- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6274

Three Stocks That May Be Undervalued In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties introduced by the incoming Trump administration, investors are keenly observing shifts in sector performance and policy impacts. With U.S. stocks retracting some gains amid these developments, identifying undervalued opportunities becomes crucial for those looking to capitalize on market fluctuations. In this context, a good stock may be one that demonstrates resilience or potential for growth despite current market volatility and policy changes.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.71 | CN¥33.16 | 49.6% |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥38.49 | CN¥76.93 | 50% |

| Taiwan Union Technology (TPEX:6274) | NT$156.50 | NT$311.70 | 49.8% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥14.57 | CN¥29.09 | 49.9% |

| ConvaTec Group (LSE:CTEC) | £2.43 | £4.85 | 49.9% |

| TF Bank (OM:TFBANK) | SEK312.00 | SEK621.04 | 49.8% |

| AirBoss of America (TSX:BOS) | CA$4.23 | CA$8.40 | 49.6% |

| Saipem (BIT:SPM) | €2.342 | €4.65 | 49.6% |

| Intellian Technologies (KOSDAQ:A189300) | ₩44450.00 | ₩88893.31 | 50% |

| Nokian Renkaat Oyj (HLSE:TYRES) | €7.408 | €14.72 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

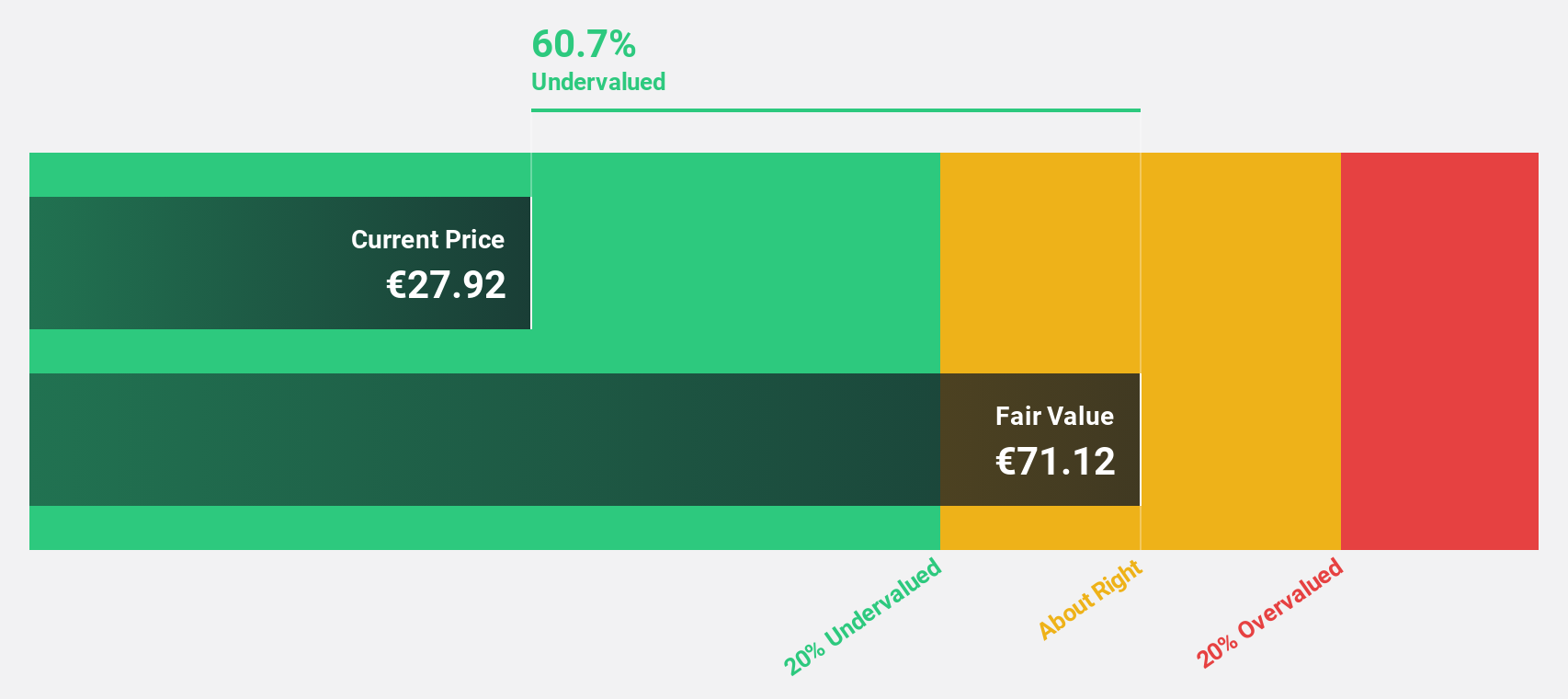

Solvay (ENXTBR:SOLB)

Overview: Solvay SA is a global provider of advanced materials and specialty chemicals, with a market cap of €3.33 billion.

Operations: The company's revenue is derived from Basic Chemicals (€3.23 billion), Performance Chemicals (€2.02 billion), and Corporate & Business Services (€130 million).

Estimated Discount To Fair Value: 43.3%

Solvay appears undervalued, trading at €31.92, significantly below its estimated fair value of €56.27. Despite recent earnings challenges—such as a drop in net income to €19 million for Q3 2024 from €220 million the previous year—the company's forecasted high return on equity and expected profitability within three years highlight potential long-term value. However, its high debt levels and volatile share price warrant cautious consideration for investors focusing on cash flow valuation metrics.

- In light of our recent growth report, it seems possible that Solvay's financial performance will exceed current levels.

- Get an in-depth perspective on Solvay's balance sheet by reading our health report here.

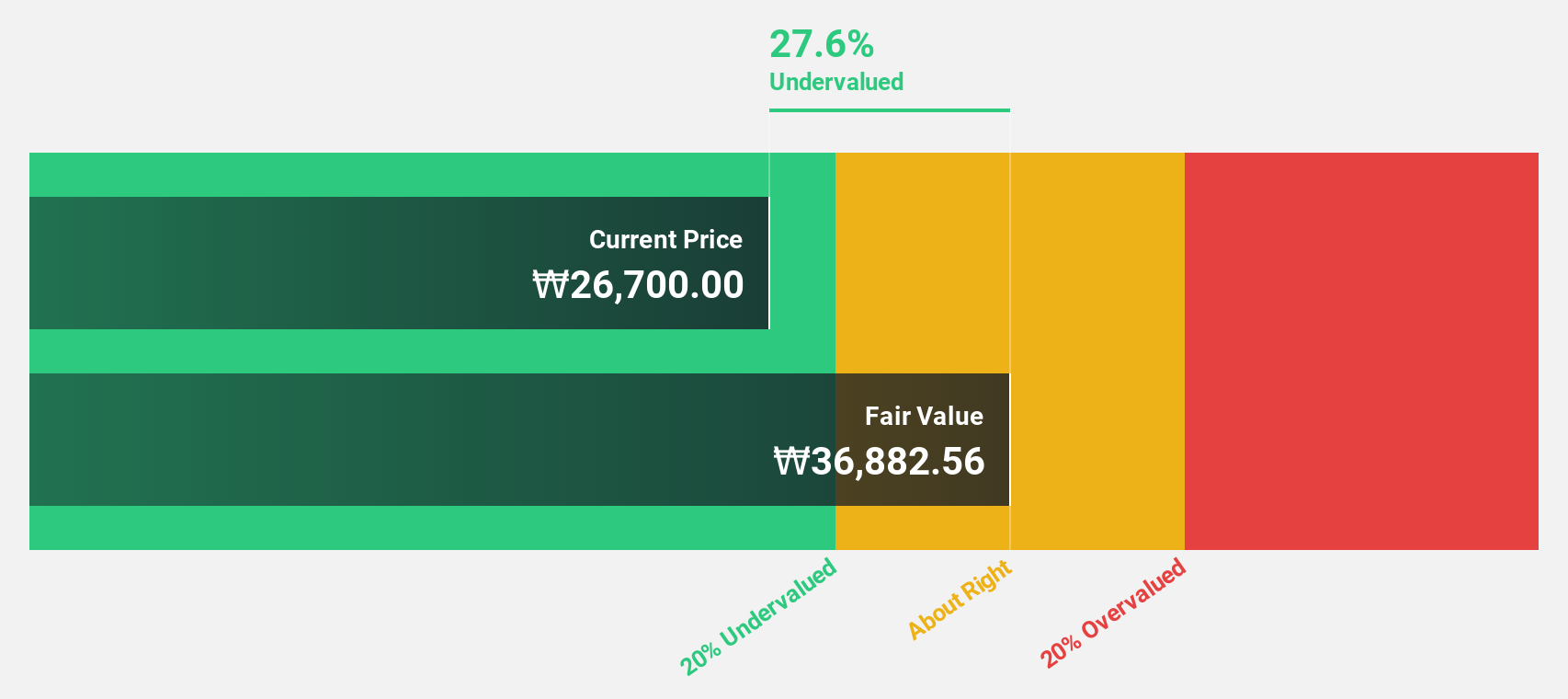

Dongsung FineTec (KOSDAQ:A033500)

Overview: Dongsung FineTec Co., Ltd. manufactures and sells cryogenic insulation products in South Korea, with a market cap of ₩369.88 billion.

Operations: The company's revenue segments include the Gas Business, generating ₩22.17 billion, and Cooling Material, contributing ₩516.27 billion.

Estimated Discount To Fair Value: 37.4%

Dongsung FineTec, trading at ₩12,740, is significantly undervalued compared to its estimated fair value of ₩20,349.99. The company's earnings have grown by 75.7% over the past year and are forecast to grow 31.2% annually—outpacing the Korean market's expected growth rate of 28.6%. Despite an unstable dividend history and slower revenue growth forecasts at 12.1%, its high projected return on equity suggests potential for long-term cash flow valuation benefits.

- The analysis detailed in our Dongsung FineTec growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Dongsung FineTec's balance sheet health report.

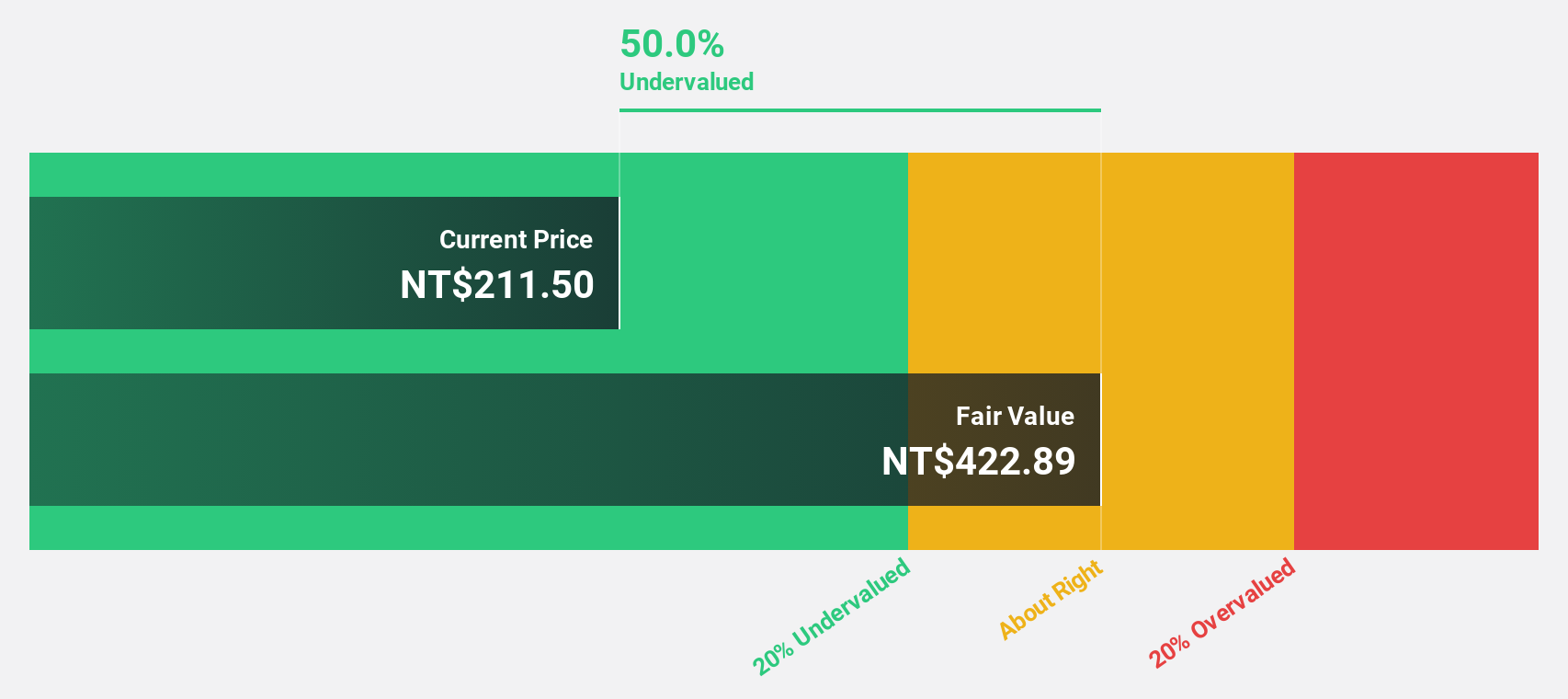

Taiwan Union Technology (TPEX:6274)

Overview: Taiwan Union Technology Corporation manufactures and sells copper foil substrates, adhesive sheets, and multi-layer laminated boards both in Taiwan and internationally, with a market capitalization of NT$42.57 billion.

Operations: The company's revenue segments include the production and distribution of copper foil substrates, adhesive sheets, and multi-layer laminated boards.

Estimated Discount To Fair Value: 49.8%

Taiwan Union Technology, trading at NT$156.5, is significantly undervalued with an estimated fair value of NT$311.7. Recent earnings growth of 217.9% and a forecasted annual profit increase of 23.6% highlight its robust financial health compared to the broader TW market's 19.5%. Despite high non-cash earnings and a dividend not fully covered by free cash flows, its strong return on equity projection and superior revenue growth rate underscore its investment potential based on cash flows.

- Insights from our recent growth report point to a promising forecast for Taiwan Union Technology's business outlook.

- Navigate through the intricacies of Taiwan Union Technology with our comprehensive financial health report here.

Summing It All Up

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 935 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Union Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6274

Taiwan Union Technology

Engages in the manufacture and sale of copper foil substrates, adhesive sheets, and multi-layer laminated boards in Taiwan and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives