- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6158

Here’s What’s Happening With Returns At P-Two Industries (GTSM:6158)

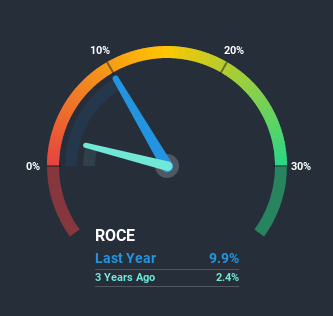

There are a few key trends to look for if we want to identify the next multi-bagger. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So on that note, P-Two Industries (GTSM:6158) looks quite promising in regards to its trends of return on capital.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for P-Two Industries, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.099 = NT$107m ÷ (NT$2.2b - NT$1.2b) (Based on the trailing twelve months to September 2020).

Thus, P-Two Industries has an ROCE of 9.9%. In absolute terms, that's a low return but it's around the Electronic industry average of 11%.

Check out our latest analysis for P-Two Industries

Historical performance is a great place to start when researching a stock so above you can see the gauge for P-Two Industries' ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of P-Two Industries, check out these free graphs here.

The Trend Of ROCE

Like most people, we're pleased that P-Two Industries is now generating some pretax earnings. While the business is profitable now, it used to be incurring losses on invested capital five years ago. Additionally, the business is utilizing 64% less capital than it was five years ago, and taken at face value, that can mean the company needs less funds at work to get a return. P-Two Industries could be selling under-performing assets since the ROCE is improving.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Effectively this means that suppliers or short-term creditors are now funding 52% of the business, which is more than it was five years ago. Given it's pretty high ratio, we'd remind investors that having current liabilities at those levels can bring about some risks in certain businesses.

The Key Takeaway

In summary, it's great to see that P-Two Industries has been able to turn things around and earn higher returns on lower amounts of capital. And investors seem to expect more of this going forward, since the stock has rewarded shareholders with a 76% return over the last five years. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

P-Two Industries does have some risks, we noticed 2 warning signs (and 1 which is concerning) we think you should know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you’re looking to trade P-Two Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6158

P-Two Industries

Manufactures and sells TVs, panels, notebook computers, and automotive-related components and connectors in Taiwan.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026