- Turkey

- /

- Hospitality

- /

- IBSE:KSTUR

Undiscovered Gems With Promising Potential In February 2025

Reviewed by Simply Wall St

As global markets edge toward record highs, with the Nasdaq Composite leading gains and small-cap stocks lagging behind larger indices, investors are navigating a landscape shaped by accelerating inflation and cautious monetary policies. In this environment of heightened economic uncertainty and shifting trade dynamics, identifying promising opportunities often involves seeking out undiscovered gems—stocks that may not be in the spotlight but hold significant potential due to their innovative business models or strategic market positions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Kustur Kusadasi Turizm Endüstrisi (IBSE:KSTUR)

Simply Wall St Value Rating: ★★★★★★

Overview: Kustur Kusadasi Turizm Endüstrisi A.S. operates holiday clubs in Turkey and has a market capitalization of TRY12.44 billion.

Operations: Kustur Kusadasi Turizm Endüstrisi generates revenue primarily from its Casinos & Resorts segment, amounting to TRY262.96 million. The company's financial performance is reflected in its market capitalization of TRY12.44 billion.

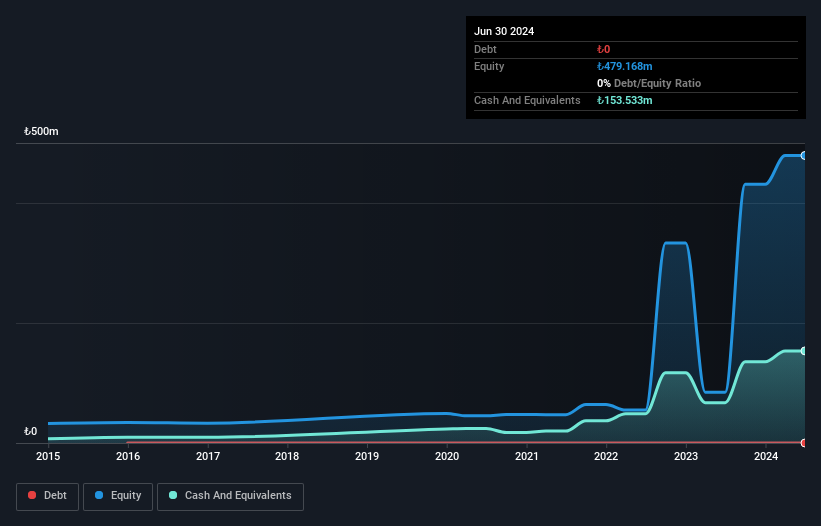

Kustur Kusadasi, a smaller player in the hospitality sector, has shown impressive earnings growth of 186.1% over the past year, outpacing its industry peers at 13.2%. The company remains debt-free for five years, eliminating concerns about interest coverage and providing financial flexibility. Its levered free cash flow surged to US$114.06 million by mid-2023 from US$45.38 million at the end of 2022, despite capital expenditures rising to US$38.10 million during this period. However, share price volatility in recent months could be a concern for risk-averse investors seeking stability in their portfolios.

CHT Security (TPEX:7765)

Simply Wall St Value Rating: ★★★★★★

Overview: CHT Security Co., Ltd. is a company specializing in cybersecurity services with a market capitalization of NT$13.13 billion.

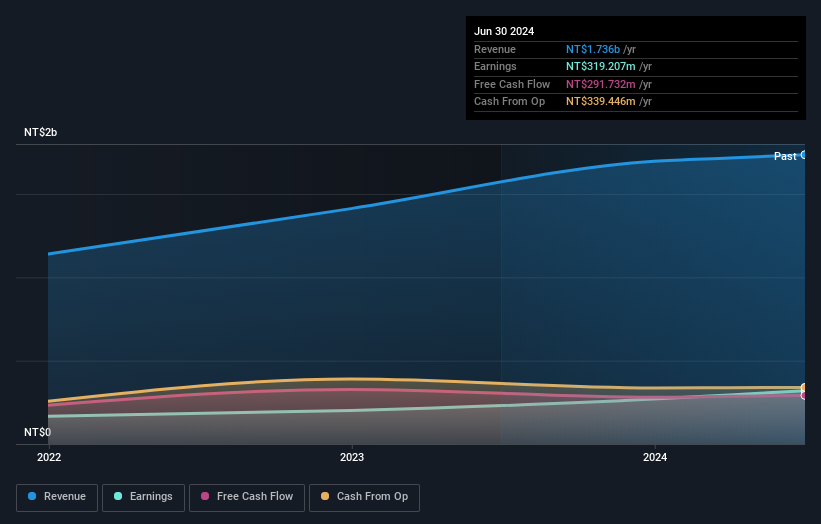

Operations: The company generates revenue primarily from its Security Software & Services segment, amounting to NT$1.74 billion.

CHT Security, a nimble player in the cybersecurity field, boasts a debt-free balance sheet and impressive earnings growth of 36% over the past year. This growth outpaced the IT industry's average of 10%, highlighting its competitive edge. The company has consistently shown high-quality earnings, reinforcing its robust financial health. With levered free cash flow reaching US$292 million as of mid-2024 and capital expenditure decreasing to US$48 million, CHT seems well-positioned for sustainable operations. Despite its small size, this firm’s performance suggests potential for continued success within the cybersecurity sector.

- Get an in-depth perspective on CHT Security's performance by reading our health report here.

Examine CHT Security's past performance report to understand how it has performed in the past.

kaonavi (TSE:4435)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kaonavi, Inc. develops and sells cloud-based human capital management systems, with a market cap of ¥50.59 billion.

Operations: Kaonavi, Inc. generates revenue through the development and sale of cloud-based human capital management systems. The company's financial performance is influenced by its cost structure and revenue streams, with particular attention to its net profit margin trends over recent periods.

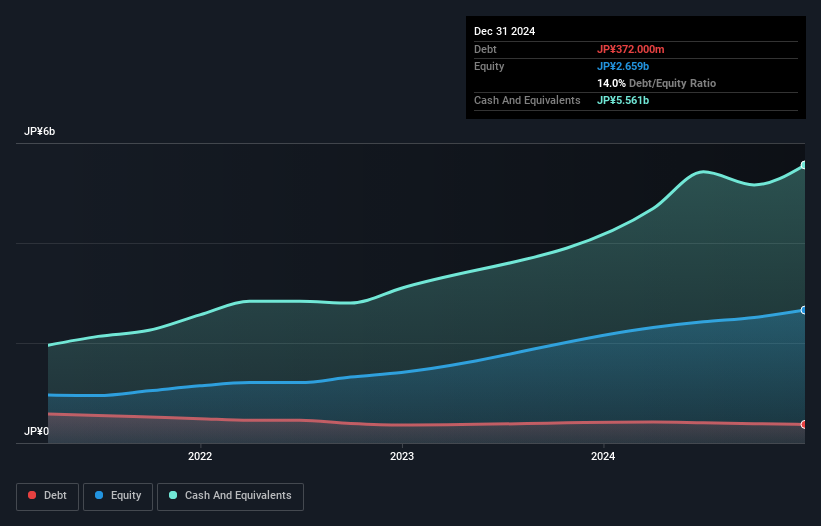

Kaonavi, a dynamic player in the software sector, showcases impressive financial health with earnings surging 36.9% last year, outpacing the industry average of 14.2%. The company has more cash than its total debt and maintains high-quality earnings. Recent corporate guidance projects net sales at ¥9.49 billion and an operating profit of ¥470 million for fiscal year-end March 2025. A significant development includes The Carlyle Group's offer to acquire a substantial stake for ¥41 billion, valuing shares at ¥4,380 each—indicating strong market confidence in Kaonavi's potential growth trajectory amidst its volatile share price history.

- Click to explore a detailed breakdown of our findings in kaonavi's health report.

Gain insights into kaonavi's historical performance by reviewing our past performance report.

Where To Now?

- Investigate our full lineup of 4716 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kustur Kusadasi Turizm Endüstrisi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:KSTUR

Flawless balance sheet with solid track record.

Market Insights

Community Narratives