- Taiwan

- /

- Semiconductors

- /

- TWSE:4967

Top Global Dividend Stocks To Watch In June 2025

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East escalate, global markets have experienced significant volatility, with oil prices surging and U.S. stocks reversing early gains. Amid this backdrop, dividend stocks remain an attractive option for investors seeking stability and income, as they can provide a steady stream of returns even during uncertain economic times.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.61% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.07% | ★★★★★★ |

| NCD (TSE:4783) | 4.20% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.32% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.41% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.10% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.29% | ★★★★★★ |

| Daicel (TSE:4202) | 4.97% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.55% | ★★★★★★ |

Click here to see the full list of 1564 stocks from our Top Global Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

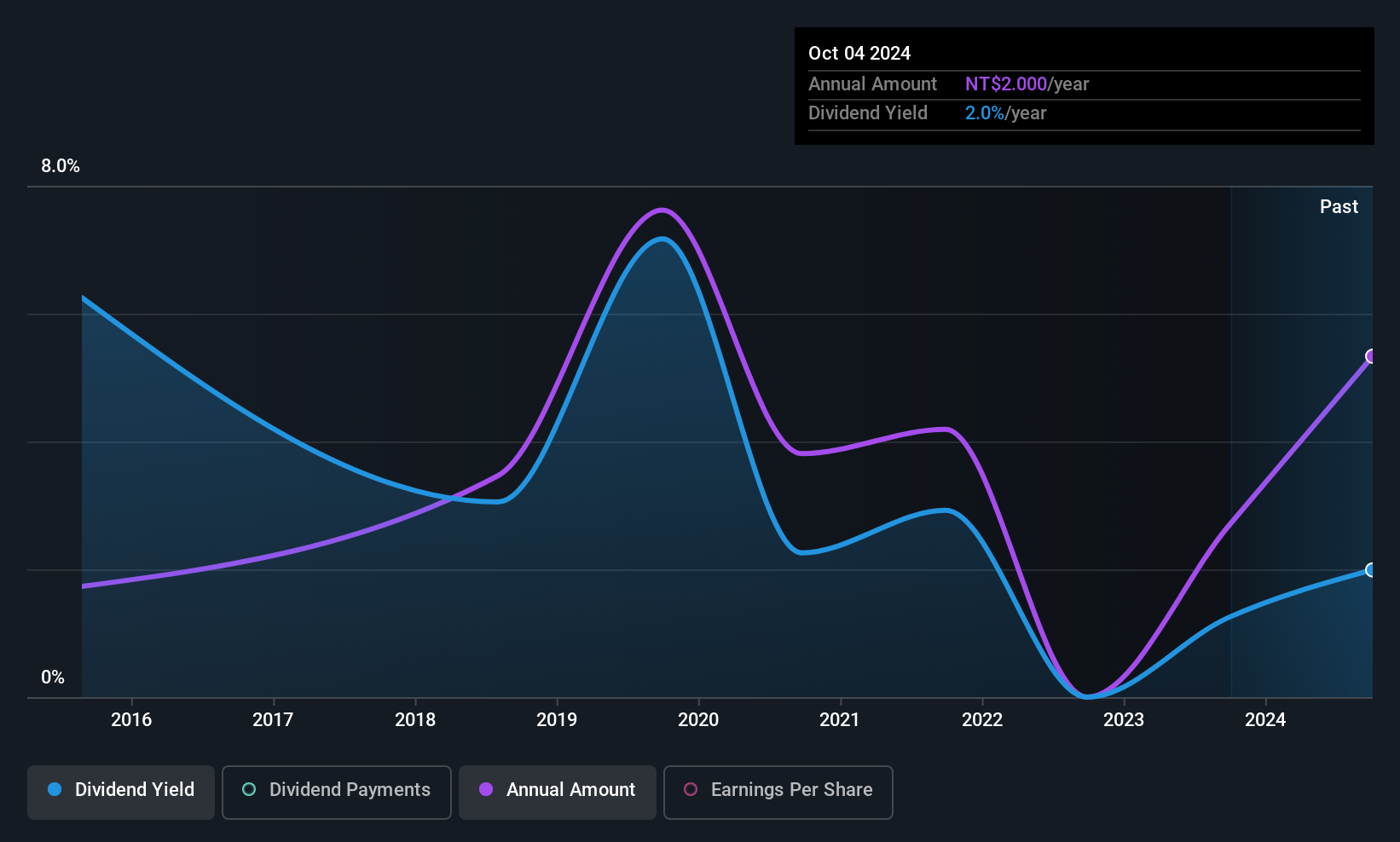

AIC (TPEX:3693)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AIC Inc. offers OEM/ODM, commercial off-the-shelf, and server and storage solutions across the United States, Asia, and Europe with a market cap of NT$13.11 billion.

Operations: AIC Inc.'s revenue primarily comes from its Computers and Related Spare Parts Department, which generated NT$9.51 billion.

Dividend Yield: 3.4%

AIC's dividend payments are well covered by earnings and cash flows, with payout ratios of 36.4% and 43.7%, respectively. Despite this coverage, dividends have been unreliable and volatile over the past decade. AIC's recent strategic alliances, such as with MangoBoost for advanced computing technologies, highlight its focus on innovation in data center solutions. These developments may support future growth but do not directly address the historical instability of its dividend payments.

- Navigate through the intricacies of AIC with our comprehensive dividend report here.

- Our valuation report here indicates AIC may be undervalued.

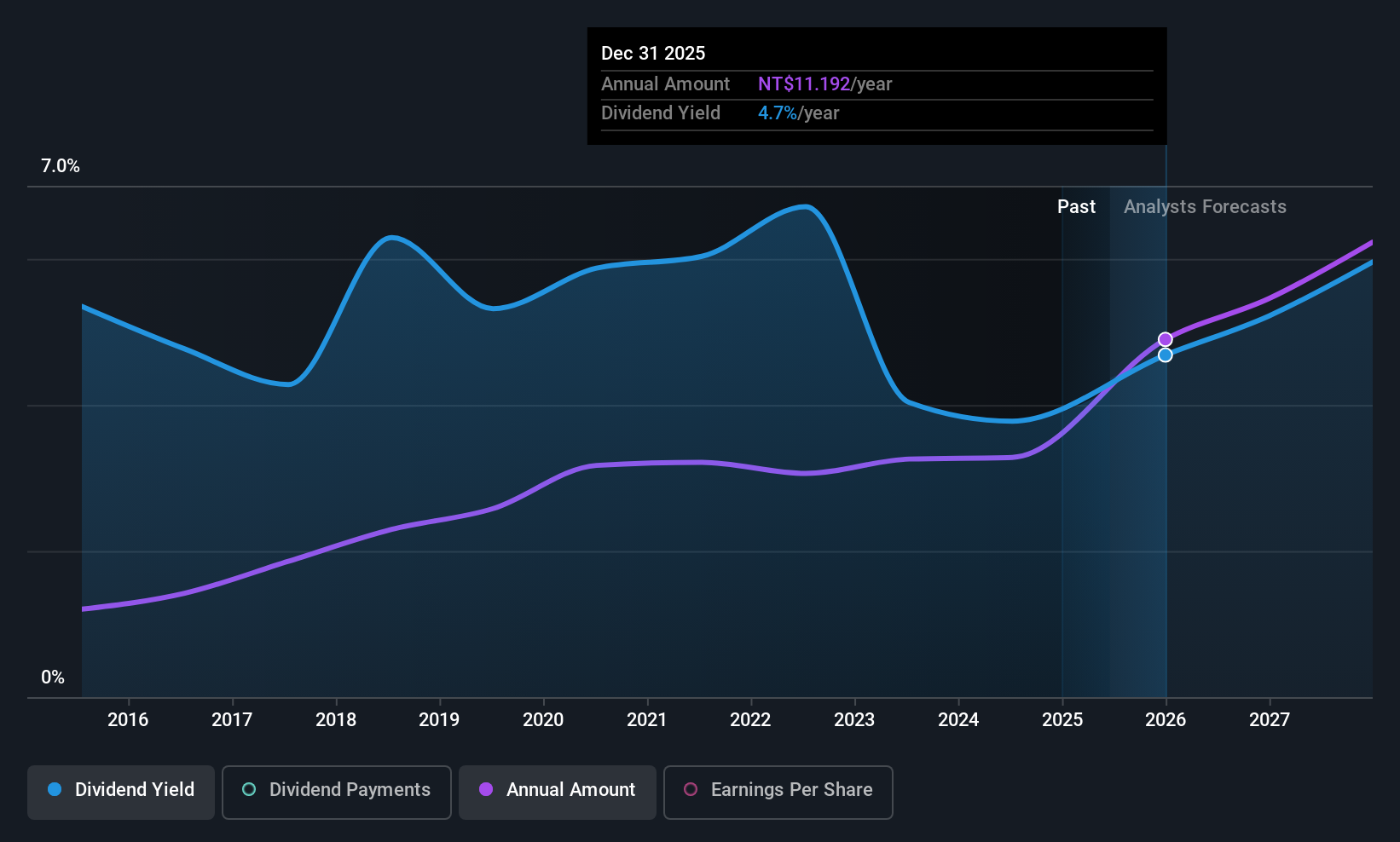

Tripod Technology (TWSE:3044)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tripod Technology Corporation processes, manufactures, and sells printed circuit boards and related components across several countries including Taiwan, China, Vietnam, Thailand, South Korea, Malaysia, and internationally with a market cap of NT$119.31 billion.

Operations: Tripod Technology Corporation's revenue primarily comes from its Printed Circuit Board segment, which generated NT$67.39 billion.

Dividend Yield: 4.2%

Tripod Technology's dividend payments, stable and reliable over the past decade, are well-covered by both earnings and cash flows with payout ratios of 60.8% and 58%, respectively. Despite trading below its estimated fair value, its dividend yield of 4.22% is lower than the top tier in Taiwan's market. Recent shareholder approval confirmed a significant TWD 5.41 billion cash dividend distribution, with payment scheduled for August 14, 2025.

- Take a closer look at Tripod Technology's potential here in our dividend report.

- The valuation report we've compiled suggests that Tripod Technology's current price could be quite moderate.

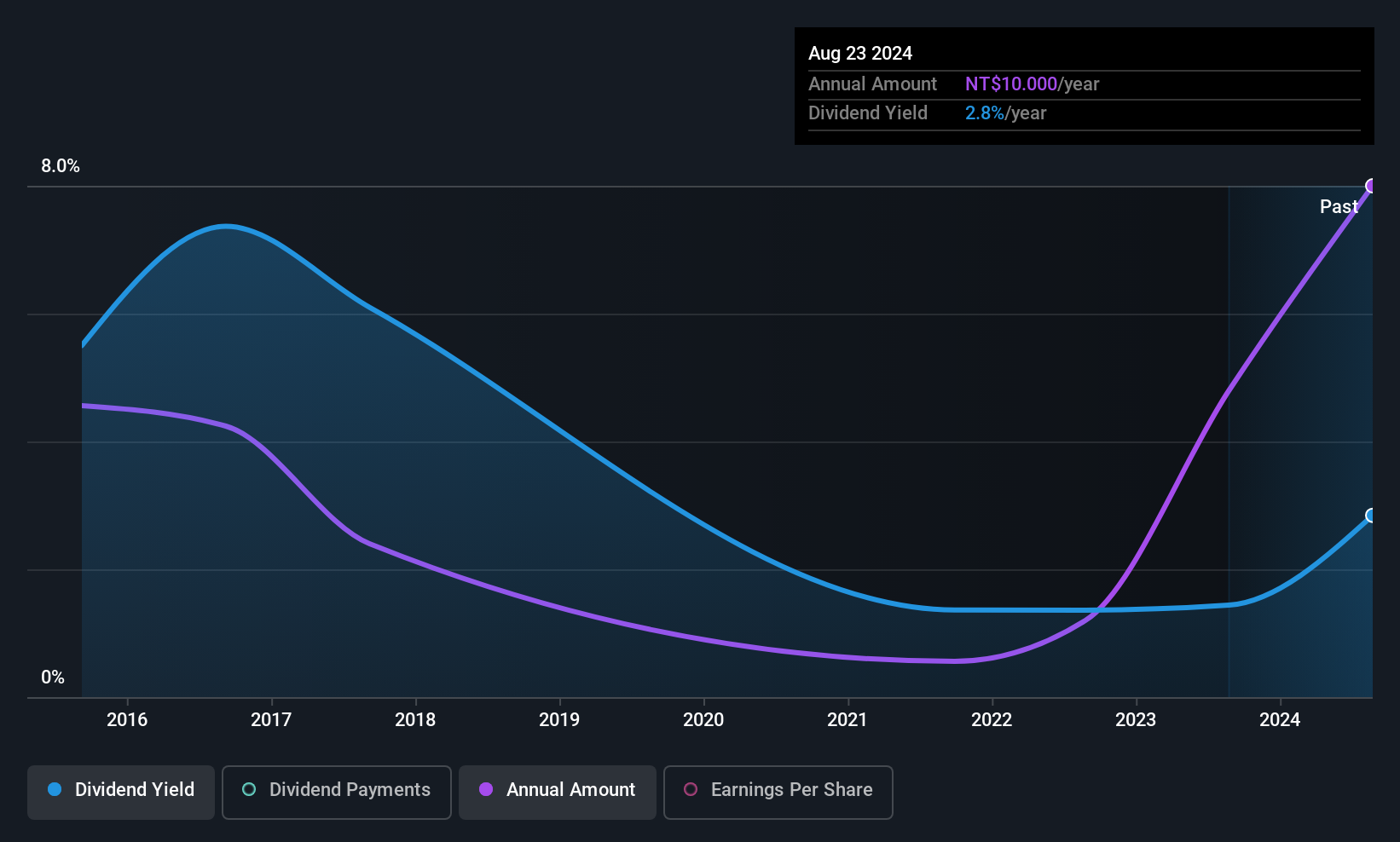

Team Group (TWSE:4967)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Team Group Inc. is a manufacturer and trader of integrated circuit chips, memory, and computer peripheral equipment with operations in Taiwan, Asia, America, Europe, and internationally; it has a market cap of NT$6.22 billion.

Operations: Team Group Inc.'s revenue primarily comes from its Memory Modules and Flash Memory Products segment, which generated NT$22.29 billion.

Dividend Yield: 3.7%

Team Group's dividend yield of 3.73% is below Taiwan's top tier, and while dividends have grown over the past decade, they remain unreliable due to volatility. The payout ratio of 75.2% indicates dividends are covered by earnings, and a low cash payout ratio of 10.7% suggests strong cash flow support. Recent amendments to the corporate charter may impact future dividend policies, but current profit margins have decreased from last year’s figures.

- Click here and access our complete dividend analysis report to understand the dynamics of Team Group.

- Our expertly prepared valuation report Team Group implies its share price may be lower than expected.

Taking Advantage

- Delve into our full catalog of 1564 Top Global Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Team Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4967

Team Group

Manufactures and trades in integrated circuit chip, memory, and computer peripheral equipment in Taiwan, Asia, America, Europe, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.