As global markets navigate a busy earnings season with mixed economic signals, small-cap stocks have shown resilience compared to their larger counterparts, even as growth stocks lag behind value shares. In this environment, identifying high-growth tech stocks with strong fundamentals and innovative potential can be crucial for investors looking to capitalize on future opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Pharma Mar | 26.94% | 55.09% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.17% | 70.50% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Chinasoft International (SEHK:354)

Simply Wall St Growth Rating: ★★★★☆☆

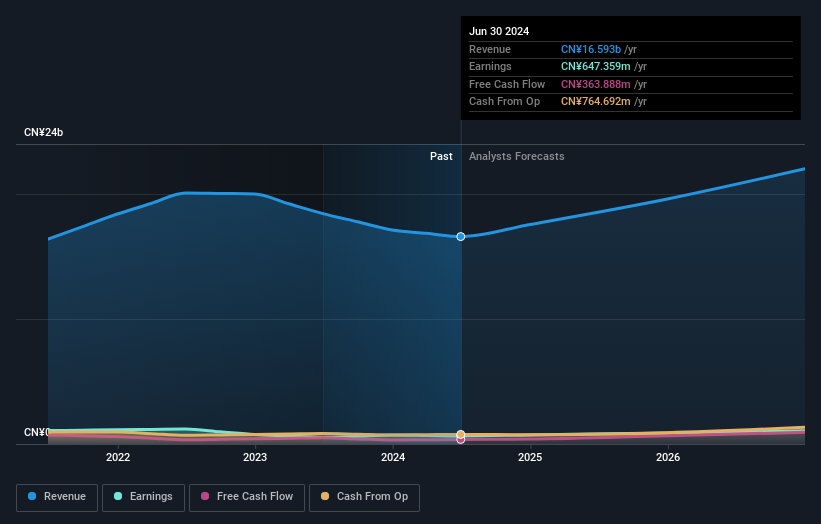

Overview: Chinasoft International Limited is a company that, along with its subsidiaries, offers IT solutions, outsourcing, and training services across various countries including China and the United States, with a market capitalization of HK$14.01 billion.

Operations: The company generates revenue primarily from its Technology Professional Services Group, contributing CN¥14.47 billion, and its Internet Information Technology Services Group, adding CN¥2.13 billion.

Chinasoft International's strategic collaborations and project wins underscore its adaptability and growth potential in the evolving tech landscape. Recently, the company enhanced its partnership with TD Tech, focusing on IoT and AI innovations to foster a localized application ecosystem, which is critical as industries increasingly rely on intelligent technology solutions. Additionally, Chinasoft's successful bid for the Guiyang Smart City project, worth approximately CNY 120 million, not only boosts its presence in smart infrastructure but also aligns with global urban development trends towards digitalization. These developments reflect positively on Chinasoft’s ability to secure large-scale projects and expand its technological footprint, supported by a robust R&D commitment that significantly exceeds industry norms.

Universal Microwave Technology (TPEX:3491)

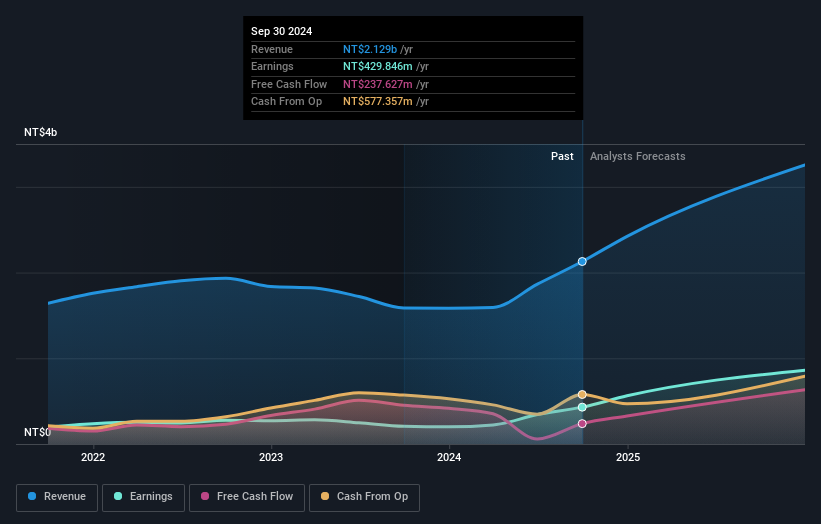

Simply Wall St Growth Rating: ★★★★★☆

Overview: Universal Microwave Technology, Inc. specializes in designing, developing, and manufacturing custom microwave and millimeter-wave devices and antennas for broadband wireless communications, with a market cap of NT$19.60 billion.

Operations: Universal Microwave Technology, Inc. generates revenue primarily through its Microwave/Millimeter Wave Products and Radio Frequency Products, contributing NT$1.12 billion and NT$791.06 million respectively. The company also offers Communications Network Engineering Services, adding NT$259.72 million to its revenue streams.

Universal Microwave Technology is distinguishing itself in the high-growth tech sector, evidenced by a remarkable 57.4% forecasted annual earnings growth, outpacing the broader Taiwanese market's 19.1%. This surge is supported by a robust R&D commitment, with expenses significantly contributing to innovative developments in microwave technology—a segment critical as industries demand more advanced communication solutions. Moreover, recent presentations at major forums underscore their active engagement with industry leaders and investors, enhancing their visibility and potential for future collaborations. With revenue also set to expand by 36.3% annually—triple the rate of Taiwan's market average—the company is well-positioned to capitalize on increasing demands within the tech sector, despite facing intense competition and rapid technological changes.

Innodisk (TPEX:5289)

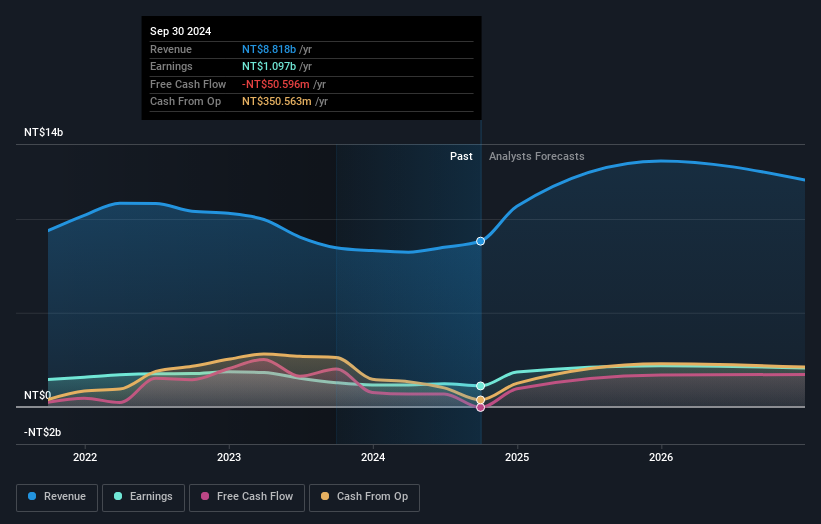

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Innodisk Corporation is engaged in the research, development, manufacturing, and sales of industrial embedded storage devices across Taiwan and various international markets with a market capitalization of NT$23.35 billion.

Operations: Innodisk Corporation generates revenue primarily from the research and development of industrial memory storage devices, amounting to NT$8.49 billion. The company operates across Taiwan, Asia, Japan, Germany, China, Europe, the United States, and other international markets.

Innodisk is shaping the future of tech with its latest DDR5 6400 DRAM series, designed for data-heavy AI and industrial applications. This innovation offers a 14% speed increase and doubles capacity to 64GB, addressing the high demands of edge computing. With R&D expenses climbing to 19.9% of revenue, Innodisk's commitment to advancing technology is evident as it enhances product capabilities critical for AI-driven environments. Moreover, recent developments like the InnoPPE recognition solution highlight Innodisk's focus on integrating AI to enhance safety in industrial settings, proving its agility in responding to market needs while pushing revenue growth forecasts above industry averages at 18% annually.

- Unlock comprehensive insights into our analysis of Innodisk stock in this health report.

Assess Innodisk's past performance with our detailed historical performance reports.

Seize The Opportunity

- Get an in-depth perspective on all 1291 High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:354

Chinasoft International

Engages in development and provision of information technology (IT) solutions, IT outsourcing, and training services in the People’s Republic of China, the United States, Malaysia, Japan, Singapore, India, and Saudi Arabia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives