- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:4909

Global Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by trade uncertainties and mixed performances across major indices, investors are increasingly looking for stability amid volatility. In this environment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive consideration for those seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.90% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.74% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.39% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.57% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.13% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.28% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.48% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★★ |

Click here to see the full list of 1518 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

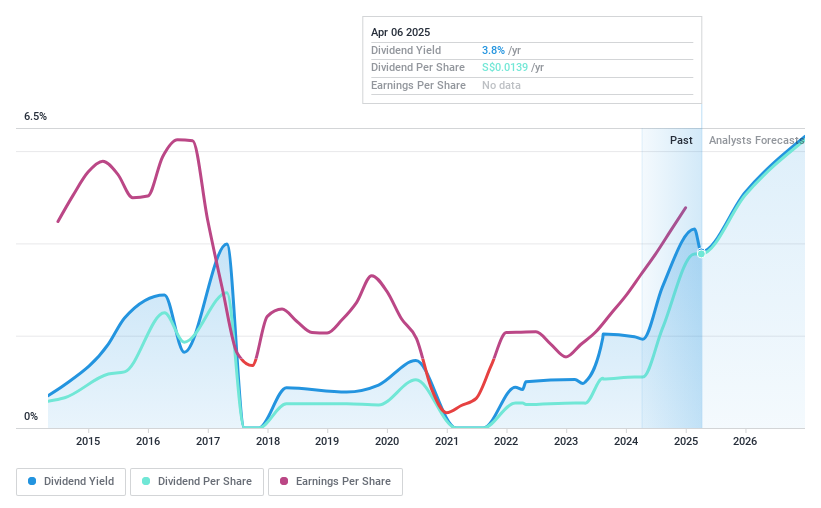

CNMC Goldmine Holdings (Catalist:5TP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNMC Goldmine Holdings Limited is an investment holding company focused on the exploration and mining of gold deposits in Malaysia, with a market capitalization of SGD182.38 million.

Operations: CNMC Goldmine Holdings Limited generates its revenue primarily from the exploration and mining of gold deposits in Malaysia.

Dividend Yield: 3%

CNMC Goldmine Holdings offers a dividend payout ratio of 24.4%, indicating dividends are well-covered by earnings, and a cash payout ratio of 28.7% shows coverage by cash flows. While its dividend yield is modest at 3.02%, recent announcements include a final and special dividend for fiscal year 2024, signaling potential growth in shareholder returns. Despite past volatility in dividends, the company's expanded processing capacity could support future financial stability and dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of CNMC Goldmine Holdings.

- Insights from our recent valuation report point to the potential undervaluation of CNMC Goldmine Holdings shares in the market.

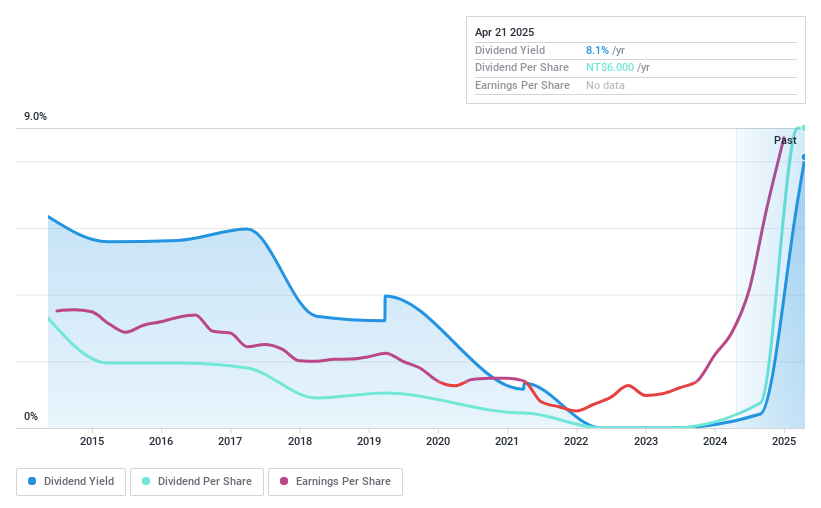

New Era Electronics (TPEX:4909)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Era Electronics Co., Ltd designs, manufactures, assembles, and sells printed circuit boards (PCBs) both in Taiwan and internationally, with a market cap of NT$7.46 billion.

Operations: New Era Electronics Co., Ltd generates revenue primarily from its Electronic Components & Parts segment, amounting to NT$2.78 billion.

Dividend Yield: 7.8%

New Era Electronics declared a cash dividend of TWD 6 per share, totaling TWD 560.14 million for 2024. Despite a strong earnings surge with net income reaching TWD 946.47 million, the dividend's sustainability is questionable due to a high cash payout ratio of 400.7% and past volatility in payments. While the dividend yield is attractive at 7.83%, coverage by free cash flows remains weak, raising concerns about future reliability despite recent profit growth.

- Unlock comprehensive insights into our analysis of New Era Electronics stock in this dividend report.

- The analysis detailed in our New Era Electronics valuation report hints at an deflated share price compared to its estimated value.

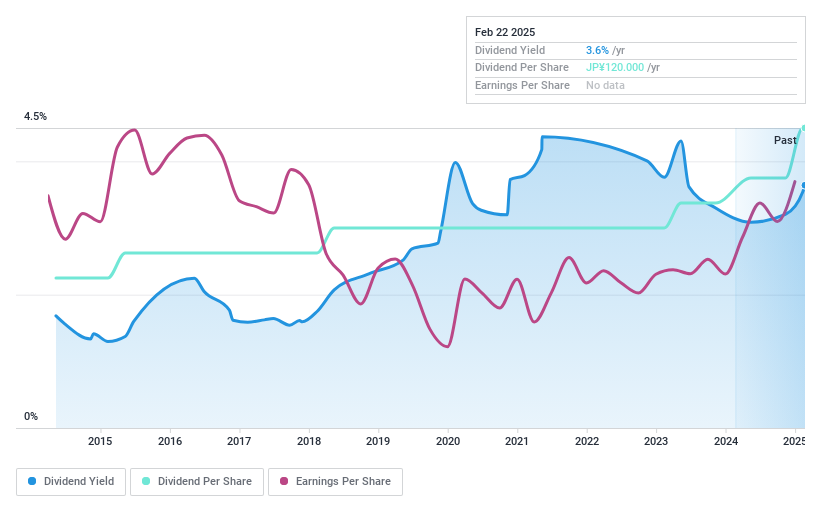

Oita Bank (TSE:8392)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Oita Bank, Ltd. offers a range of banking products and services to individual and corporate clients mainly in Japan, with a market cap of ¥48.27 billion.

Operations: Oita Bank generates revenue primarily from its Banking Operations segment, which accounts for ¥62.23 billion, and also from its Leasing segment, contributing ¥9.62 billion.

Dividend Yield: 3.6%

Oita Bank's dividend has been reliable and stable over the past decade, with a 3.61% yield. Despite its low payout ratio of 18.7%, which indicates strong coverage by earnings, the yield is below Japan's top dividend payers. The bank recently completed a share buyback for ¥849.97 million to enhance shareholder value, reflecting its commitment to returning profits to shareholders despite recent share price volatility and a low allowance for bad loans at 56%.

- Get an in-depth perspective on Oita Bank's performance by reading our dividend report here.

- According our valuation report, there's an indication that Oita Bank's share price might be on the expensive side.

Taking Advantage

- Discover the full array of 1518 Top Global Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Era Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4909

New Era Electronics

Engages in the design, manufacture, assembly, and sale of printed circuit boards (PCBs) in Taiwan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives