- Switzerland

- /

- Banks

- /

- SWX:BLKB

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate cuts from the ECB and SNB, alongside expectations for a potential Fed cut, investors are witnessing mixed performances across major indices. While the Nasdaq Composite reached new heights, other indexes faced declines amid evolving economic indicators such as inflation and labor market shifts. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for enhancing portfolios amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.70% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.05% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.79% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.55% | ★★★★★★ |

Click here to see the full list of 1847 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

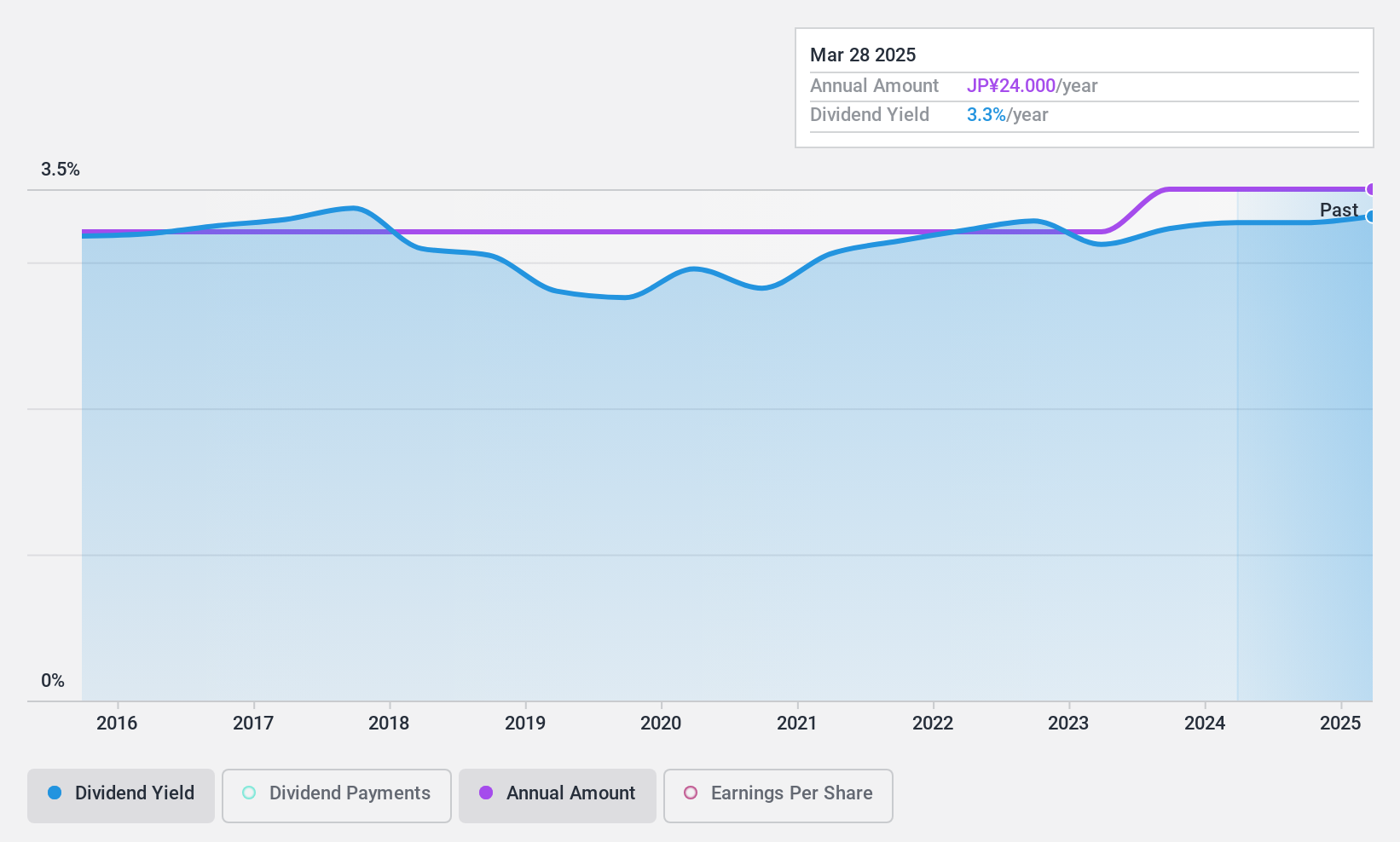

Isewan Terminal Service (NSE:9359)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Isewan Terminal Service Co., Ltd. and its subsidiaries offer a range of logistics services both in Japan and internationally, with a market cap of ¥17.10 billion.

Operations: Isewan Terminal Service Co., Ltd. generates revenue primarily from its Logistics Business, amounting to ¥53.89 billion.

Dividend Yield: 3.4%

Isewan Terminal Service offers a stable dividend profile with a payout ratio of 25.6%, indicating dividends are well-covered by earnings. The cash payout ratio of 32.7% further supports sustainability through free cash flows. Although the dividend yield of 3.41% is below the top tier in Japan, it remains reliable and has grown steadily over the past decade, making it an attractive option for income-focused investors seeking consistency in payouts.

- Get an in-depth perspective on Isewan Terminal Service's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Isewan Terminal Service is priced higher than what may be justified by its financials.

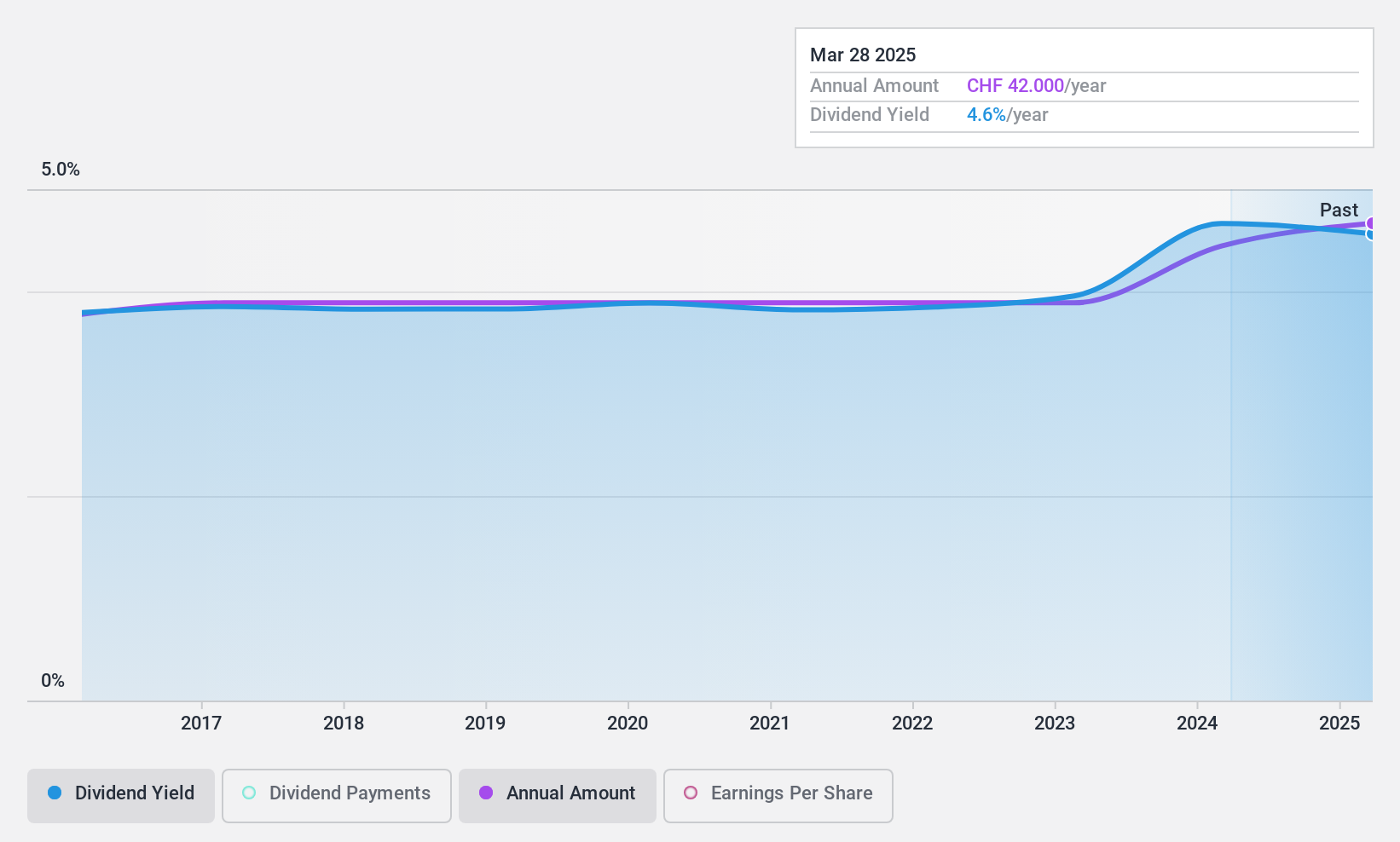

Basellandschaftliche Kantonalbank (SWX:BLKB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Basellandschaftliche Kantonalbank offers a range of banking products and services to private and corporate customers in Switzerland, with a market cap of CHF1.87 billion.

Operations: Basellandschaftliche Kantonalbank generates revenue of CHF466.77 million from its banking products and services offered to private and corporate clients in Switzerland.

Dividend Yield: 4.6%

Basellandschaftliche Kantonalbank offers a compelling dividend profile with a high yield of 4.62%, placing it in the top 25% of Swiss dividend payers. The bank's dividends have been stable and growing over the past decade, supported by a reasonable payout ratio of 56.7%. However, its low allowance for bad loans at 51% may be concerning. Trading at 33.6% below estimated fair value, it presents potential value for investors prioritizing income stability.

- Delve into the full analysis dividend report here for a deeper understanding of Basellandschaftliche Kantonalbank.

- Insights from our recent valuation report point to the potential overvaluation of Basellandschaftliche Kantonalbank shares in the market.

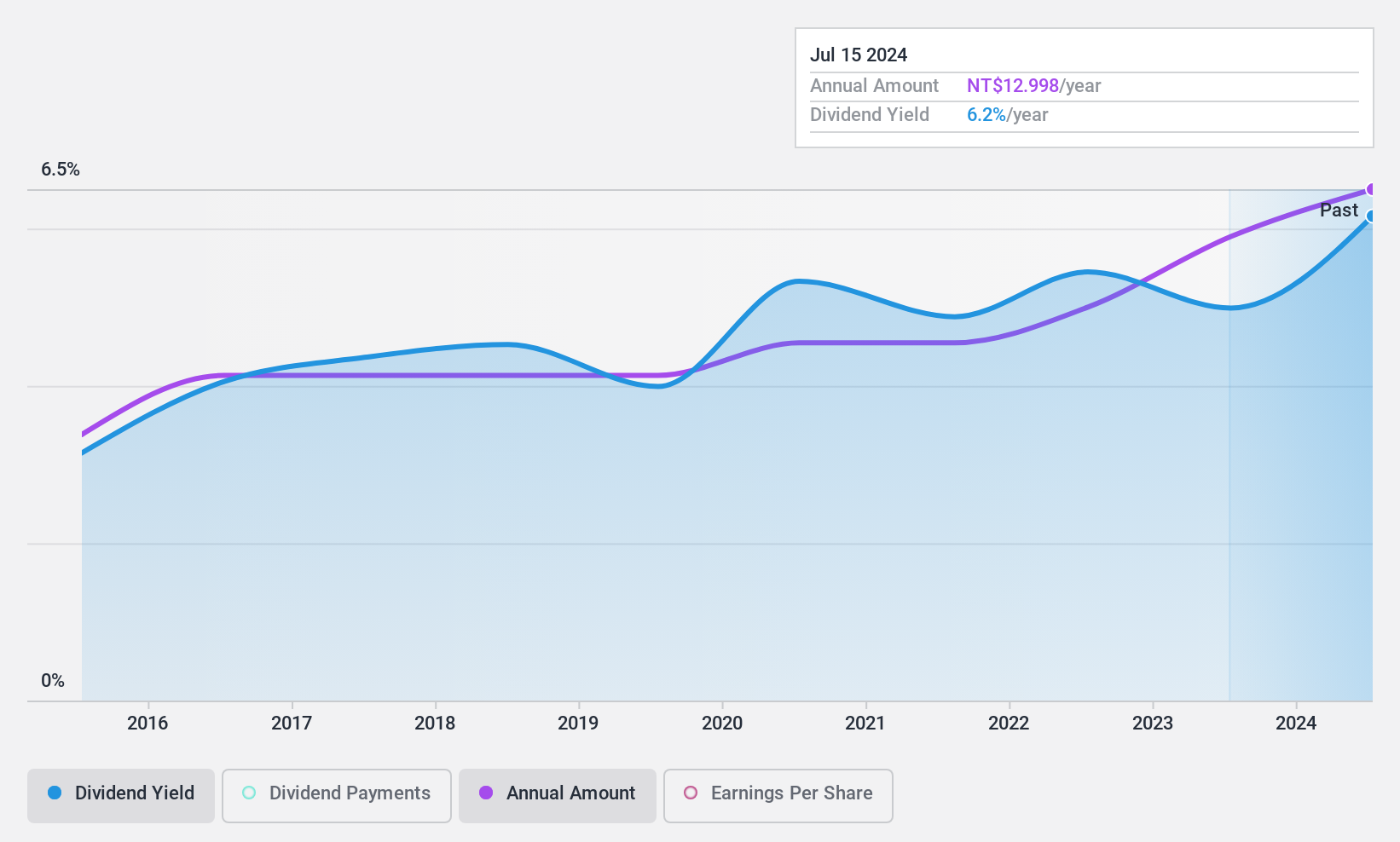

TSC Auto ID Technology (TPEX:3611)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TSC Auto ID Technology Co., Ltd. specializes in the manufacturing and services of auto-identification systems and products globally, with a market cap of NT$9.61 billion.

Operations: TSC Auto ID Technology Co., Ltd.'s revenue primarily comes from selling bar code printers and their spare parts (NT$4.86 billion) and various label papers and consumables for printers (NT$3.47 billion).

Dividend Yield: 5.8%

TSC Auto ID Technology's dividend yield of 5.82% ranks in the top 25% of Taiwan's market, supported by a payout ratio of 87.1%, indicating dividends are covered by earnings and cash flow (78.1%). Despite this, profit margins have declined from 12.2% to 8.5%. Dividends have increased over the past decade but remain volatile and unreliable, reflecting potential instability for income-focused investors despite trading at a good relative value with a P/E ratio of 13.7x against the market's 21.3x.

- Unlock comprehensive insights into our analysis of TSC Auto ID Technology stock in this dividend report.

- Our valuation report unveils the possibility TSC Auto ID Technology's shares may be trading at a discount.

Summing It All Up

- Click through to start exploring the rest of the 1844 Top Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Basellandschaftliche Kantonalbank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BLKB

Basellandschaftliche Kantonalbank

Provides various banking products and services to the private and corporate customers in Switzerland.

Solid track record with excellent balance sheet and pays a dividend.