- Mexico

- /

- Consumer Finance

- /

- BMV:GENTERA *

Uncovering 3 Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As global markets continue to climb, with major indices like the S&P 500 and Dow Jones reaching record highs, investors are navigating a landscape influenced by significant geopolitical developments and economic indicators. In this environment of robust market performance, identifying stocks that may be undervalued can present unique opportunities for those looking to capitalize on potential price discrepancies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$633.57 | MX$1257.07 | 49.6% |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR2.39 | 49.7% |

| Ramssol Group Berhad (KLSE:RAMSSOL) | MYR0.70 | MYR1.39 | 49.5% |

| Krsnaa Diagnostics (NSEI:KRSNAA) | ₹996.65 | ₹1971.74 | 49.5% |

| Equity Bancshares (NYSE:EQBK) | US$48.12 | US$96.15 | 50% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Acerinox (BME:ACX) | €9.92 | €19.82 | 49.9% |

| Nidaros Sparebank (OB:NISB) | NOK100.10 | NOK198.62 | 49.6% |

| Marcus & Millichap (NYSE:MMI) | US$40.88 | US$81.13 | 49.6% |

| FINEOS Corporation Holdings (ASX:FCL) | A$1.90 | A$3.77 | 49.5% |

We'll examine a selection from our screener results.

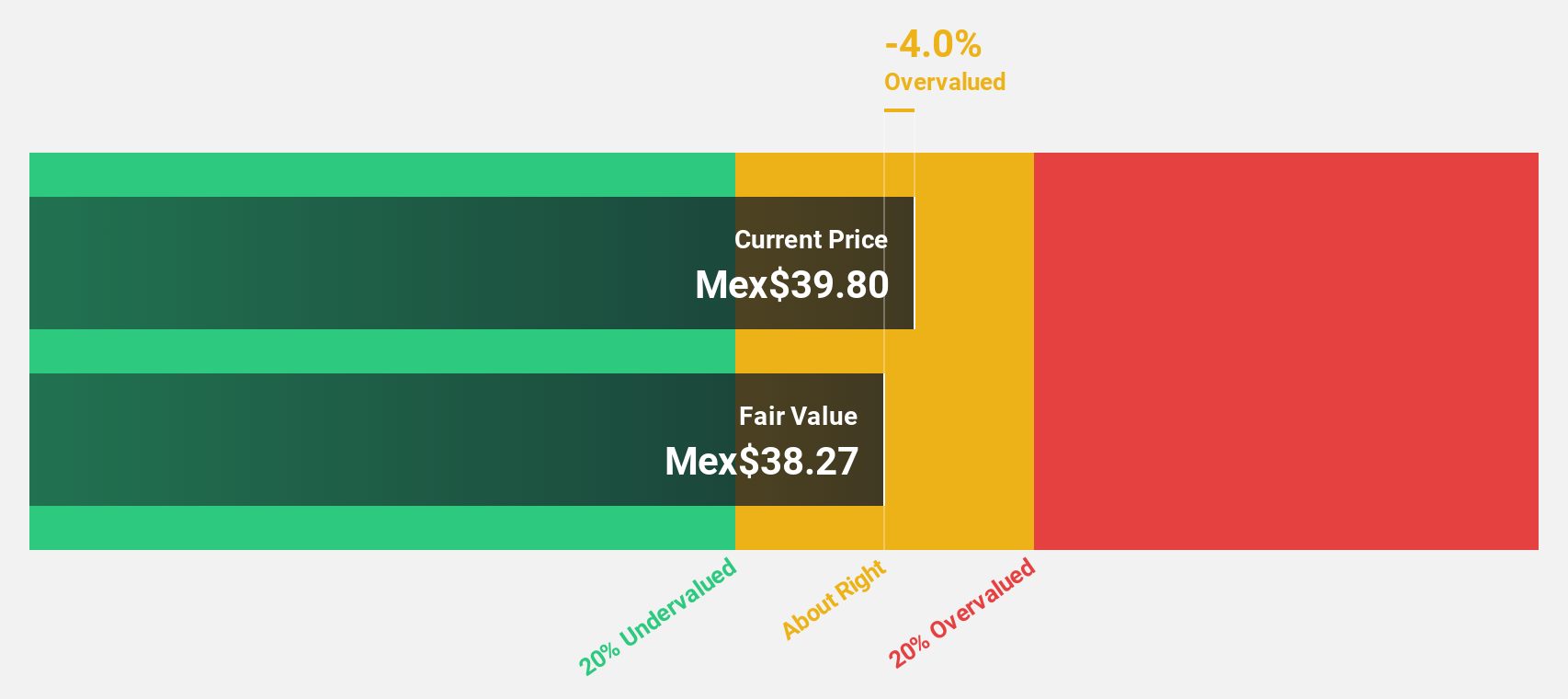

Gentera. de (BMV:GENTERA *)

Overview: Gentera, S.A.B. de C.V. offers a range of financial products and services in Mexico and Peru, with a market cap of MX$41.53 billion.

Operations: Gentera's revenue is primarily derived from its diverse range of financial products and services offered across Mexico and Peru.

Estimated Discount To Fair Value: 15.8%

Gentera is trading at MX$26.59, below its fair value estimate of MX$31.59, indicating it may be undervalued based on cash flows. Despite a high level of bad loans at 3.5%, the company shows strong revenue growth forecasts of 21.2% annually, outpacing the market average. Recent earnings reports highlight increased net interest income and net income compared to last year, supporting its potential as an undervalued stock with growing profitability prospects.

- Our expertly prepared growth report on Gentera. de implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Gentera. de stock in this financial health report.

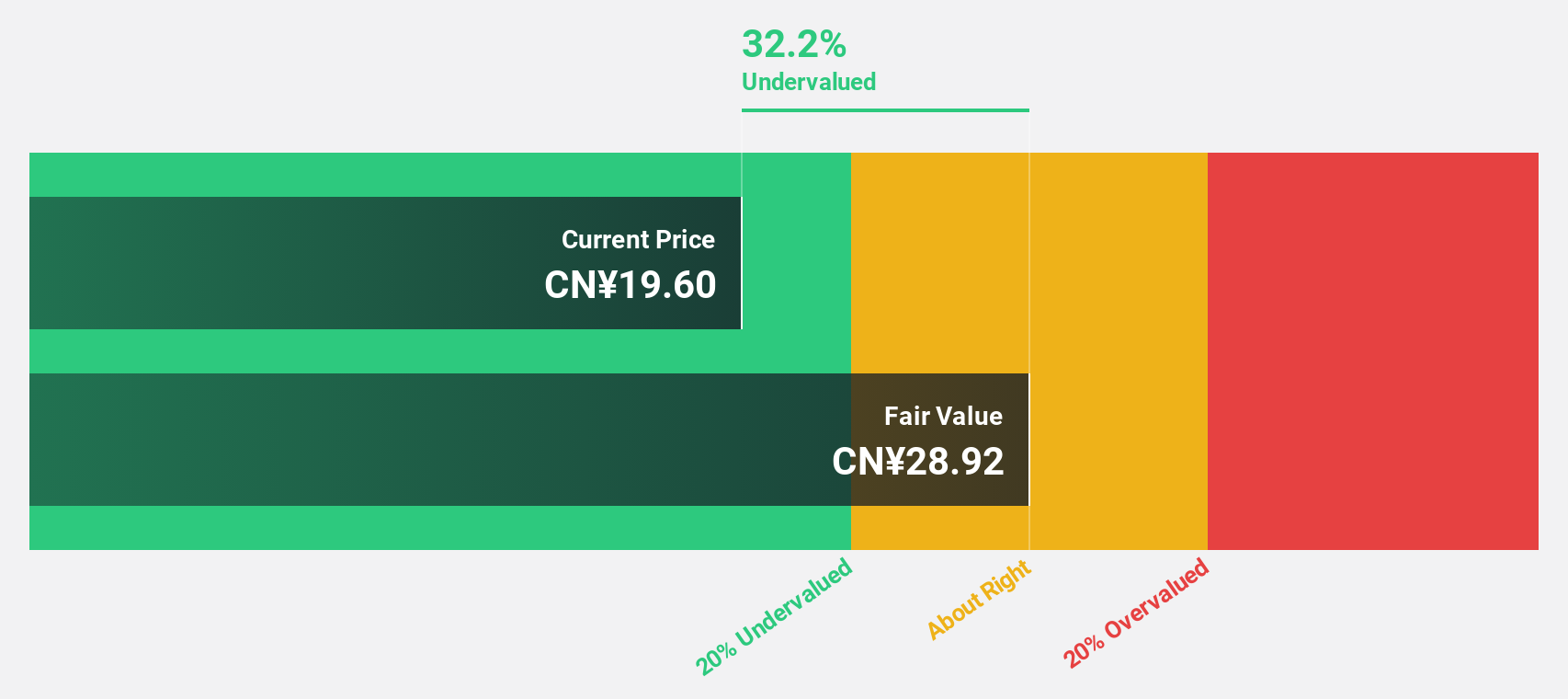

Tongqinglou Catering (SHSE:605108)

Overview: Tongqinglou Catering Co., Ltd. operates in the catering services industry in China, with a market capitalization of approximately CN¥6.38 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 43.7%

Tongqinglou Catering is trading at CNY 24.65, significantly below its estimated fair value of CNY 43.75, suggesting undervaluation based on cash flows. Despite a decline in net income to CNY 83.4 million for the first nine months of 2024, earnings are expected to grow substantially over the next three years, outpacing market averages with a forecasted annual growth rate of 40.8%. However, high debt levels and unsustainable dividends present challenges.

- Our comprehensive growth report raises the possibility that Tongqinglou Catering is poised for substantial financial growth.

- Navigate through the intricacies of Tongqinglou Catering with our comprehensive financial health report here.

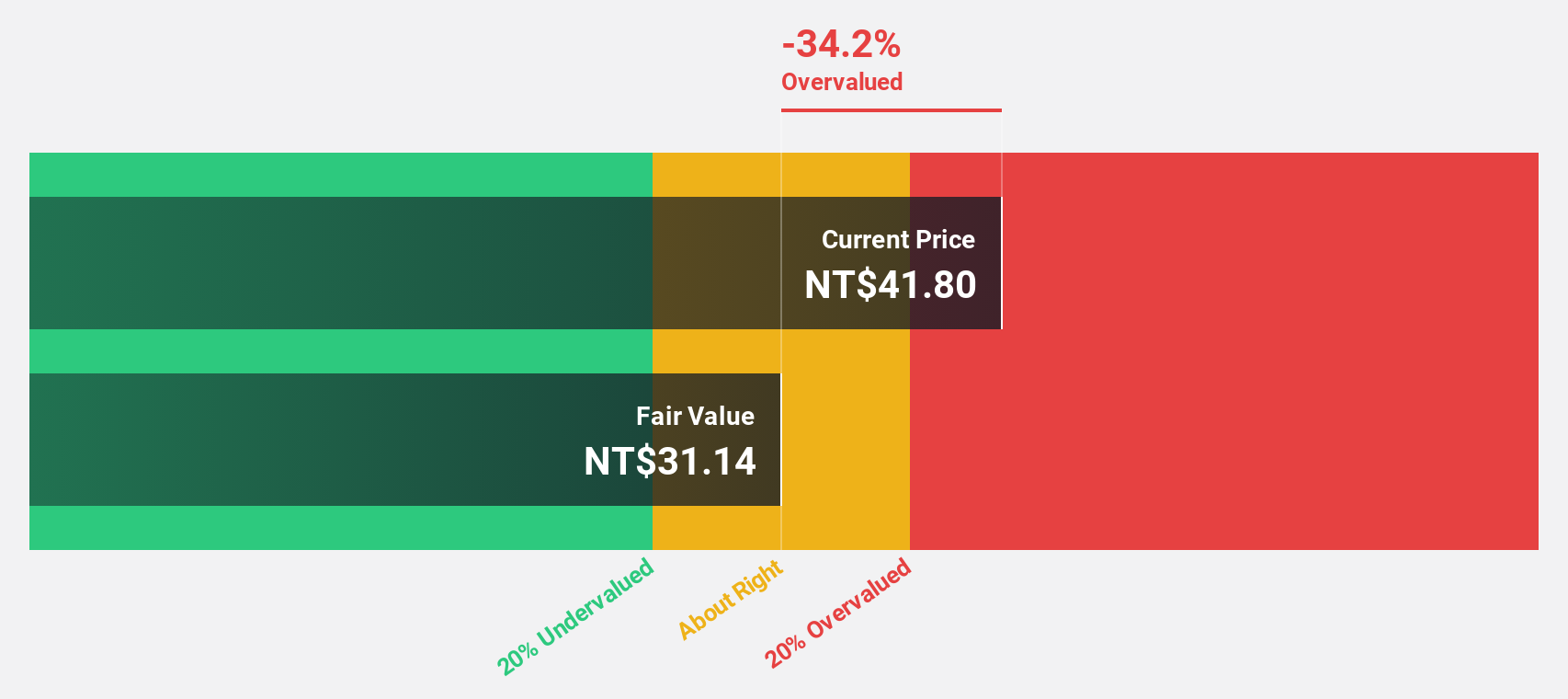

Speed Tech (TPEX:5457)

Overview: Speed Tech Corp. designs, develops, manufactures, and sells connectors for the communication, computer, automotive, and consumer industries globally with a market cap of NT$11.07 billion.

Operations: The company's revenue segments include connectors for the communication, computer, automotive, and consumer industries in Taiwan and internationally.

Estimated Discount To Fair Value: 49.1%

Speed Tech, trading at NT$63.4, is significantly undervalued with an estimated fair value of NT$124.5. The company reported substantial revenue and net income growth for the third quarter, with sales reaching TWD 7.12 billion and net income at TWD 256.66 million compared to the previous year. Despite past shareholder dilution, earnings are projected to grow significantly faster than market averages over the next three years, highlighting its potential based on cash flows.

- Upon reviewing our latest growth report, Speed Tech's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Speed Tech's balance sheet by reading our health report here.

Taking Advantage

- Gain an insight into the universe of 889 Undervalued Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:GENTERA *

Gentera. de

Provides various financial products and services in Mexico and Peru.

Solid track record with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives