- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3441

Is Unique Opto-Electronics Co.,Ltd. (GTSM:3441) At Risk Of Cutting Its Dividend?

Dividend paying stocks like Unique Opto-Electronics Co.,Ltd. (GTSM:3441) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

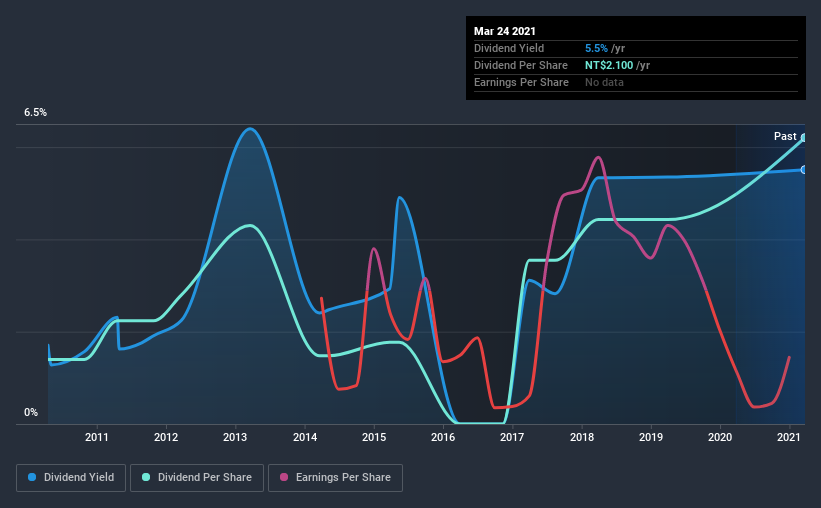

In this case, Unique Opto-ElectronicsLtd likely looks attractive to investors, given its 5.5% dividend yield and a payment history of over ten years. We'd guess that plenty of investors have purchased it for the income. That said, the recent jump in the share price will make Unique Opto-ElectronicsLtd's dividend yield look smaller, even though the company prospects could be improving. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Unique Opto-ElectronicsLtd!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. While Unique Opto-ElectronicsLtd pays a dividend, it reported a loss over the last year. When a company is loss-making, we next need to check to see if its cash flows can support the dividend.

Unique Opto-ElectronicsLtd paid out 347% of its free cash flow last year, suggesting the dividend is poorly covered by cash flow. Paying out such a high percentage of cash flow suggests that the dividend was funded from either cash at bank or by borrowing, neither of which is desirable over the long term.

With a strong net cash balance, Unique Opto-ElectronicsLtd investors may not have much to worry about in the near term from a dividend perspective.

Remember, you can always get a snapshot of Unique Opto-ElectronicsLtd's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. For the purpose of this article, we only scrutinise the last decade of Unique Opto-ElectronicsLtd's dividend payments. Its dividend payments have declined on at least one occasion over the past 10 years. During the past 10-year period, the first annual payment was NT$0.5 in 2011, compared to NT$2.1 last year. This works out to be a compound annual growth rate (CAGR) of approximately 16% a year over that time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

It's not great to see that the payment has been cut in the past. We're generally more wary of companies that have cut their dividend before, as they tend to perform worse in an economic downturn.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Unique Opto-ElectronicsLtd's earnings per share have been essentially flat over the past five years. Over the long term, steady earnings per share is a risk as the value of the dividends can be reduced by inflation. Unique Opto-ElectronicsLtd is paying out less than half of its earnings, which we like. However, earnings per share are unfortunately not growing much. Might this suggest that the company should pay a higher dividend instead?

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're a bit uncomfortable with Unique Opto-ElectronicsLtd paying a dividend while loss-making, especially since the dividend was also not well covered by free cash flow. Second, earnings have been essentially flat, and its history of dividend payments is chequered - having cut its dividend at least once in the past. There are a few too many issues for us to get comfortable with Unique Opto-ElectronicsLtd from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 3 warning signs for Unique Opto-ElectronicsLtd that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you decide to trade Unique Opto-ElectronicsLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3441

Unique Opto-ElectronicsLtd

Develops, manufactures, processes, and trades in various optical glasses, optical lenses, and lens blanks in Taiwan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion