- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:5457

Hidden Opportunities: Three Promising Small Caps with Robust Fundamentals

Reviewed by Simply Wall St

In the current market landscape, characterized by fluctuations in major indices and economic uncertainties stemming from policy shifts and inflationary pressures, small-cap stocks have shown a mixed performance. Despite these challenges, certain small-cap companies with strong fundamentals present intriguing opportunities for investors seeking growth potential beyond the mainstream options. Identifying such stocks involves focusing on robust financial health and strategic positioning within their respective industries, which can offer resilience amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | NA | 13.11% | 9.95% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 12.19% | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Speed Tech (TPEX:5457)

Simply Wall St Value Rating: ★★★★★★

Overview: Speed Tech Corp. is involved in the design, research and development, manufacturing, and sale of connectors for communication, computers, automotive, and consumer industries both in Taiwan and internationally with a market cap of NT$9.43 billion.

Operations: Speed Tech generates revenue from the sale of connectors across various industries, including communication, computers, automotive, and consumer sectors. The company has reported a market capitalization of NT$9.43 billion.

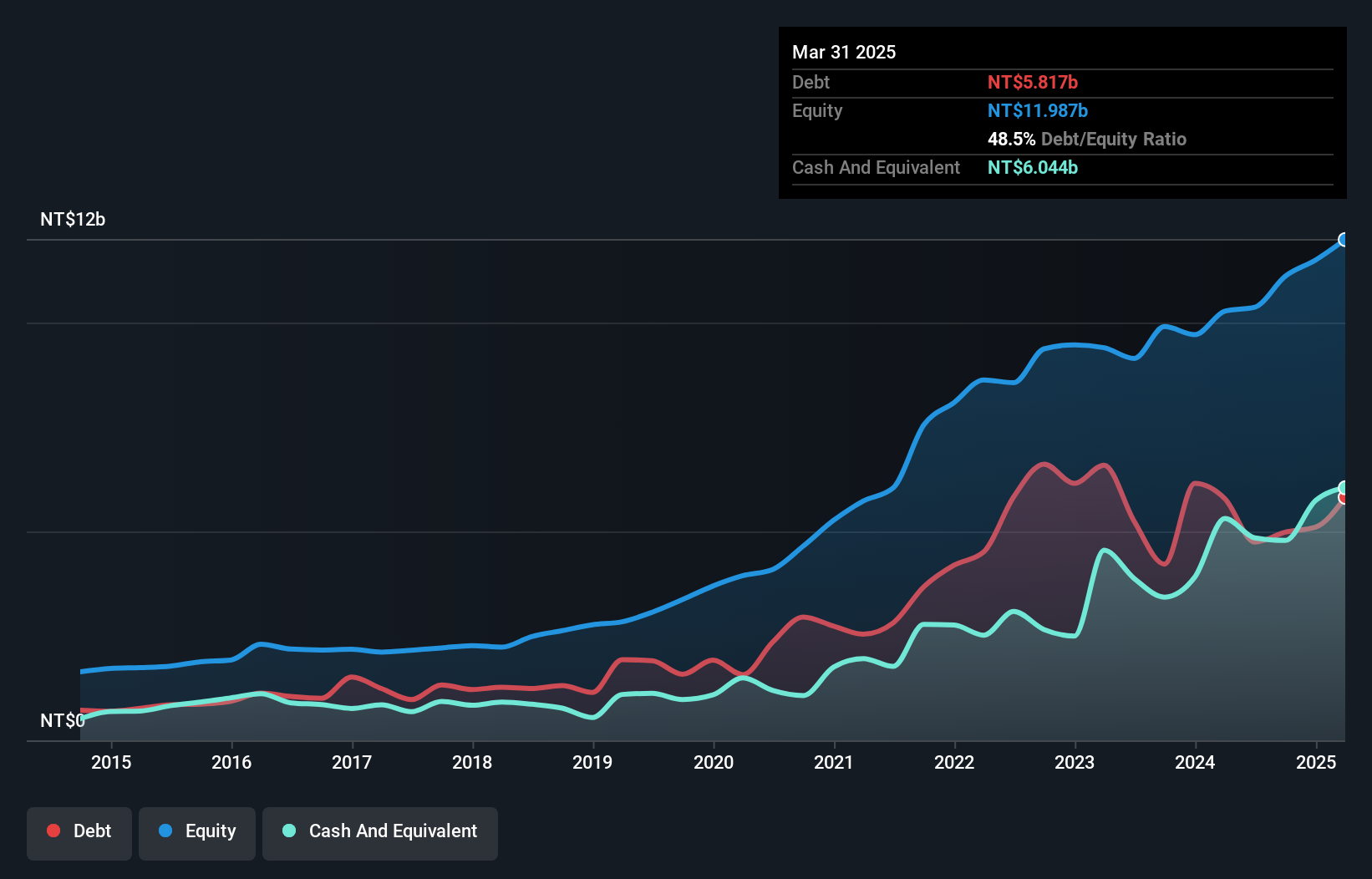

Speed Tech has been making waves with its impressive financial performance, showcasing a 36% earnings growth over the past year, outpacing the electronic industry's 9%. The company reported third-quarter sales of TWD 7.12 billion and net income of TWD 256.66 million, reflecting strong operational momentum. Trading at a value that's 28% below its estimated fair value suggests potential upside for investors. Despite shareholder dilution in the past year, Speed Tech maintains a satisfactory net debt to equity ratio of just 1.1%, indicating prudent financial management and positioning it well for future growth prospects in the industry.

- Navigate through the intricacies of Speed Tech with our comprehensive health report here.

Assess Speed Tech's past performance with our detailed historical performance reports.

Insyde Software (TPEX:6231)

Simply Wall St Value Rating: ★★★★★★

Overview: Insyde Software Corp. offers system firmware and software engineering services to global clients in the mobile, desktop, server, and embedded systems sectors with a market cap of NT$22.35 billion.

Operations: Revenue primarily stems from software and programming, amounting to NT$1.56 billion.

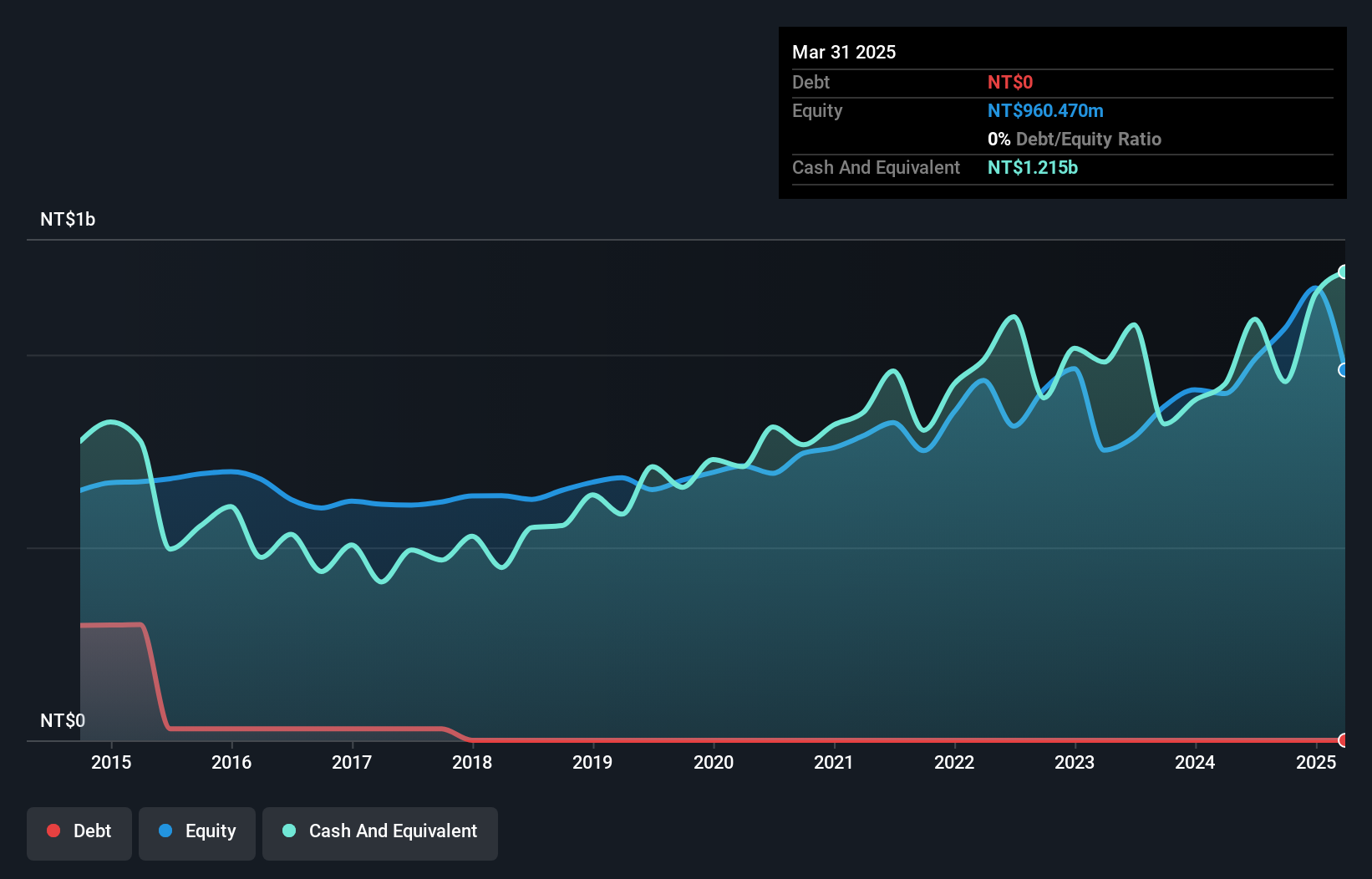

Insyde Software, a nimble player in the tech sector, is showcasing impressive financial momentum. Recent earnings growth of 62.2% outpaced the industry's 16.8%, highlighting its competitive edge. The company remains debt-free, which likely contributes to its robust financial health and ability to focus on innovation without interest concerns. Trading at 46% below estimated fair value suggests potential for upside appreciation. For Q3 2024, sales reached TWD 413 million from TWD 357 million last year, while net income climbed to TWD 88 million from TWD 69 million. Changes in leadership with a new CTO might drive fresh strategic directions moving forward.

- Click here to discover the nuances of Insyde Software with our detailed analytical health report.

Review our historical performance report to gain insights into Insyde Software's's past performance.

Chiba Kogyo Bank (TSE:8337)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Chiba Kogyo Bank, Ltd., along with its subsidiaries, offers a range of banking products and services in Japan and has a market capitalization of ¥75.42 billion.

Operations: Chiba Kogyo Bank generates revenue primarily through its banking products and services in Japan, with a market capitalization of ¥75.42 billion.

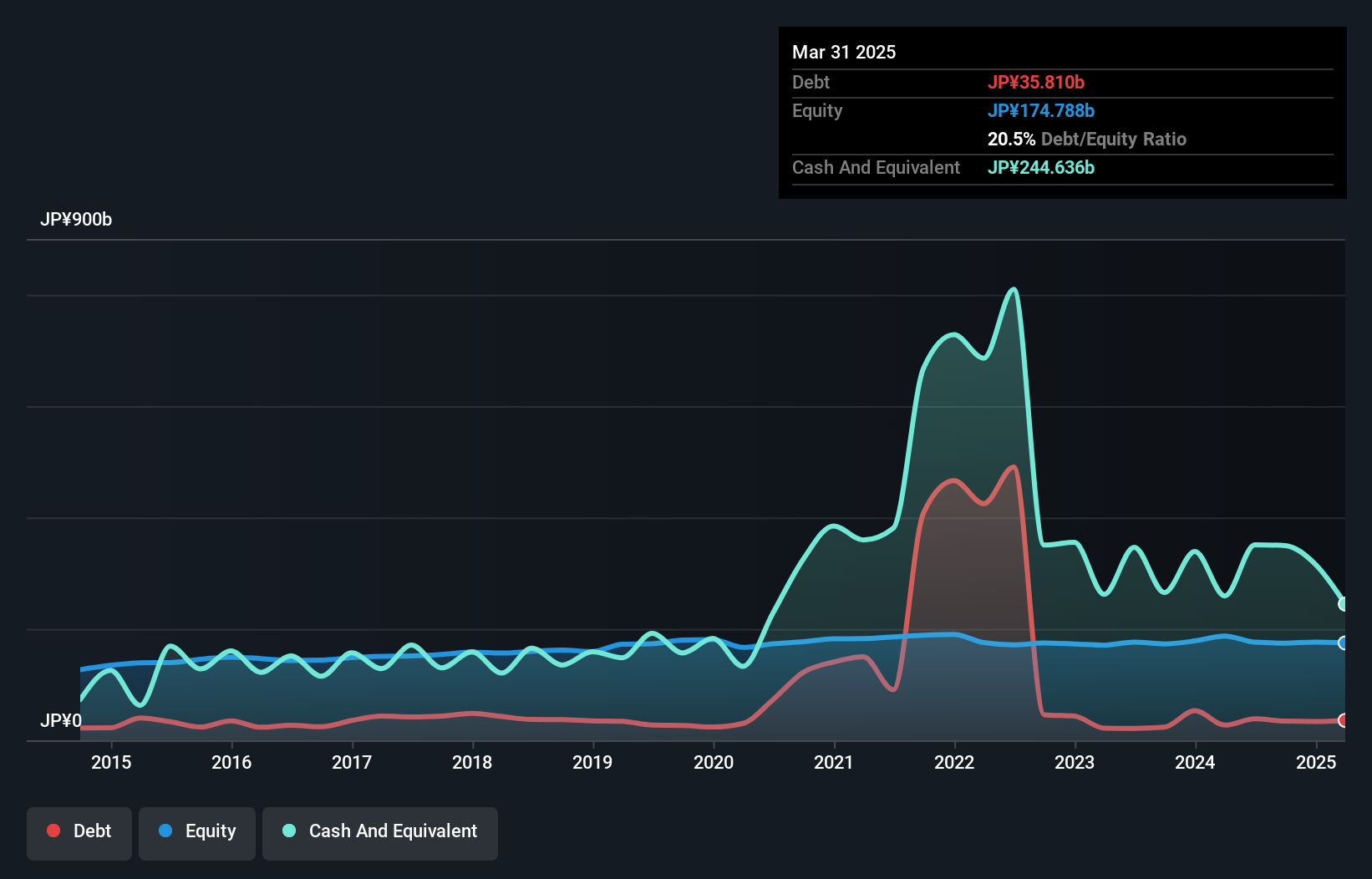

With total assets of ¥3,298.6 billion and equity of ¥174.5 billion, Chiba Kogyo Bank stands as a notable player with primarily low-risk funding sources, accounting for 98% of its liabilities. The bank's earnings have grown at an impressive rate of 18.1% annually over the past five years, although recent growth was slightly outpaced by the industry average. Despite trading at a significant discount to its estimated fair value, the bank faces challenges with an insufficient allowance for bad loans at 1.8%. Recent guidance projects profits attributable to owners at ¥7 billion with earnings per share expected to reach ¥108.45 by March 2025.

- Unlock comprehensive insights into our analysis of Chiba Kogyo Bank stock in this health report.

Gain insights into Chiba Kogyo Bank's past trends and performance with our Past report.

Make It Happen

- Click this link to deep-dive into the 4627 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5457

Speed Tech

Designs, research and develops, manufactures, and sells connectors for use in communication, computers, automotive, and consumer industries in Taiwan and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives