As global markets navigate a period of mixed economic signals, with U.S. consumer confidence declining and small-cap indices like the Russell 2000 showing modest gains, investors are increasingly attentive to the performance of smaller companies amid broader market volatility. In this environment, identifying promising small-cap stocks requires a focus on companies with strong fundamentals and growth potential that can withstand economic headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

cBrain (CPSE:CBRAIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: cBrain A/S is a software company that offers solutions for government, private, education, and non-profit sectors both in Denmark and internationally, with a market cap of DKK3.71 billion.

Operations: Revenue for cBrain primarily comes from its Software & Programming segment, amounting to DKK246.58 million.

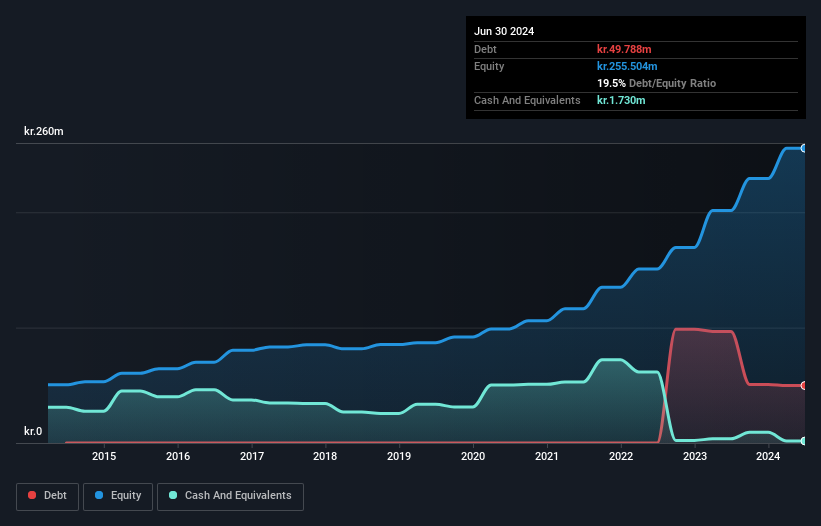

cBrain, a promising player in the software sector, boasts high-quality earnings and a satisfactory net debt to equity ratio of 18.8%. Over the past five years, its earnings have surged by 39% annually, although recent growth of 5.9% lagged behind industry peers at 17.7%. With interest payments well covered by EBIT at 26 times over, financial stability is evident. The company forecasts revenue growth between 10%-15% for 2024 and anticipates EBT margins from 24%-30%, indicating potential for robust future performance despite increased debt levels from zero to a current ratio of 19.5%.

- Click to explore a detailed breakdown of our findings in cBrain's health report.

Gain insights into cBrain's historical performance by reviewing our past performance report.

Focus Technology (SZSE:002315)

Simply Wall St Value Rating: ★★★★★★

Overview: Focus Technology Co., Ltd. operates e-commerce platforms both within the People’s Republic of China and internationally, with a market capitalization of CN¥13.26 billion.

Operations: Focus Technology generates revenue primarily through its e-commerce platforms. The company has a market capitalization of CN¥13.26 billion, reflecting its financial scale.

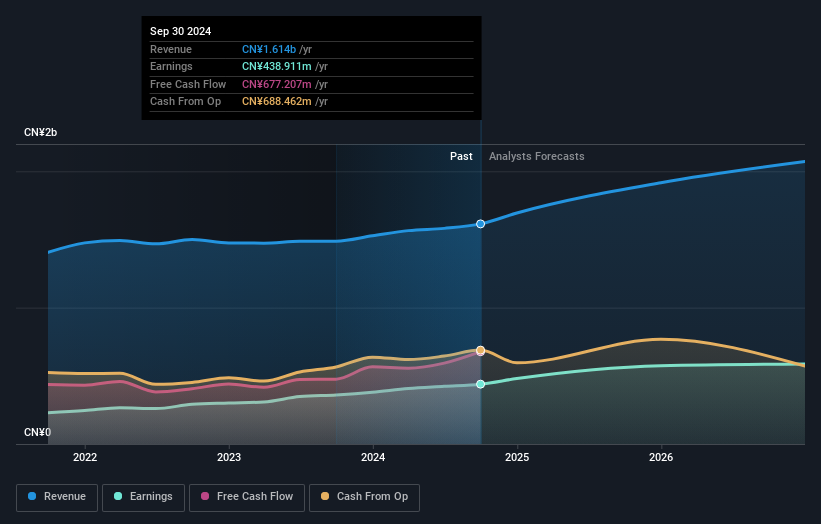

Focus Technology, a nimble player in the industry, is making waves with its financial health and growth trajectory. Over the past year, earnings surged by 22.1%, outpacing the Interactive Media and Services sector's modest 1.7% rise. This debt-free company has shown remarkable improvement from five years ago when it had a debt-to-equity ratio of 0.2%. Trading at 23.6% below fair value estimates, it presents an intriguing opportunity for investors seeking undervalued stocks with potential upside. With net income climbing to CNY 357 million from CNY 298 million last year, Focus Technology continues to demonstrate robust performance and quality earnings.

- Take a closer look at Focus Technology's potential here in our health report.

Evaluate Focus Technology's historical performance by accessing our past performance report.

Alltop Technology (TPEX:3526)

Simply Wall St Value Rating: ★★★★★★

Overview: Alltop Technology Co., Ltd., along with its subsidiaries, specializes in the research, design, development, manufacture, and sale of electronic connectors in Taiwan and China, with a market capitalization of NT$16.88 billion.

Operations: Alltop Technology generates revenue primarily from the electronic coupling segment, amounting to NT$2.95 billion.

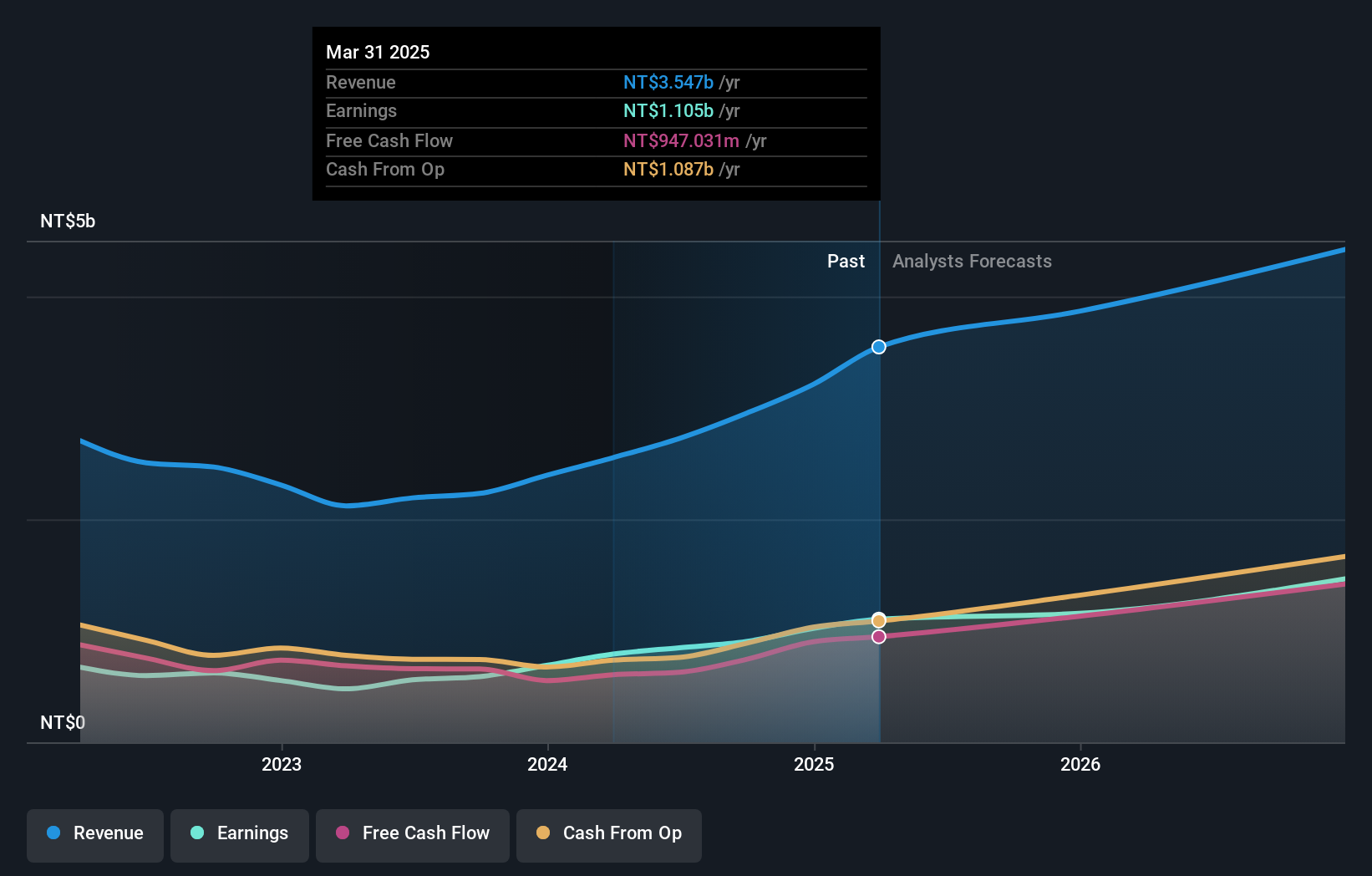

Alltop Technology is making waves with impressive earnings growth of 53.4% over the past year, outpacing the electronic industry's 6.6%. The company's debt-to-equity ratio has improved significantly from 86.5% to 44.3% in five years, indicating better financial health. Recent earnings show a net income increase to TWD 264.94 million for Q3, up from TWD 209.49 million last year, and basic EPS rose to TWD 4.36 from TWD 3.55 a year ago, reflecting strong operational performance and value potential against peers while trading at nearly half its fair value estimate.

- Unlock comprehensive insights into our analysis of Alltop Technology stock in this health report.

Explore historical data to track Alltop Technology's performance over time in our Past section.

Summing It All Up

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4645 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if cBrain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:CBRAIN

cBrain

A software company, provides software solutions for government, private, education, and non-profit sectors in Denmark, rest of the European Union, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives