- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3297

Is Hunt Electronic (GTSM:3297) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Hunt Electronic Co., Ltd. (GTSM:3297) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Hunt Electronic

What Is Hunt Electronic's Net Debt?

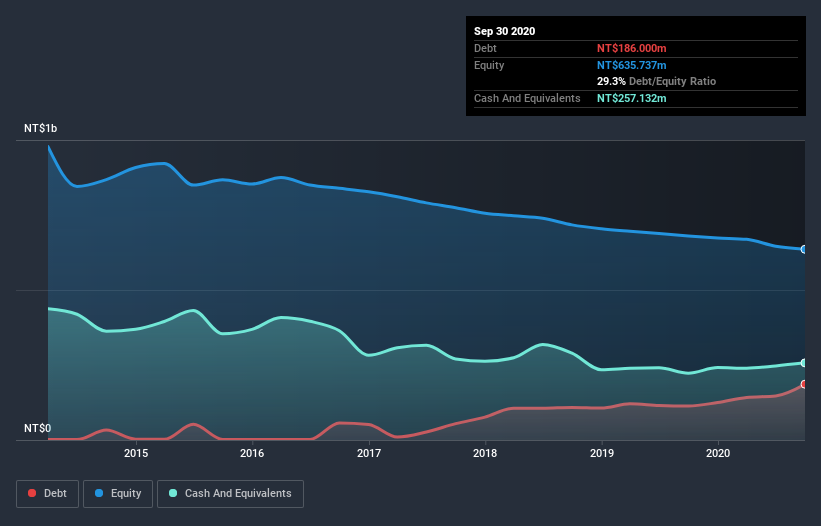

As you can see below, at the end of September 2020, Hunt Electronic had NT$186.0m of debt, up from NT$113.0m a year ago. Click the image for more detail. However, it does have NT$257.1m in cash offsetting this, leading to net cash of NT$71.1m.

How Healthy Is Hunt Electronic's Balance Sheet?

We can see from the most recent balance sheet that Hunt Electronic had liabilities of NT$232.3m falling due within a year, and liabilities of NT$8.56m due beyond that. On the other hand, it had cash of NT$257.1m and NT$34.3m worth of receivables due within a year. So it actually has NT$50.6m more liquid assets than total liabilities.

This surplus suggests that Hunt Electronic has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Hunt Electronic boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Hunt Electronic will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Hunt Electronic had a loss before interest and tax, and actually shrunk its revenue by 2.6%, to NT$202m. That's not what we would hope to see.

So How Risky Is Hunt Electronic?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Hunt Electronic had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of NT$16m and booked a NT$26m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of NT$71.1m. That means it could keep spending at its current rate for more than two years. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Hunt Electronic is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Hunt Electronic, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hunt Electronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3297

Hunt Electronic

Manufactures and sells surveillance equipment in Taiwan, Asia, the United States, and Europe.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026