There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should MAYO Human Capital (GTSM:6738) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for MAYO Human Capital

Does MAYO Human Capital Have A Long Cash Runway?

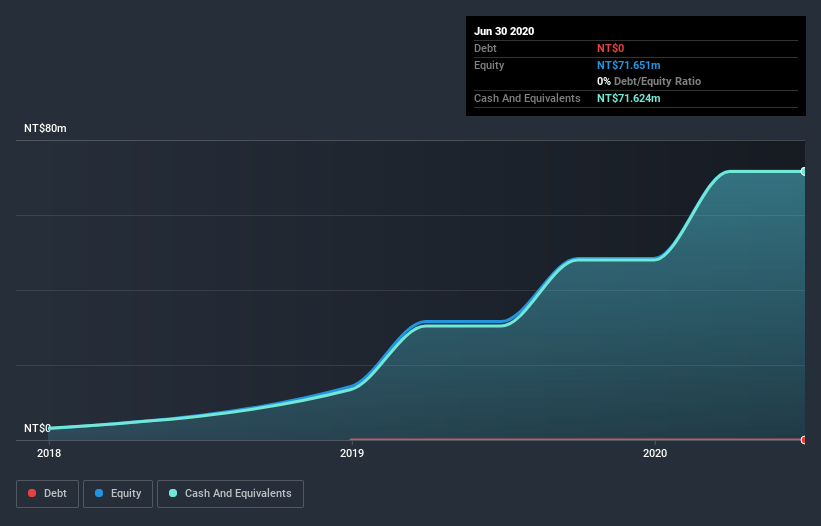

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When MAYO Human Capital last reported its balance sheet in June 2020, it had zero debt and cash worth NT$72m. Looking at the last year, the company burnt through NT$121m. That means it had a cash runway of around 7 months as of June 2020. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. The image below shows how its cash balance has been changing over the last few years.

How Well Is MAYO Human Capital Growing?

MAYO Human Capital boosted investment sharply in the last year, with cash burn ramping by 55%. While that isa little concerning at a glance, the company has a track record of recent growth, evidenced by the impressive 80% growth in revenue, over the very same year. On balance, we'd say the company is improving over time. In reality, this article only makes a short study of the company's growth data. This graph of historic revenue growth shows how MAYO Human Capital is building its business over time.

How Hard Would It Be For MAYO Human Capital To Raise More Cash For Growth?

Since MAYO Human Capital has been boosting its cash burn, the market will likely be considering how it can raise more cash if need be. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

MAYO Human Capital has a market capitalisation of NT$1.0b and burnt through NT$121m last year, which is 12% of the company's market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About MAYO Human Capital's Cash Burn?

On this analysis of MAYO Human Capital's cash burn, we think its revenue growth was reassuring, while its cash runway has us a bit worried. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. Taking a deeper dive, we've spotted 4 warning signs for MAYO Human Capital you should be aware of, and 1 of them is significant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade MAYO Human Capital, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:6738

MAYO Human Capital

Provides human resources management solutions to various industries and enterprises.

Excellent balance sheet low.