- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3322

If You Had Bought Joinsoon Electronics Manufacturing (GTSM:3322) Shares A Year Ago You'd Have Earned 268% Returns

When you buy shares in a company, there is always a risk that the price drops to zero. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Joinsoon Electronics Manufacturing CO., LTD. (GTSM:3322) share price has soared 268% in the last year. Most would be very happy with that, especially in just one year! Also pleasing for shareholders was the 54% gain in the last three months. And shareholders have also done well over the long term, with an increase of 94% in the last three years.

Check out our latest analysis for Joinsoon Electronics Manufacturing

Because Joinsoon Electronics Manufacturing made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Joinsoon Electronics Manufacturing grew its revenue by 8.8% last year. That's not great considering the company is losing money. So we wouldn't have expected the share price to rise by 268%. The business will need a lot more growth to justify that increase. It's quite likely that the market is considering other factors, not just revenue growth.

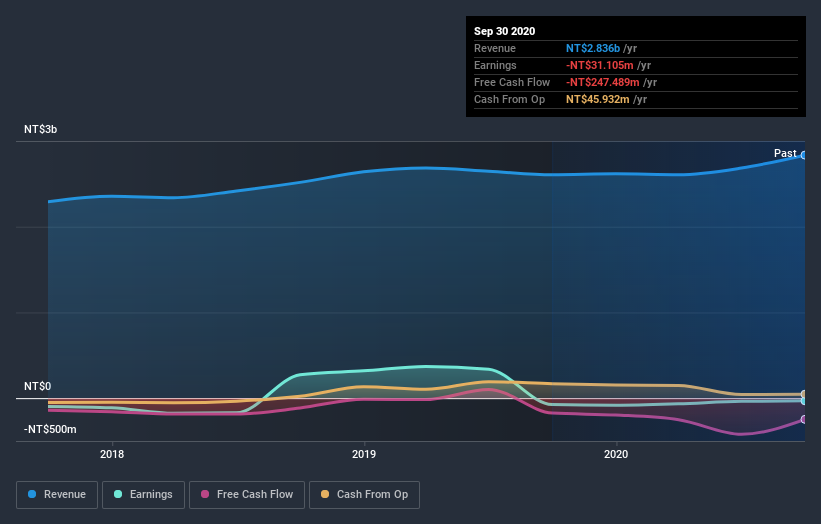

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Joinsoon Electronics Manufacturing's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Joinsoon Electronics Manufacturing shareholders have received a total shareholder return of 268% over the last year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 10% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Joinsoon Electronics Manufacturing you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Joinsoon Electronics Manufacturing, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3322

Joinsoon Electronics Manufacturing

Joinsoon Electronics Manufacturing CO., LTD.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026