As global markets navigate a complex landscape of cooling labor markets and trade tensions, Asian stocks have shown resilience, with Chinese indices advancing amid hopes for government stimulus. In this dynamic environment, identifying promising small-cap stocks in Asia requires a keen eye for companies that demonstrate robust fundamentals and the potential to thrive despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 32.83% | 39.29% | ★★★★★★ |

| AOKI Holdings | 25.32% | 5.06% | 57.58% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Suzhou Highfine Biotech | NA | -1.11% | 7.27% | ★★★★★★ |

| Miwon Chemicals | 0.12% | 10.40% | 16.52% | ★★★★★★ |

| Champion Building MaterialsLtd | 26.64% | -4.40% | 14.21% | ★★★★★★ |

| Alltek Technology | 100.78% | 4.48% | 7.73% | ★★★★★☆ |

| CMC | 1.18% | 2.73% | 9.22% | ★★★★★☆ |

| Dong Fang Offshore | 29.10% | 42.34% | 42.27% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 121.34% | 2.97% | 8.06% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Yunfeng Financial Group (SEHK:376)

Simply Wall St Value Rating: ★★★★★☆

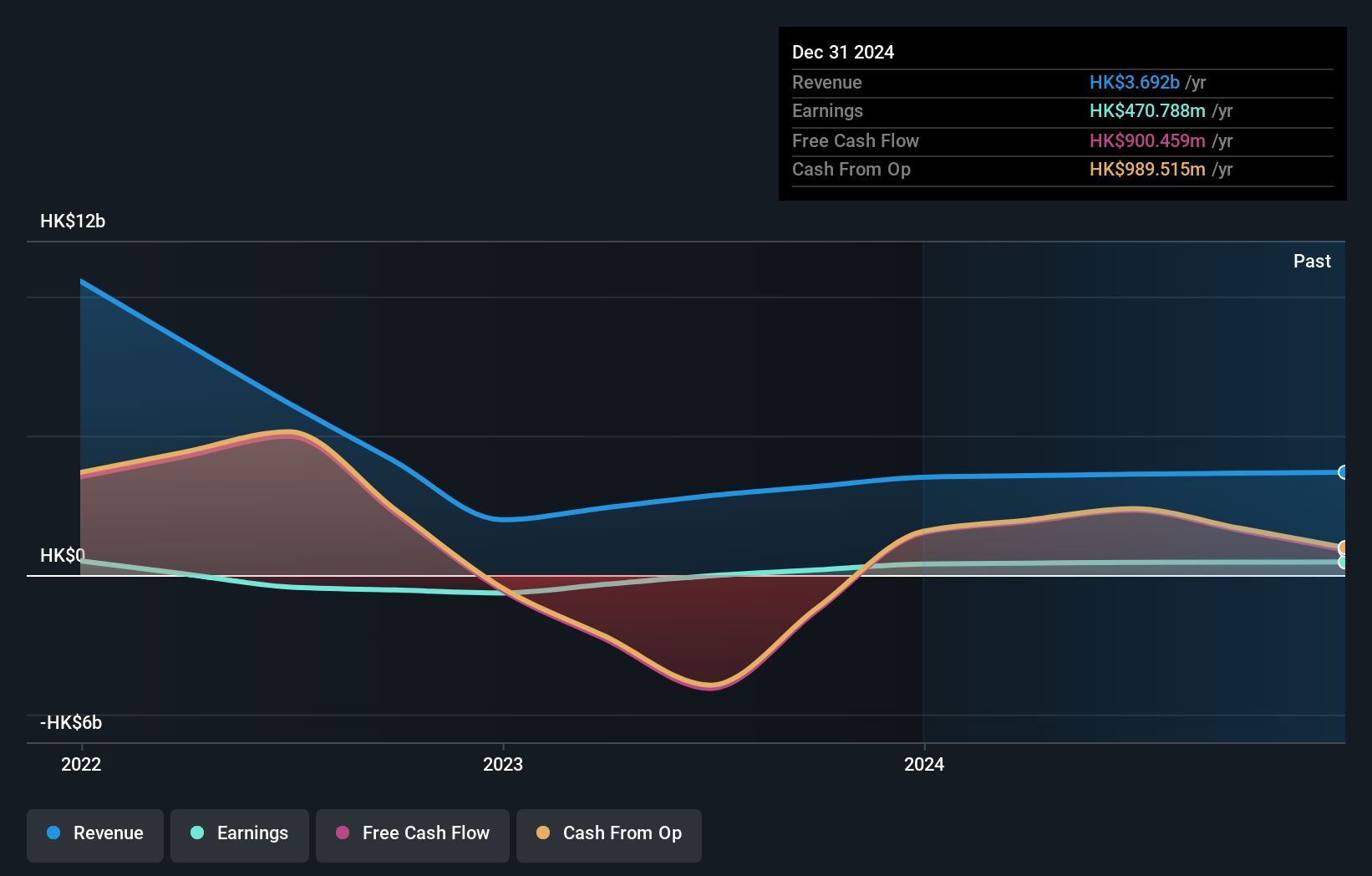

Overview: Yunfeng Financial Group Limited, an investment holding company, offers insurance products in Hong Kong and Macao with a market capitalization of HK$10.56 billion.

Operations: The primary revenue stream for Yunfeng Financial Group comes from its insurance business, generating HK$3.59 billion. Additional revenue is derived from other financial services and corporate activities, contributing HK$108.55 million.

Yunfeng Financial Group, a smaller player in the financial sector, has shown resilience with net income rising to HK$470.79 million from HK$397.16 million last year and earnings per share increasing to HK$0.12 from HK$0.10. Despite an 18% earnings growth over the past year, it lags behind the broader insurance industry's 63%. The company's debt management is commendable with interest payments well-covered by EBIT at 5x and a reduced debt-to-equity ratio from 22% to 19% over five years. However, its share price remains highly volatile in recent months, reflecting broader market uncertainties.

- Take a closer look at Yunfeng Financial Group's potential here in our health report.

Gain insights into Yunfeng Financial Group's past trends and performance with our Past report.

Dong Fang Offshore (TPEX:7786)

Simply Wall St Value Rating: ★★★★★☆

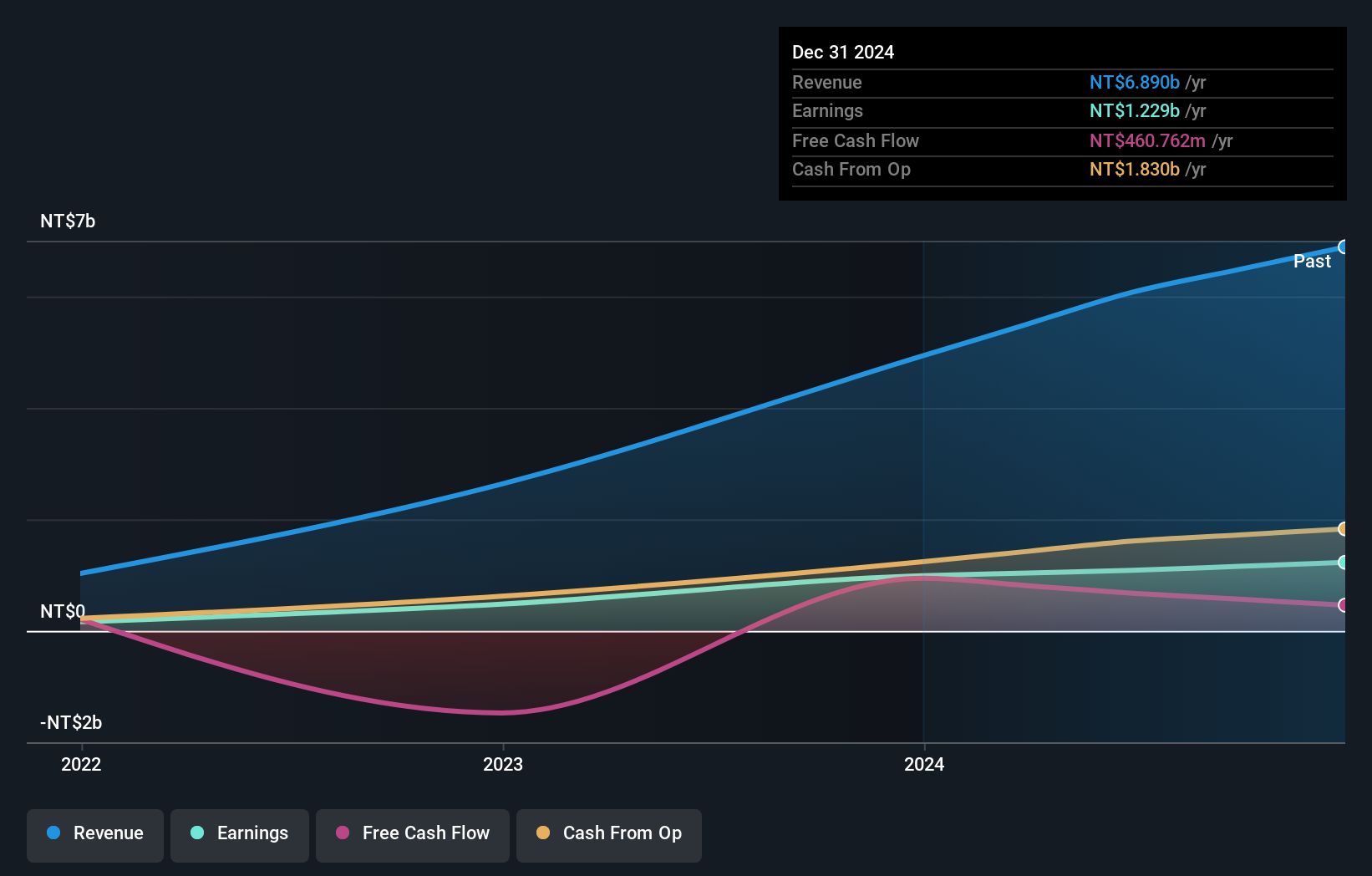

Overview: Dong Fang Offshore Co., Ltd. provides vessel solutions for offshore wind projects, including guard, MMO, CTV, HDD, transportation, berth, and cargo transfer services with a market cap of NT$35.46 billion.

Operations: The primary revenue stream for Dong Fang Offshore comes from its transportation and shipping services, generating NT$6.89 billion. The company has a market cap of NT$35.46 billion.

Dong Fang Offshore, with its nimble market presence, has seen robust financial performance. Its net income reached TWD 1.23 billion for the year ending December 2024, up from TWD 988.91 million the previous year, while sales climbed to TWD 6.89 billion from TWD 4.93 billion. The company boasts high-quality earnings and a strong cash position relative to its debt obligations, with EBIT covering interest payments by an impressive 363 times. Despite recent share price volatility over three months, Dong Fang's inclusion in the S&P Global BMI Index suggests positive recognition within industry circles.

- Click here to discover the nuances of Dong Fang Offshore with our detailed analytical health report.

Evaluate Dong Fang Offshore's historical performance by accessing our past performance report.

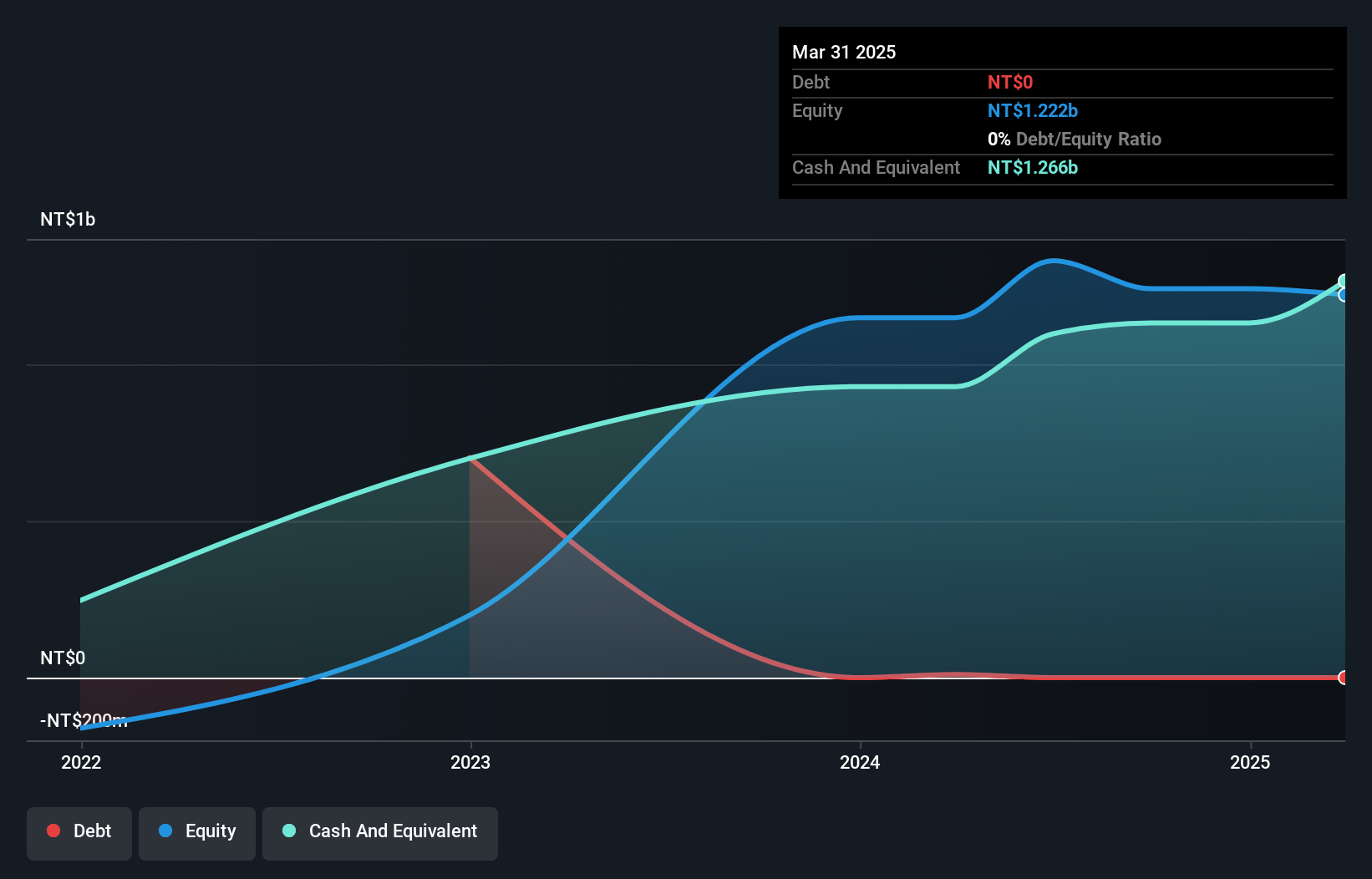

Intelligo Technology (TWSE:7749)

Simply Wall St Value Rating: ★★★★★★

Overview: Intelligo Technology, Inc. offers artificial intelligence solutions to improve communication interactions and has a market capitalization of NT$16.14 billion.

Operations: Intelligo Technology generates revenue primarily through its artificial intelligence solutions aimed at enhancing communication interactions. The company has a market capitalization of NT$16.14 billion.

Intelligo Technology, a nimble player in Asia's tech scene, boasts impressive earnings growth of 182.6% over the past year, outpacing the Software industry's 19.2%. With no debt for five years and high-quality earnings, it stands on solid financial ground. The company is also free cash flow positive with a levered free cash flow of US$377.45 million as of December 2024. Recently, Yuanta Securities was appointed as lead underwriter for its TWD 2.1 billion IPO, signaling potential expansion opportunities on the horizon despite shares being highly illiquid in nature.

Summing It All Up

- Access the full spectrum of 2621 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:7749

Intelligo Technology

Intelligo Technology, Inc. provides artificial intelligence solutions that enhance human-to-human and human-to-machine communications.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026