- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8069

November 2024 Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate the challenges of rising U.S. Treasury yields and tepid economic growth, investors are increasingly focused on identifying stocks that may be trading below their intrinsic value. In this environment, a good stock is often characterized by strong fundamentals and resilience against macroeconomic pressures, offering potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 49.9% |

| Acerinox (BME:ACX) | €8.52 | €16.98 | 49.8% |

| Enento Group Oyj (HLSE:ENENTO) | €18.40 | €36.57 | 49.7% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.52 | CN¥22.89 | 49.7% |

| WEX (NYSE:WEX) | US$172.60 | US$343.98 | 49.8% |

| Semiconductor Manufacturing International (SEHK:981) | HK$27.05 | HK$53.78 | 49.7% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2706.00 | ¥5411.18 | 50% |

| Energy One (ASX:EOL) | A$5.53 | A$11.06 | 50% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.70 | 49.9% |

| Sinch (OM:SINCH) | SEK31.45 | SEK62.48 | 49.7% |

Let's explore several standout options from the results in the screener.

MLP Saglik Hizmetleri (IBSE:MPARK)

Overview: MLP Saglik Hizmetleri A.S. operates healthcare services in Turkey, Azerbaijan, and Hungary with a market cap of TRY65.04 billion.

Operations: The company generates revenue from its Healthcare Facilities & Services segment, totaling TRY25.77 billion.

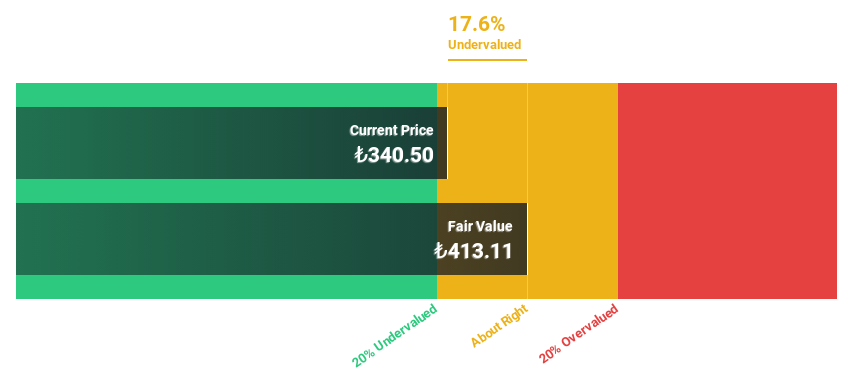

Estimated Discount To Fair Value: 17.6%

MLP Saglik Hizmetleri is trading at TRY340.5, below its estimated fair value of TRY413.11, indicating potential undervaluation based on cash flows. The company's revenue is forecast to grow significantly at 30.6% annually, outpacing the TR market's 24.7%. Despite slower earnings growth compared to the market, its return on equity is expected to reach a high of 26% in three years. Recent reports show increased sales but slightly lower quarterly net income year-over-year.

- Our growth report here indicates MLP Saglik Hizmetleri may be poised for an improving outlook.

- Dive into the specifics of MLP Saglik Hizmetleri here with our thorough financial health report.

Beijing LeiKe Defense Technology (SZSE:002413)

Overview: Beijing LeiKe Defense Technology Co., Ltd. operates in the defense technology sector and has a market capitalization of CN¥6.38 billion.

Operations: The company's revenue is primarily derived from its Computer, Communications, and Other Electronic Equipment Manufacturing segment, which generated CN¥1.18 billion.

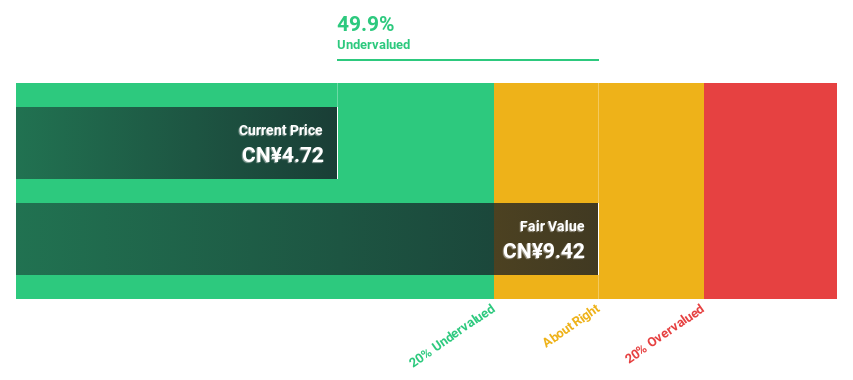

Estimated Discount To Fair Value: 45.3%

Beijing LeiKe Defense Technology is trading at CN¥5.14, significantly below its estimated fair value of CN¥9.39. Despite recent losses, with a net loss of CNY 134.45 million for the nine months ended September 2024, the company is expected to achieve profitability within three years and has a forecasted revenue growth rate of 21.9% annually, surpassing the Chinese market's average growth rate of 13.9%.

- Insights from our recent growth report point to a promising forecast for Beijing LeiKe Defense Technology's business outlook.

- Click here to discover the nuances of Beijing LeiKe Defense Technology with our detailed financial health report.

E Ink Holdings (TPEX:8069)

Overview: E Ink Holdings Inc. researches, develops, manufactures, and sells electronic paper display panels globally, with a market cap of NT$350.34 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to NT$25.95 billion.

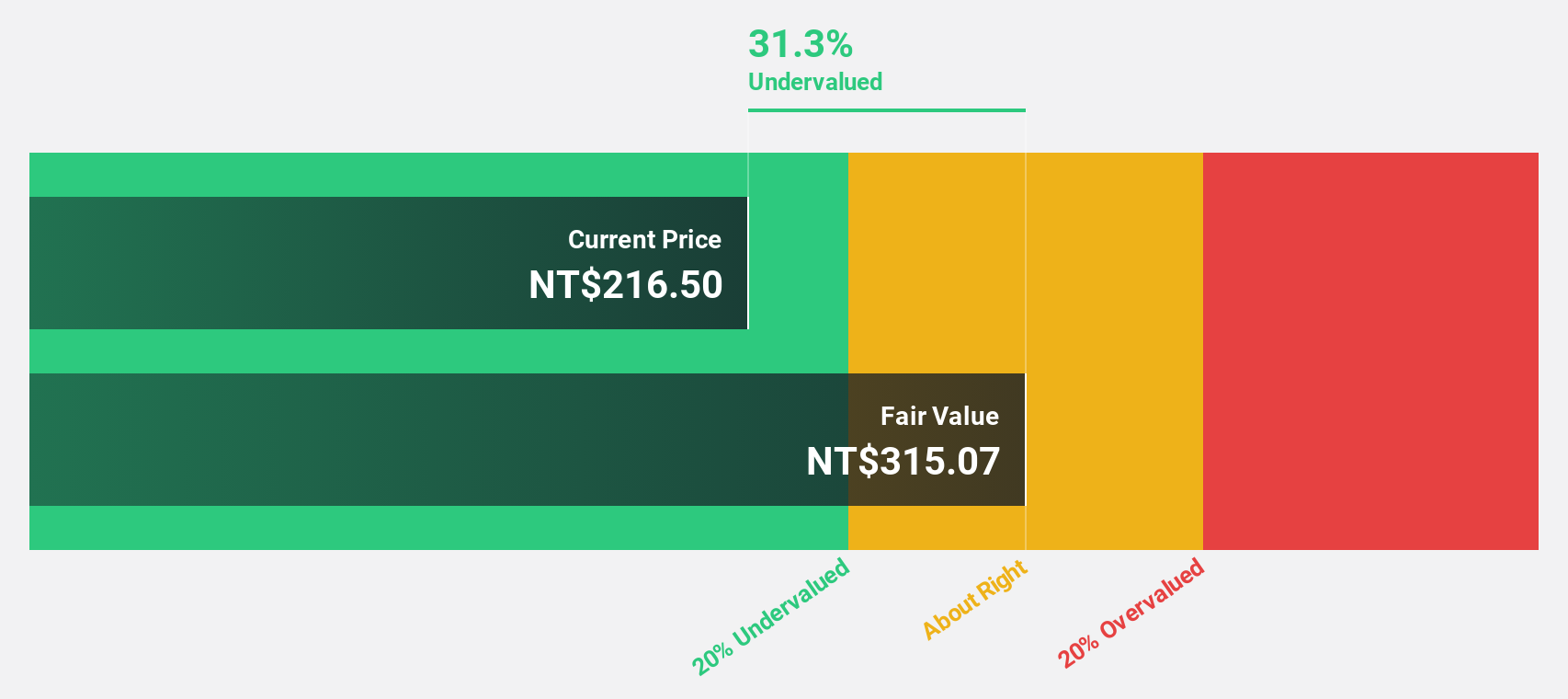

Estimated Discount To Fair Value: 20.2%

E Ink Holdings is trading at NT$306, over 20% below its estimated fair value of NT$383.25, suggesting potential undervaluation based on cash flows. Despite a dip in recent earnings, with a net income of TWD 3.34 billion for the first half of 2024 compared to TWD 4.18 billion last year, the company's earnings and revenue are forecasted to grow significantly above market averages. Recent investments in production facilities and securing a TWD 12 billion syndicated loan highlight strategic growth initiatives.

- According our earnings growth report, there's an indication that E Ink Holdings might be ready to expand.

- Get an in-depth perspective on E Ink Holdings' balance sheet by reading our health report here.

Key Takeaways

- Delve into our full catalog of 958 Undervalued Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade E Ink Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if E Ink Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8069

E Ink Holdings

Researches, develops, manufactures, and sells electronic paper display panels worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives