- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6538

If You Had Bought Brave C&H SupplyLtd (GTSM:6538) Stock A Year Ago, You Could Pocket A 619% Gain Today

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. When you find (and hold) a big winner, you can markedly improve your finances. For example, the Brave C&H Supply Co.,Ltd. (GTSM:6538) share price is up a whopping 619% in the last year, a handsome return in a single year. It's also good to see the share price up 79% over the last quarter. It is also impressive that the stock is up 409% over three years, adding to the sense that it is a real winner.

We love happy stories like this one. The company should be really proud of that performance!

See our latest analysis for Brave C&H SupplyLtd

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Brave C&H SupplyLtd went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

We doubt the modest 0.3% dividend yield is doing much to support the share price. However the year on year revenue growth of 57% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

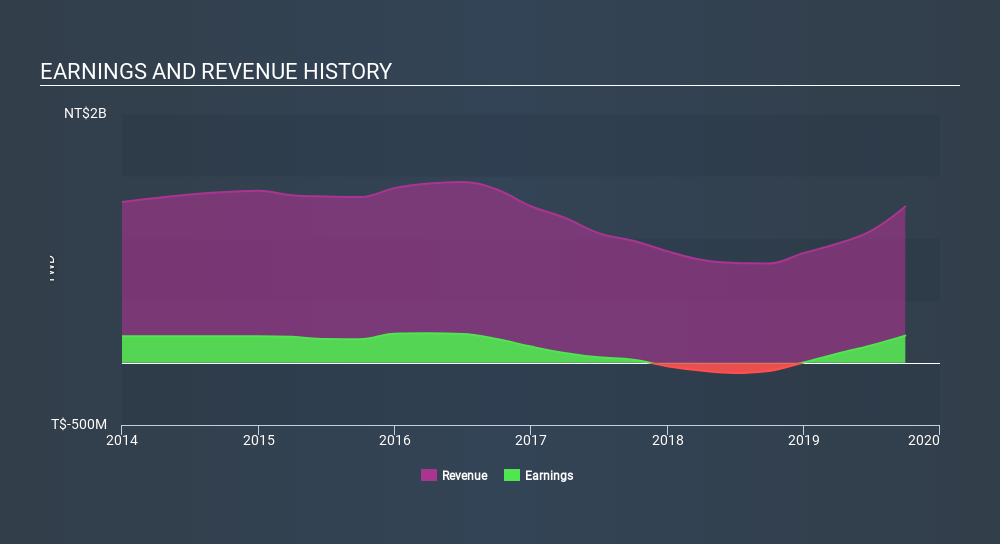

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Brave C&H SupplyLtd has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Brave C&H SupplyLtd stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Brave C&H SupplyLtd, it has a TSR of 628% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Brave C&H SupplyLtd rewarded shareholders with a total shareholder return of 628% over the last year. That includes the value of the dividend. So this year's TSR was actually better than the three-year TSR (annualized) of 80%. Given the track record of solid returns over varying time frames, it might be worth putting Brave C&H SupplyLtd on your watchlist. It's always interesting to track share price performance over the longer term. But to understand Brave C&H SupplyLtd better, we need to consider many other factors. Take risks, for example - Brave C&H SupplyLtd has 1 warning sign we think you should be aware of.

We will like Brave C&H SupplyLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TPEX:6538

Brave C&H SupplyLtd

Manufactures and sells precision screens and screen-printing materials in Taiwan and China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives