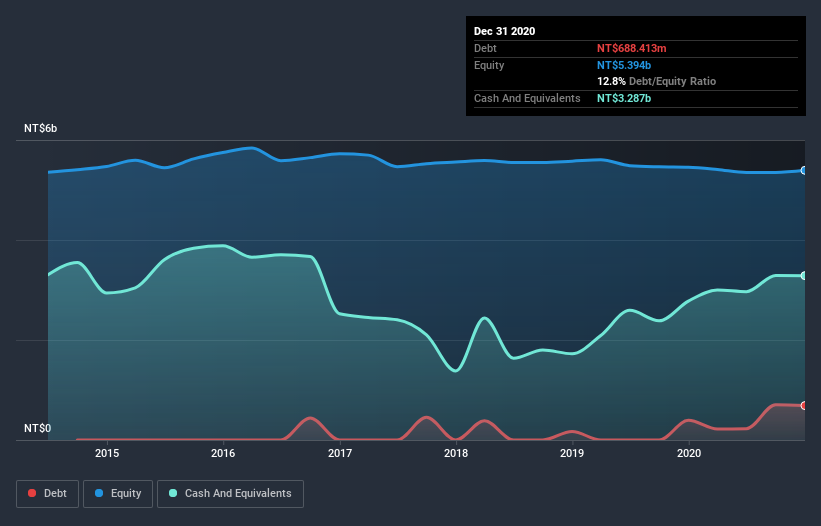

As you can see below, at the end of December 2020, CyberTAN Technology had NT$688.4m of debt, up from NT$392.6m a year ago. Click the image for more detail. But it also has NT$3.29b in cash to offset that, meaning it has NT$2.60b net cash.

How Healthy Is CyberTAN Technology's Balance Sheet?

According to the last reported balance sheet, CyberTAN Technology had liabilities of NT$2.01b due within 12 months, and liabilities of NT$616.4m due beyond 12 months. Offsetting these obligations, it had cash of NT$3.29b as well as receivables valued at NT$1.37b due within 12 months. So it actually has NT$2.03b more liquid assets than total liabilities.

This surplus strongly suggests that CyberTAN Technology has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, lenders should feel as safe as the beloved of a black-belt karate master. Simply put, the fact that CyberTAN Technology has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is CyberTAN Technology's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year CyberTAN Technology had a loss before interest and tax, and actually shrunk its revenue by 15%, to NT$4.8b. We would much prefer see growth.

So How Risky Is CyberTAN Technology?

Although CyberTAN Technology had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of NT$24m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. With mediocre revenue growth in the last year, we're don't find the investment opportunity particularly compelling. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 2 warning signs we've spotted with CyberTAN Technology (including 1 which makes us a bit uncomfortable) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading CyberTAN Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3062

CyberTAN Technology

Manufactures and sells wireless broadband network equipment in Europe, the United States, and Asia.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion