- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6284

Top Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade tensions and economic adjustments, Asia's stock markets have shown mixed performance, with Japan experiencing declines due to yen strength and political uncertainties while China faces deflationary pressures amid ongoing trade challenges. In such an environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for investors seeking to balance risk with steady returns in their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.26% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.02% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.89% | ★★★★★★ |

| NCD (TSE:4783) | 4.25% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Daicel (TSE:4202) | 4.40% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.77% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.52% | ★★★★★★ |

Click here to see the full list of 1062 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

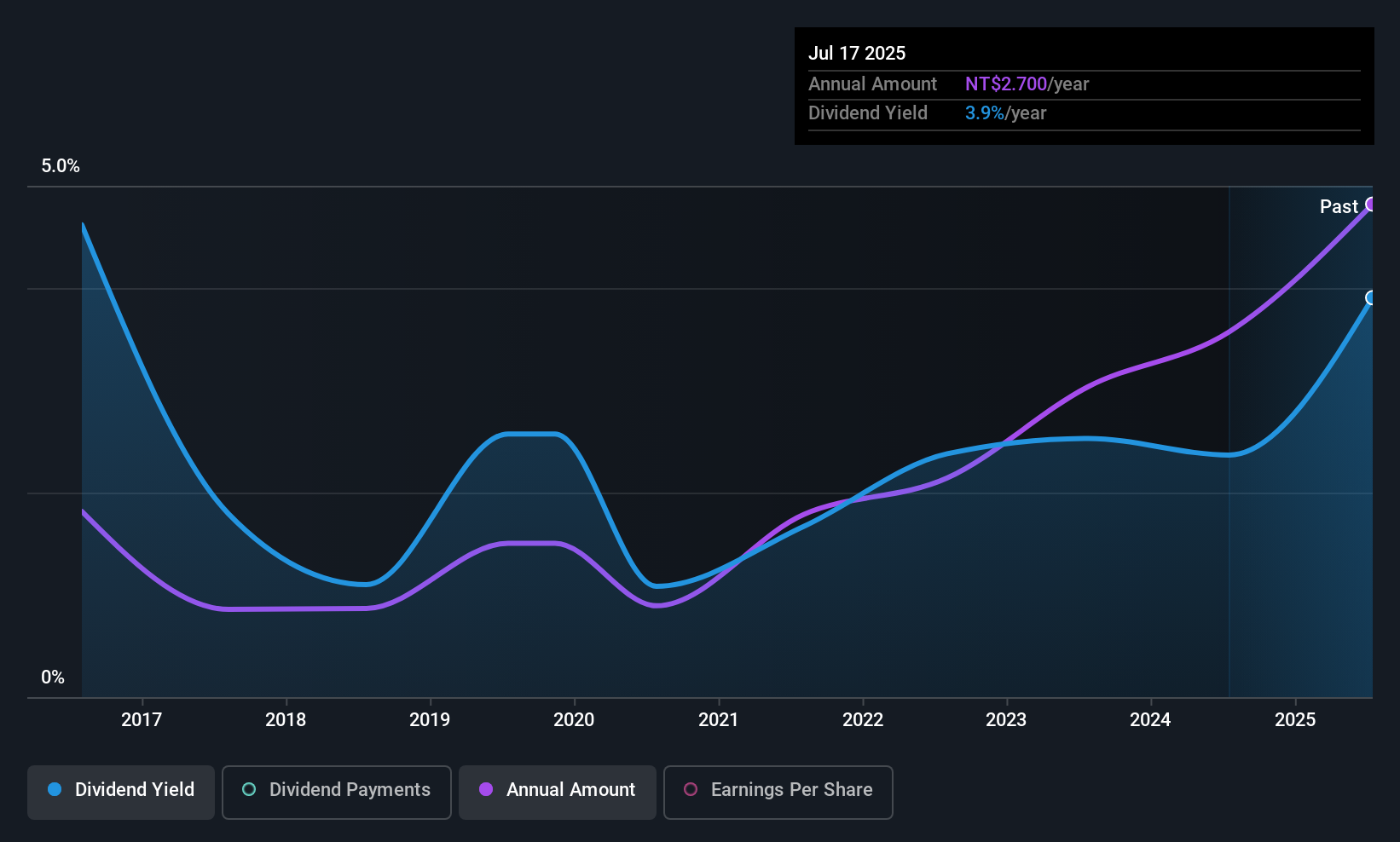

Liton Technology (TPEX:6175)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liton Technology Corp. manufactures and sells etched and formed aluminum foils across various regions including Mainland China, Europe, the Americas, Japan, Korea, India, Southeast Asia, Malaysia, Indonesia and internationally with a market cap of NT$6.09 billion.

Operations: Liton Technology Corp.'s revenue segments include NT$4.99 billion from China and NT$1.14 billion from Taiwan.

Dividend Yield: 3.9%

Liton Technology's dividends are covered by earnings and cash flows, with a payout ratio of 58.5% and a cash payout ratio of 46.6%, respectively. However, its dividend yield at 3.91% is below the top quartile in Taiwan, and its dividend history has been volatile over the past decade despite recent growth. The company's share price has also been highly volatile recently, although it trades at a favorable P/E ratio of 15x compared to the market average of 20.9x.

- Click here and access our complete dividend analysis report to understand the dynamics of Liton Technology.

- Insights from our recent valuation report point to the potential overvaluation of Liton Technology shares in the market.

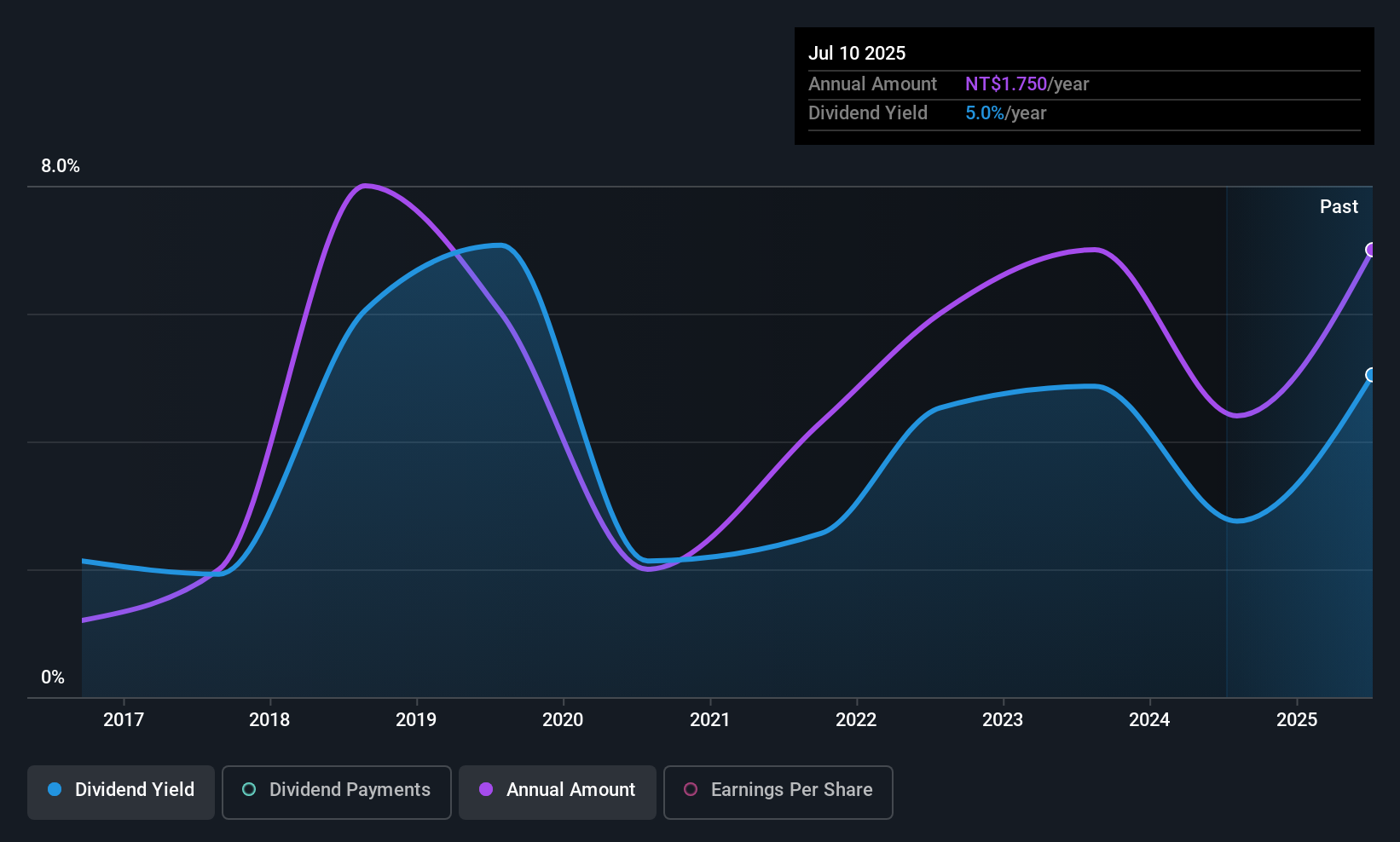

INPAQ Technology (TPEX:6284)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: INPAQ Technology Co., Ltd. specializes in circuit protection components and antenna products for various sectors including computing, communication, consumer electronics, and automotive electronics across Taiwan, China, Hong Kong, and globally with a market cap of NT$10.78 billion.

Operations: INPAQ Technology Co., Ltd.'s revenue is primarily derived from its Protection Component Department, which contributes NT$3.22 billion, and its High-Frequency Component Department, which generates NT$4.48 billion.

Dividend Yield: 3.5%

INPAQ Technology's dividends are supported by earnings and cash flows, with a payout ratio of 60.3% and a cash payout ratio of 37.8%. Despite this coverage, the dividend yield of 3.53% is below Taiwan's top quartile, and the company's dividend history has been unstable over the past decade despite some growth. Recent financial results show increased sales but a net loss for Q2 2025, highlighting profitability challenges that could impact future payouts.

- Navigate through the intricacies of INPAQ Technology with our comprehensive dividend report here.

- Our valuation report unveils the possibility INPAQ Technology's shares may be trading at a discount.

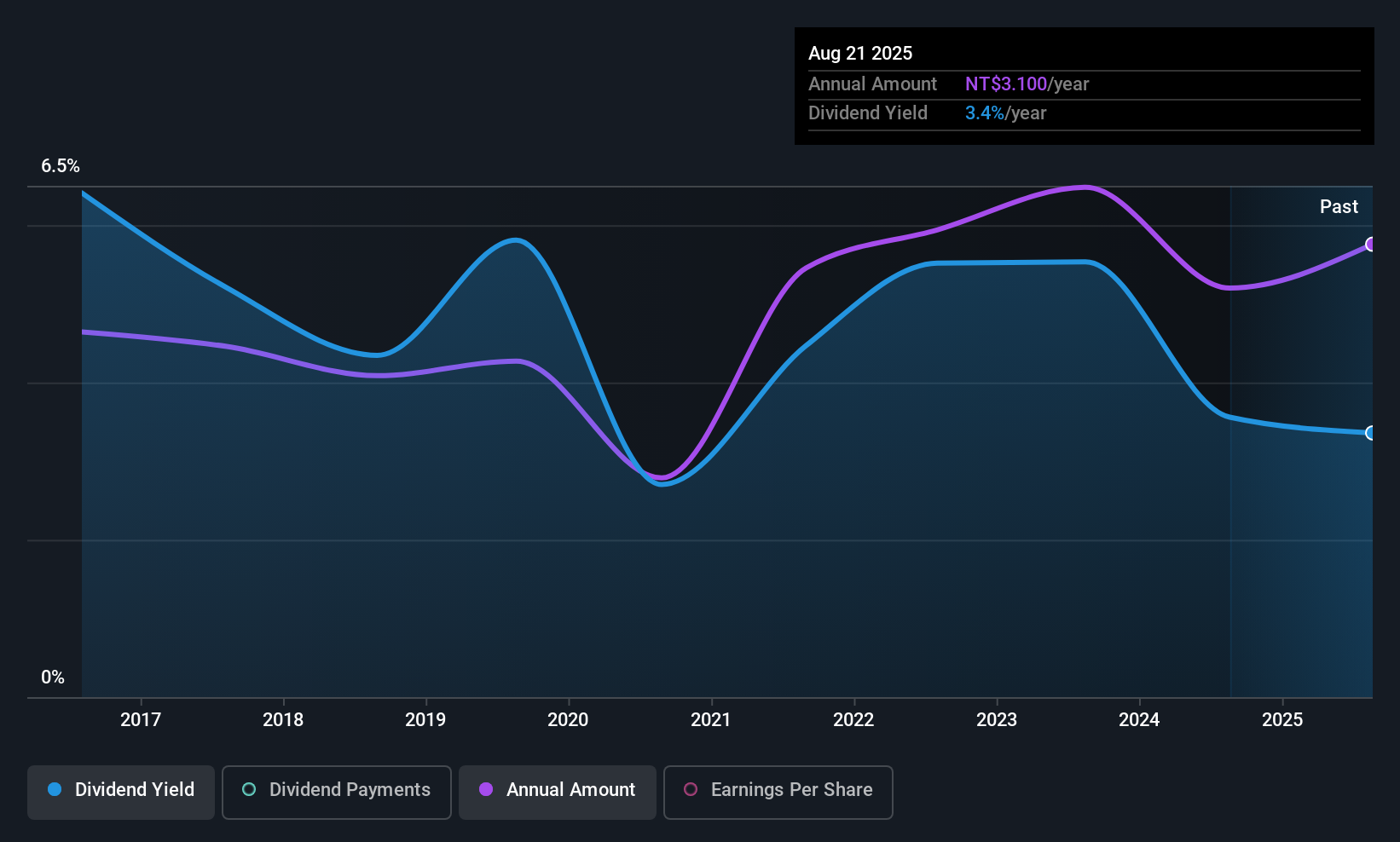

Lelon Electronics (TWSE:2472)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lelon Electronics Corp., along with its subsidiaries, is engaged in the development, manufacturing, marketing, trading, and sales of electrolytic capacitors globally, with a market capitalization of NT$14.63 billion.

Operations: Lelon Electronics Corp.'s revenue is primarily derived from its LELON Department, which contributes NT$7.25 billion, and its Li Dun Department, which adds NT$4.33 billion.

Dividend Yield: 3.3%

Lelon Electronics' dividends are well-covered by earnings and cash flows, with a payout ratio of 47.2% and a cash payout ratio of 28.9%. Despite this solid coverage, the dividend yield of 3.3% is below Taiwan's top quartile. The company has an unstable dividend track record over the past decade, marked by volatility. Recent Q2 2025 results show increased sales to TWD 2.91 billion but a decline in net income to TWD 201.63 million, potentially affecting future stability.

- Dive into the specifics of Lelon Electronics here with our thorough dividend report.

- Our valuation report here indicates Lelon Electronics may be undervalued.

Next Steps

- Access the full spectrum of 1062 Top Asian Dividend Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6284

INPAQ Technology

Provides circuit protection components and antenna products for computing, communication, consumer electronics, and automotive electronics primarily in Taiwan, China, Hong Kong, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.