- Taiwan

- /

- Tech Hardware

- /

- TPEX:6150

These 4 Measures Indicate That TUL (GTSM:6150) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, TUL Corporation (GTSM:6150) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for TUL

How Much Debt Does TUL Carry?

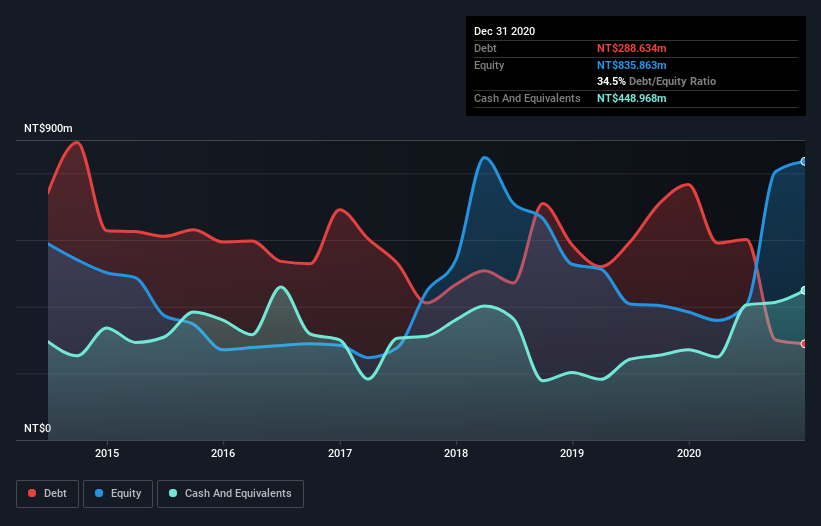

As you can see below, TUL had NT$288.6m of debt at December 2020, down from NT$766.6m a year prior. However, its balance sheet shows it holds NT$449.0m in cash, so it actually has NT$160.3m net cash.

How Strong Is TUL's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that TUL had liabilities of NT$1.03b due within 12 months and liabilities of NT$34.7m due beyond that. Offsetting these obligations, it had cash of NT$449.0m as well as receivables valued at NT$549.1m due within 12 months. So it has liabilities totalling NT$64.9m more than its cash and near-term receivables, combined.

This state of affairs indicates that TUL's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the NT$9.74b company is short on cash, but still worth keeping an eye on the balance sheet. Despite its noteworthy liabilities, TUL boasts net cash, so it's fair to say it does not have a heavy debt load!

We also note that TUL improved its EBIT from a last year's loss to a positive NT$39m. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since TUL will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. TUL may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, TUL actually produced more free cash flow than EBIT over the last year. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

We could understand if investors are concerned about TUL's liabilities, but we can be reassured by the fact it has has net cash of NT$160.3m. The cherry on top was that in converted 571% of that EBIT to free cash flow, bringing in NT$224m. So is TUL's debt a risk? It doesn't seem so to us. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that TUL is showing 2 warning signs in our investment analysis , you should know about...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade TUL, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TUL might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6150

Acceptable track record and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion