- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2402

Is Ichia Technologies, Inc.'s (TPE:2402) Recent Stock Performance Influenced By Its Fundamentals In Any Way?

Most readers would already be aware that Ichia Technologies' (TPE:2402) stock increased significantly by 11% over the past three months. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. Particularly, we will be paying attention to Ichia Technologies' ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Ichia Technologies

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Ichia Technologies is:

2.5% = NT$139m ÷ NT$5.6b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.02 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Ichia Technologies' Earnings Growth And 2.5% ROE

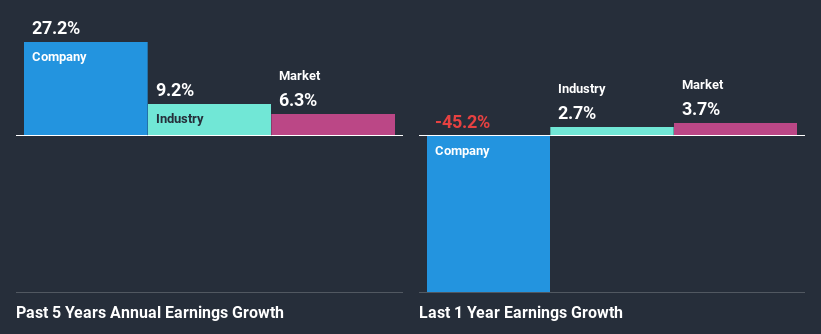

As you can see, Ichia Technologies' ROE looks pretty weak. Even when compared to the industry average of 9.9%, the ROE figure is pretty disappointing. However, we we're pleasantly surprised to see that Ichia Technologies grew its net income at a significant rate of 27% in the last five years. We reckon that there could be other factors at play here. Such as - high earnings retention or an efficient management in place.

As a next step, we compared Ichia Technologies' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 9.2%.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Ichia Technologies is trading on a high P/E or a low P/E, relative to its industry.

Is Ichia Technologies Making Efficient Use Of Its Profits?

Ichia Technologies has a significant three-year median payout ratio of 66%, meaning the company only retains 34% of its income. This implies that the company has been able to achieve high earnings growth despite returning most of its profits to shareholders.

Additionally, Ichia Technologies has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

In total, it does look like Ichia Technologies has some positive aspects to its business. That is, quite an impressive growth in earnings. However, the low profit retention means that the company's earnings growth could have been higher, had it been reinvesting a higher portion of its profits. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. You can do your own research on Ichia Technologies and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you decide to trade Ichia Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:2402

Ichia Technologies

Manufactures, processes, and trades in components and materials for electronics, home appliances, electronical engineering, electrical equipment, communications, and computers in the United States, Europe, and Asia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.