- Taiwan

- /

- Tech Hardware

- /

- TPEX:3540

Are Robust Financials Driving The Recent Rally In Thermaltake Technology Co., Ltd.'s (GTSM:3540) Stock?

Thermaltake Technology's (GTSM:3540) stock is up by a considerable 14% over the past month. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. In this article, we decided to focus on Thermaltake Technology's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Thermaltake Technology

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Thermaltake Technology is:

23% = NT$384m ÷ NT$1.6b (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every NT$1 worth of equity, the company was able to earn NT$0.23 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Thermaltake Technology's Earnings Growth And 23% ROE

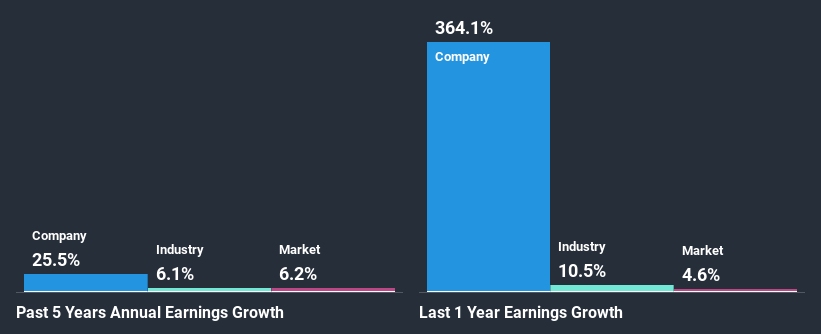

To begin with, Thermaltake Technology has a pretty high ROE which is interesting. Second, a comparison with the average ROE reported by the industry of 11% also doesn't go unnoticed by us. So, the substantial 26% net income growth seen by Thermaltake Technology over the past five years isn't overly surprising.

Next, on comparing with the industry net income growth, we found that Thermaltake Technology's growth is quite high when compared to the industry average growth of 6.1% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Thermaltake Technology's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Thermaltake Technology Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 61% (implying that it keeps only 39% of profits) for Thermaltake Technology suggests that the company's growth wasn't really hampered despite it returning most of the earnings to its shareholders.

Moreover, Thermaltake Technology is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Summary

On the whole, we feel that Thermaltake Technology's performance has been quite good. In particular, its high ROE is quite noteworthy and also the probable explanation behind its considerable earnings growth. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you’re looking to trade Thermaltake Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Thermaltake Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3540

Thermaltake Technology

Provides entertainment, e-sports, technology, and lifestyle products in Taiwan.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026