- Taiwan

- /

- Communications

- /

- TPEX:3363

Here's Why FOCI Fiber Optic Communications (GTSM:3363) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, FOCI Fiber Optic Communications, Inc. (GTSM:3363) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for FOCI Fiber Optic Communications

What Is FOCI Fiber Optic Communications's Debt?

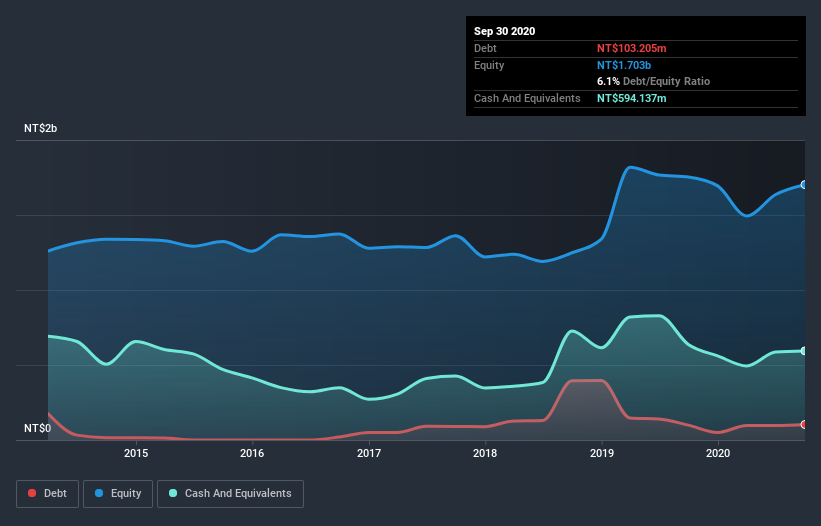

You can click the graphic below for the historical numbers, but it shows that as of September 2020 FOCI Fiber Optic Communications had NT$103.2m of debt, an increase on NT$98.9m, over one year. But it also has NT$594.1m in cash to offset that, meaning it has NT$490.9m net cash.

How Healthy Is FOCI Fiber Optic Communications' Balance Sheet?

According to the last reported balance sheet, FOCI Fiber Optic Communications had liabilities of NT$413.2m due within 12 months, and liabilities of NT$101.6m due beyond 12 months. Offsetting these obligations, it had cash of NT$594.1m as well as receivables valued at NT$455.2m due within 12 months. So it actually has NT$534.6m more liquid assets than total liabilities.

This excess liquidity suggests that FOCI Fiber Optic Communications is taking a careful approach to debt. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Simply put, the fact that FOCI Fiber Optic Communications has more cash than debt is arguably a good indication that it can manage its debt safely.

In fact FOCI Fiber Optic Communications's saving grace is its low debt levels, because its EBIT has tanked 65% in the last twelve months. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. There's no doubt that we learn most about debt from the balance sheet. But it is FOCI Fiber Optic Communications's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While FOCI Fiber Optic Communications has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, FOCI Fiber Optic Communications recorded free cash flow worth 62% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

While it is always sensible to investigate a company's debt, in this case FOCI Fiber Optic Communications has NT$490.9m in net cash and a decent-looking balance sheet. So we don't have any problem with FOCI Fiber Optic Communications's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for FOCI Fiber Optic Communications that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade FOCI Fiber Optic Communications, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3363

FOCI Fiber Optic Communications

Engages in the design, manufacture, design, consulting, service, and marketing of fiber optic components and integrated modules for communication networks primarily in Taiwan.

Moderate growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026