As global markets navigate a landscape of easing trade tensions and mixed economic signals, the Asian market has been experiencing its own set of dynamics, with Japan's stock indices rising amid stable interest rates and China's market showing resilience despite holiday-shortened trading weeks. In this environment, dividend stocks can offer a compelling opportunity for investors seeking steady income streams, as they often provide yields that can help cushion against economic uncertainties.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.81% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.26% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.48% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.16% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.80% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.99% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.07% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.49% | ★★★★★★ |

Click here to see the full list of 1219 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

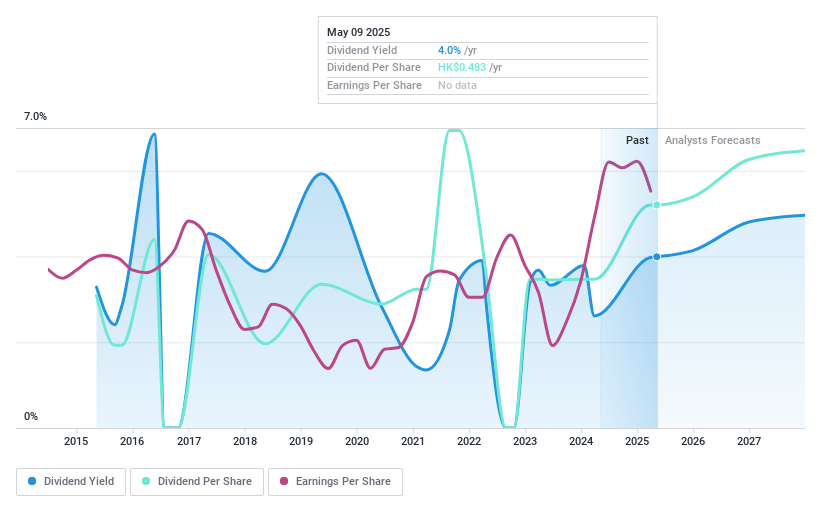

Great Wall Motor (SEHK:2333)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Great Wall Motor Company Limited manufactures and sells automobiles and automotive parts in various regions including China, Europe, ASEAN countries, Latin America, the Middle East, Australia, South Africa, and internationally with a market cap of HK$184.34 billion.

Operations: Great Wall Motor's revenue primarily comes from the manufacture and sale of automobiles and automotive parts, totaling CN¥199.36 billion.

Dividend Yield: 3.9%

Great Wall Motor's dividend payments have been volatile over the past decade, with an unstable track record. Despite this, the dividends are well-covered by earnings and cash flows, with a payout ratio of 34% and a cash payout ratio of 38.9%. The stock trades at good value compared to peers, being significantly below its estimated fair value. Recent sales figures show slight declines year-to-date but indicate potential for future growth given past earnings improvements.

- Click here to discover the nuances of Great Wall Motor with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Great Wall Motor's share price might be too pessimistic.

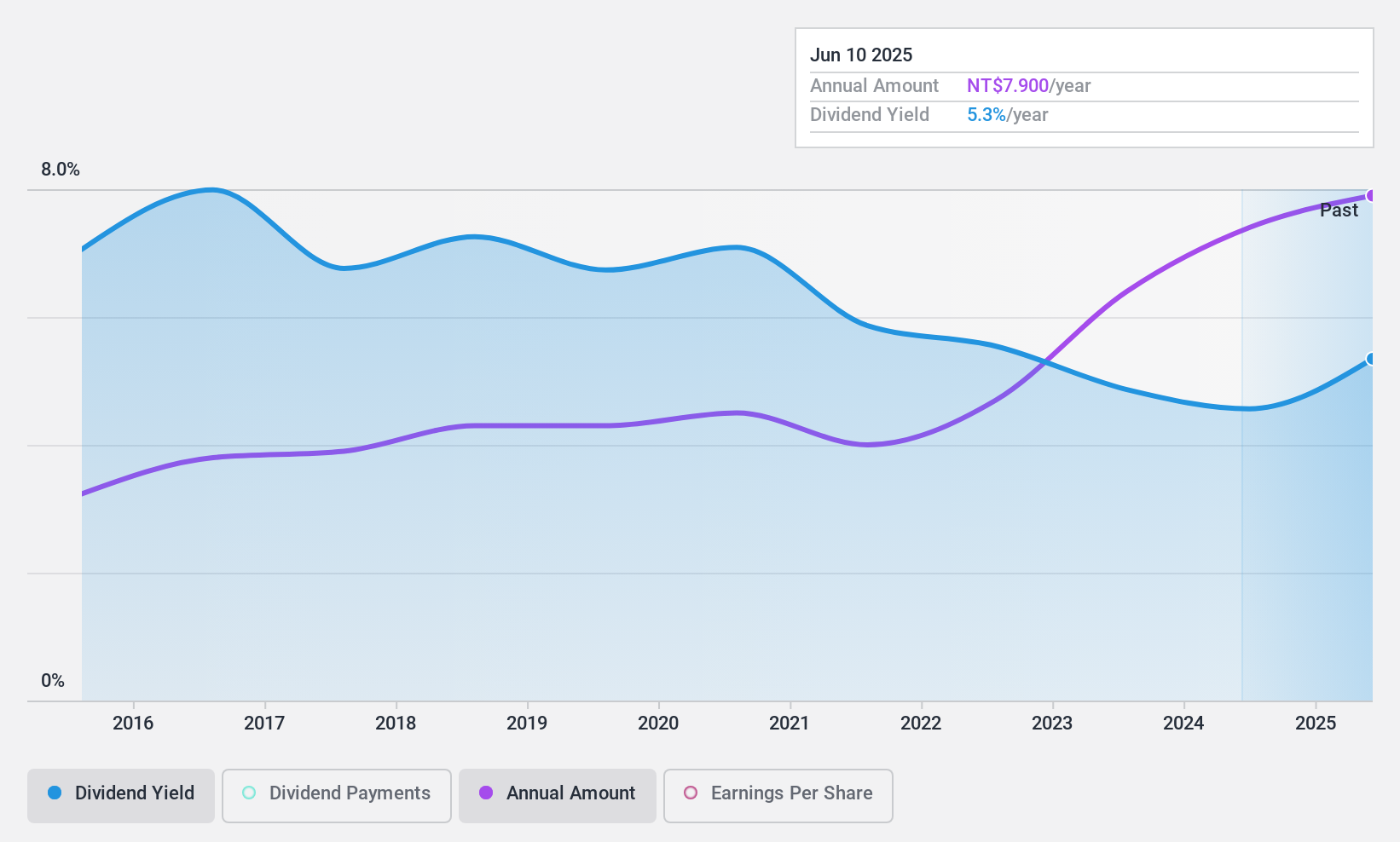

Planet Technology (TPEX:6263)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Planet Technology Corporation offers IP-based networking products and solutions for small-to-medium-sized businesses, enterprises, and network infrastructures globally, with a market cap of NT$9.84 billion.

Operations: Planet Technology Corporation generates revenue primarily from its Computer Network Equipment and Telecommunication Products segment, which amounts to NT$1.91 billion.

Dividend Yield: 4.7%

Planet Technology offers a stable dividend history over the past decade, with increasing payments. However, its current 4.7% yield is below the top quartile in Taiwan, and high payout ratios indicate dividends are not well-covered by cash flows or earnings. Recent financial results show growth, with Q1 2025 net income rising to TWD 131.52 million from TWD 116.17 million year-over-year, suggesting potential for sustained earnings support despite coverage concerns.

- Get an in-depth perspective on Planet Technology's performance by reading our dividend report here.

- Our valuation report unveils the possibility Planet Technology's shares may be trading at a discount.

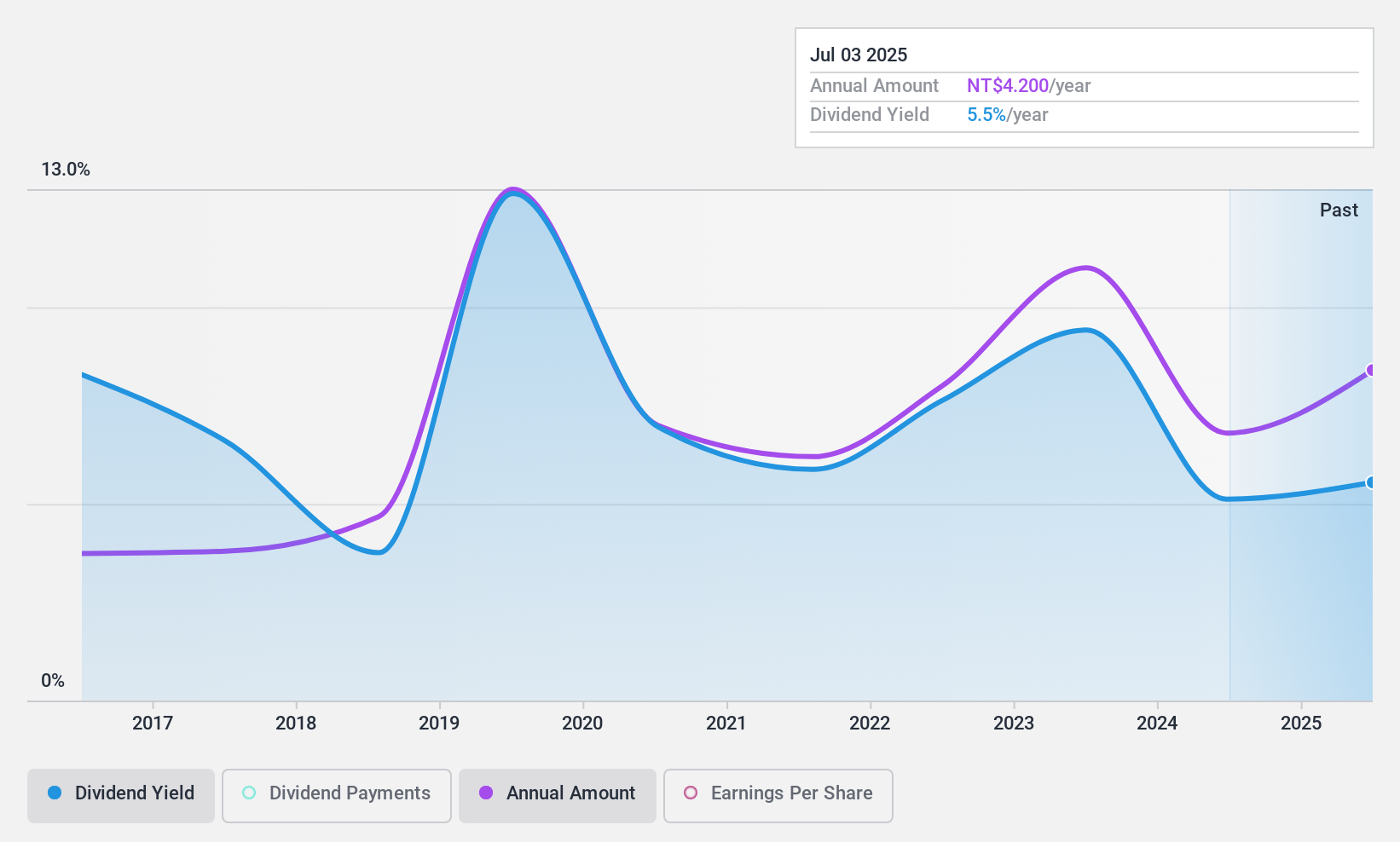

Nichidenbo (TWSE:3090)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nichidenbo Corporation is involved in the global distribution of electronic components and has a market capitalization of NT$15.07 billion.

Operations: Nichidenbo Corporation generates its revenue through the distribution of electronic components across international markets.

Dividend Yield: 5.9%

Nichidenbo's dividend yield of 5.92% ranks in the top quartile of Taiwan's market, yet it faces sustainability issues due to a high payout ratio of 84.8% and lack of free cash flow coverage. Despite earnings growth of 27.5% last year, dividends have been unreliable and volatile over the past decade, with frequent fluctuations exceeding 20%. Recent financials show improved sales and net income, but non-cash earnings raise quality concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of Nichidenbo.

- Our valuation report unveils the possibility Nichidenbo's shares may be trading at a premium.

Make It Happen

- Access the full spectrum of 1219 Top Asian Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Great Wall Motor, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2333

Great Wall Motor

Engages in the manufacture and sale of automobiles, and automotive parts and components in the People's Republic of China, Europe, ASEAN countries, Latin America, the Middle East, Australia, South Africa, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives