- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8069

KE Holdings And Two Other Value Stocks Trading Below Estimated Worth

Reviewed by Simply Wall St

Global markets have experienced significant volatility recently, driven by concerns over economic growth and technical factors. Despite these fluctuations, opportunities exist for discerning investors to identify undervalued stocks that may offer potential value. In the current market environment, characterized by swings in major indices and mixed economic signals, identifying stocks trading below their estimated worth can be a prudent strategy. Here, we explore KE Holdings and two other value stocks that appear to be trading at attractive valuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Italian Sea Group (BIT:TISG) | €8.76 | €17.46 | 49.8% |

| KE Holdings (NYSE:BEKE) | US$14.80 | US$29.48 | 49.8% |

| Global PMX (TWSE:4551) | NT$111.00 | NT$221.94 | 50% |

| Elders (ASX:ELD) | A$9.08 | A$18.11 | 49.9% |

| AGC (TSE:5201) | ¥4633.00 | ¥9253.14 | 49.9% |

| Banca Sistema (BIT:BST) | €1.426 | €2.85 | 49.9% |

| Qingdao NovelBeam TechnologyLtd (SHSE:688677) | CN¥31.47 | CN¥62.60 | 49.7% |

| Loihde Oyj (HLSE:LOIHDE) | €11.40 | €22.79 | 50% |

| Honkarakenne Oyj (HLSE:HONBS) | €3.10 | €6.20 | 50% |

| Live Nation Entertainment (NYSE:LYV) | US$91.60 | US$182.07 | 49.7% |

Here's a peek at a few of the choices from the screener.

KE Holdings (NYSE:BEKE)

Overview: KE Holdings Inc. operates an integrated online and offline platform for housing transactions and services in China, with a market cap of $16.94 billion.

Operations: The company's revenue segments include New Home Transaction Services (CN¥27.09 billion), Existing Home Transaction Services (CN¥24.50 billion), and Home Renovation and Furnishing (CN¥11.85 billion).

Estimated Discount To Fair Value: 49.8%

KE Holdings is trading 49.8% below its estimated fair value of US$29.48, with a current price of US$14.8, indicating significant undervaluation based on discounted cash flow analysis. Despite recent impairment charges and mixed earnings results—net income for the first half of 2024 was lower than the previous year—the company’s earnings are forecast to grow at 22.9% annually, outpacing the US market's growth rate of 14.8%.

- In light of our recent growth report, it seems possible that KE Holdings' financial performance will exceed current levels.

- Get an in-depth perspective on KE Holdings' balance sheet by reading our health report here.

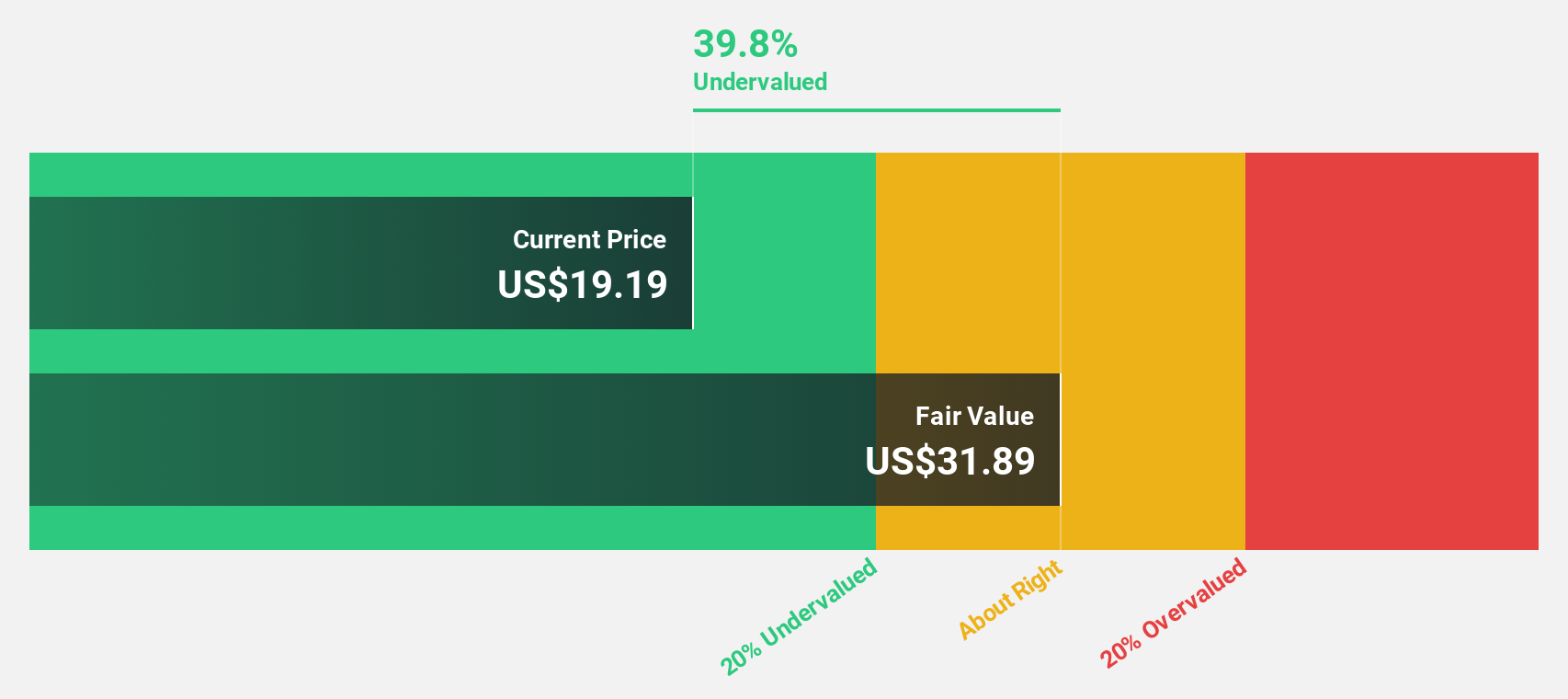

Pure Storage (NYSE:PSTG)

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services both in the United States and internationally, with a market cap of approximately $18.43 billion.

Operations: Pure Storage's revenue from its Computer Storage Devices segment is approximately $2.93 billion.

Estimated Discount To Fair Value: 44.3%

Pure Storage (US$57.19) is trading 44.3% below its estimated fair value of US$102.68, highlighting significant undervaluation based on discounted cash flow analysis. Despite recent insider selling and shareholder dilution, the company’s earnings grew by a large amount over the past year and are forecast to grow at 32.08% annually, outpacing the US market's growth rate of 14.8%. Recent product innovations further enhance its competitive position in AI and cyber resilience solutions.

- Our earnings growth report unveils the potential for significant increases in Pure Storage's future results.

- Unlock comprehensive insights into our analysis of Pure Storage stock in this financial health report.

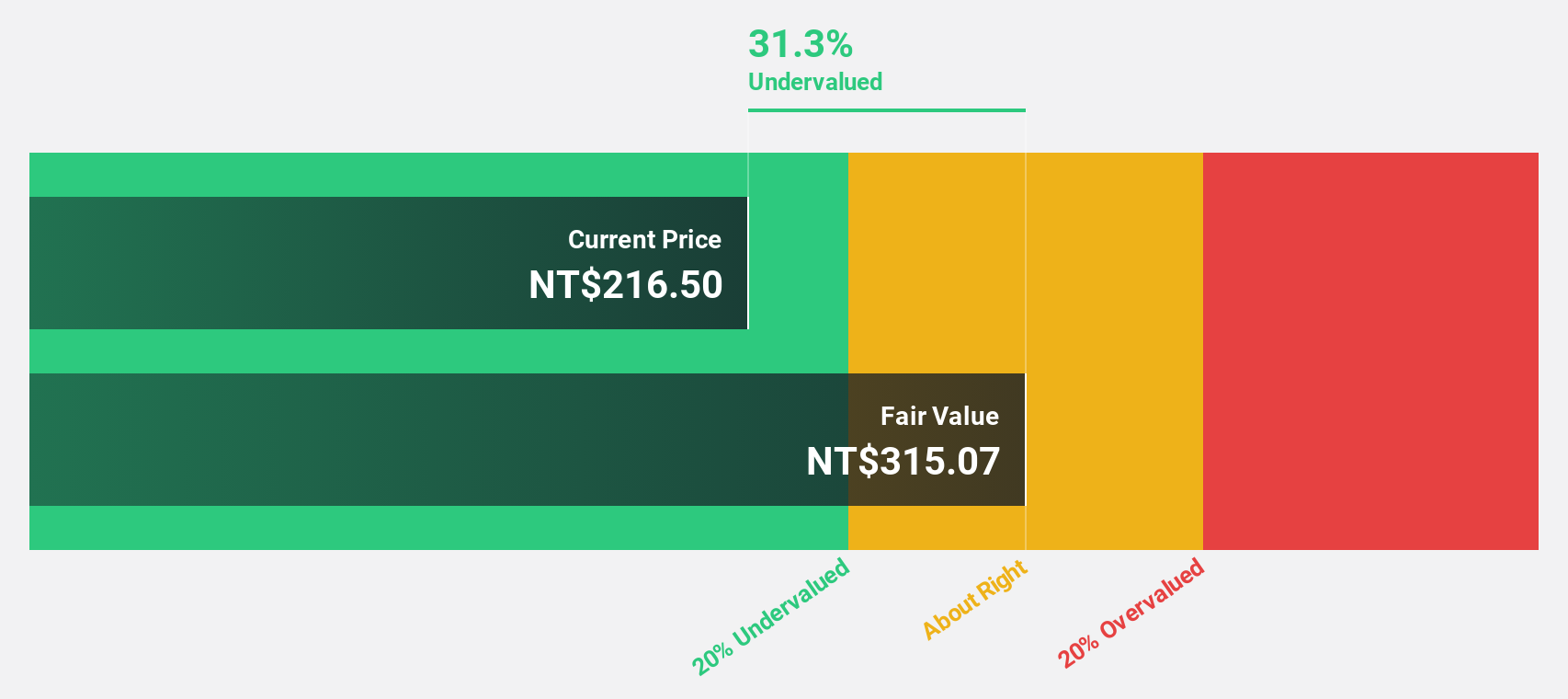

E Ink Holdings (TPEX:8069)

Overview: E Ink Holdings Inc. researches, develops, manufactures, and sells electronic paper display panels worldwide with a market cap of NT$322.73 billion.

Operations: E Ink Holdings Inc. generates revenue primarily from the sale of electronic components and parts, amounting to NT$25.53 billion.

Estimated Discount To Fair Value: 16.2%

E Ink Holdings (NT$282) is trading 16.2% below its estimated fair value of NT$336.33, indicating undervaluation based on discounted cash flow analysis. Earnings and revenue are forecast to grow significantly at 28.41% and 26.7% per year, respectively, outpacing the TW market's growth rates. Recent developments include a NT$1.49 billion investment in new production equipment and a NT$12 billion syndicated loan to bolster operating capital, which may support future growth initiatives.

- Our expertly prepared growth report on E Ink Holdings implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in E Ink Holdings' balance sheet health report.

Taking Advantage

- Discover the full array of 915 Undervalued Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E Ink Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8069

E Ink Holdings

Researches, develops, manufactures, and sells electronic paper display panels worldwide.

Exceptional growth potential with excellent balance sheet.