- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8069

3 Growth Companies With High Insider Ownership And 26% Revenue Growth

Reviewed by Simply Wall St

In a week marked by volatility and mixed economic signals, global markets have shown resilience despite fears over rising interest rates and fluctuating consumer demand. As investors navigate these uncertain waters, identifying growth companies with high insider ownership can offer a measure of confidence. High insider ownership often indicates that those closest to the company believe in its long-term potential. In this article, we explore three such growth companies that have demonstrated impressive 26% revenue growth, highlighting their potential amidst current market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.2% |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 52.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Underneath we present a selection of stocks filtered out by our screen.

Full Truck Alliance (NYSE:YMM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Full Truck Alliance Co. Ltd. operates a digital freight platform in China that connects shippers with truckers for various shipment needs, with a market cap of $7.55 billion.

Operations: The company generates revenue of CN¥9.00 billion from its Internet Information Providers segment.

Insider Ownership: 10.4%

Revenue Growth Forecast: 20% p.a.

Full Truck Alliance has demonstrated strong growth, with Q1 2024 sales rising to CNY 2.27 billion from CNY 1.70 billion a year ago, and net income increasing to CNY 581.17 million from CNY 408.91 million. The company forecasts Q2 revenue between RMB 2.65 billion and RMB 2.72 billion, indicating significant year-over-year growth of up to approximately 31.7%. Despite recent executive changes, the firm's earnings are expected to grow substantially over the next three years at an annual rate of around 30%.

- Take a closer look at Full Truck Alliance's potential here in our earnings growth report.

- Our valuation report here indicates Full Truck Alliance may be undervalued.

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

Overview: E Ink Holdings Inc. researches, develops, manufactures, and sells electronic paper display panels worldwide with a market cap of NT$322.73 billion.

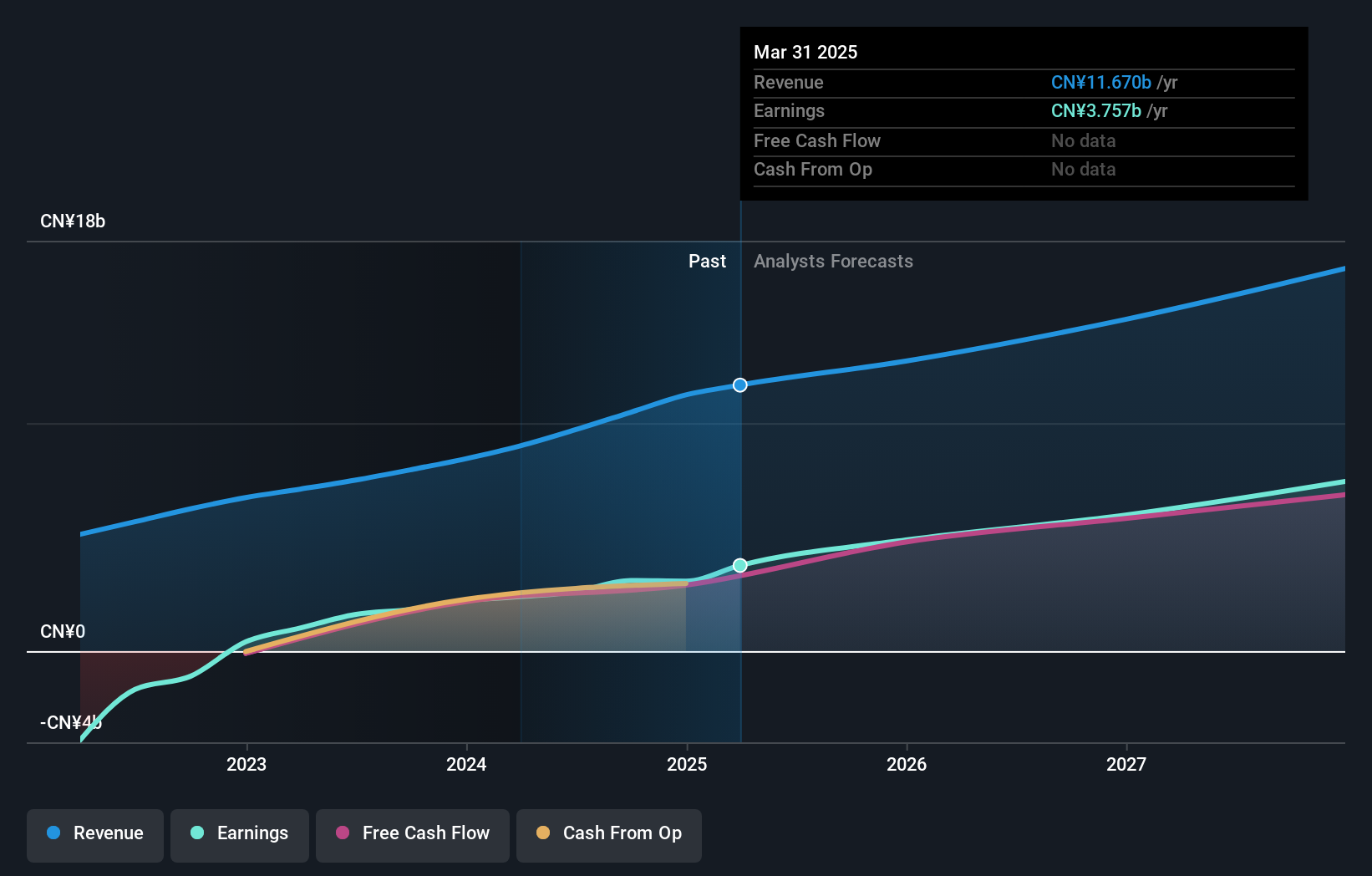

Operations: The company's revenue primarily comes from electronic components and parts, amounting to NT$25.53 billion.

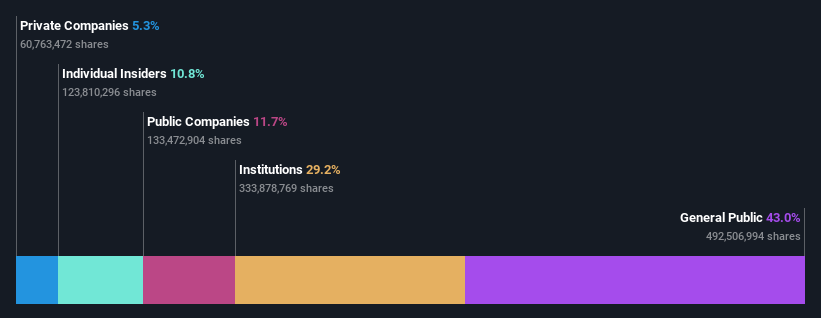

Insider Ownership: 10.8%

Revenue Growth Forecast: 26.7% p.a.

E Ink Holdings is poised for strong growth, with earnings forecasted to increase by 28.41% annually and revenue expected to grow at 26.7% per year, outpacing the Taiwan market. Recent developments include a TWD 12 billion syndicated loan to strengthen operating capital and a TWD 1.49 billion investment in new production equipment at the Hsinchu plant. The launch of the advanced T2000 color ePaper timing controller also underscores its innovative edge in display technology.

- Navigate through the intricacies of E Ink Holdings with our comprehensive analyst estimates report here.

- The analysis detailed in our E Ink Holdings valuation report hints at an inflated share price compared to its estimated value.

Silergy (TWSE:6415)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Silergy Corp. designs, manufactures, and sells various integrated circuit products and related technical services in China and internationally, with a market cap of NT$159.13 billion.

Operations: The company's revenue primarily comes from its semiconductor segment, which generated NT$15.83 billion.

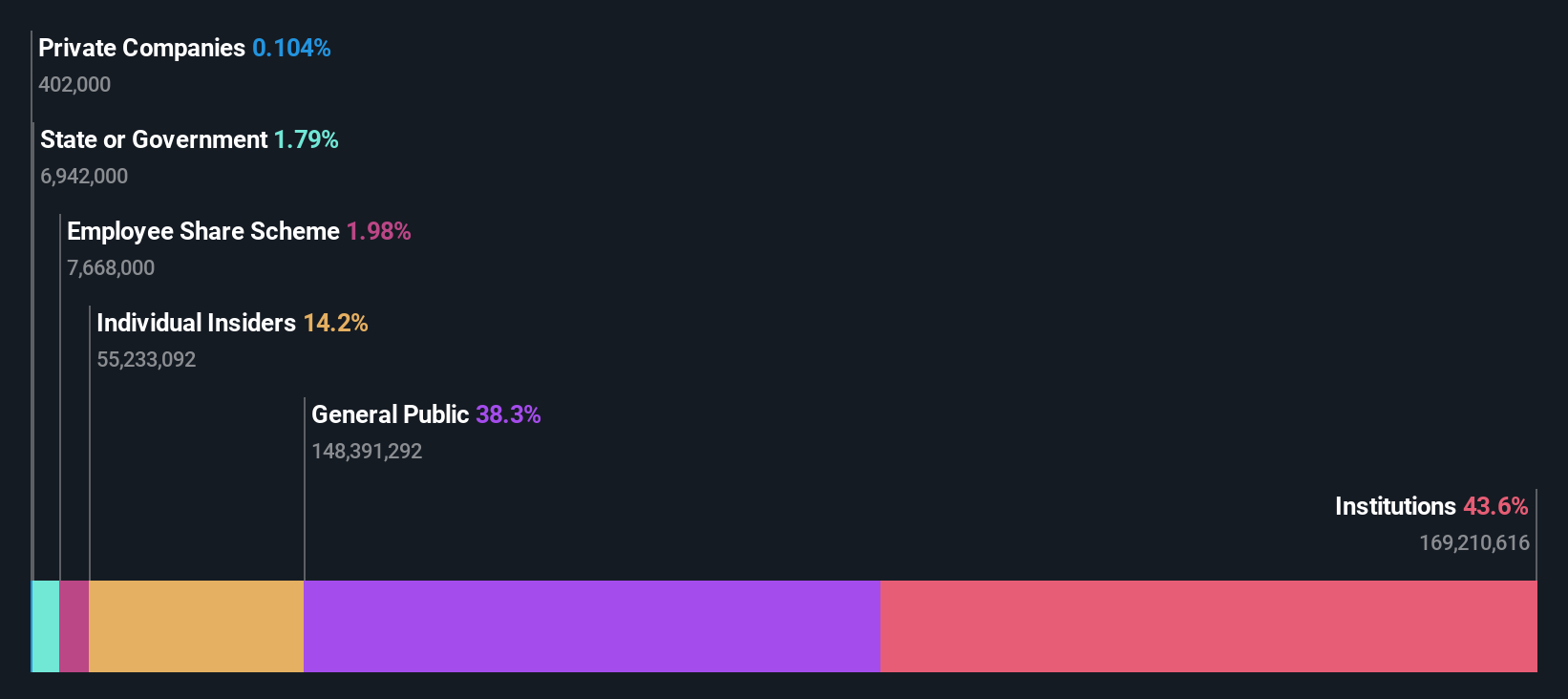

Insider Ownership: 14.4%

Revenue Growth Forecast: 23.7% p.a.

Silergy's revenue is forecast to grow 23.7% annually, outpacing the Taiwan market. However, net income for Q1 2024 dropped significantly to TWD 78.01 million from TWD 218.38 million a year ago, with profit margins declining from 22.4% to 3.8%. Despite trading at a significant discount to its estimated fair value, the stock has experienced high volatility recently and lacks substantial insider trading activity over the past three months.

- Get an in-depth perspective on Silergy's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Silergy's current price could be quite moderate.

Taking Advantage

- Investigate our full lineup of 1470 Fast Growing Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if E Ink Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8069

E Ink Holdings

Researches, develops, manufactures, and sells electronic paper display panels worldwide.

Exceptional growth potential with excellent balance sheet.