- Taiwan

- /

- Semiconductors

- /

- TWSE:8028

Here's Why Phoenix Silicon International (TWSE:8028) Has A Meaningful Debt Burden

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Phoenix Silicon International Corporation (TWSE:8028) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Phoenix Silicon International

How Much Debt Does Phoenix Silicon International Carry?

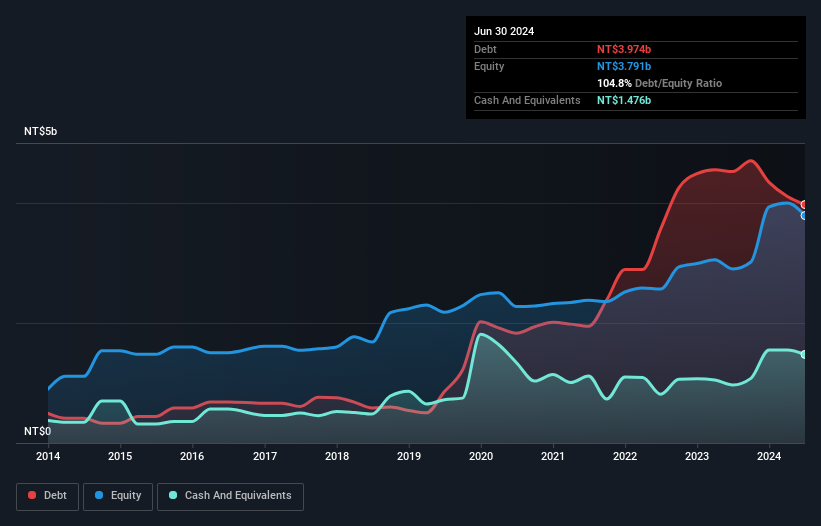

As you can see below, Phoenix Silicon International had NT$3.97b of debt at June 2024, down from NT$4.52b a year prior. However, it does have NT$1.48b in cash offsetting this, leading to net debt of about NT$2.50b.

A Look At Phoenix Silicon International's Liabilities

The latest balance sheet data shows that Phoenix Silicon International had liabilities of NT$1.56b due within a year, and liabilities of NT$3.60b falling due after that. Offsetting this, it had NT$1.48b in cash and NT$875.2m in receivables that were due within 12 months. So its liabilities total NT$2.81b more than the combination of its cash and short-term receivables.

Since publicly traded Phoenix Silicon International shares are worth a total of NT$21.1b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Phoenix Silicon International's net debt is sitting at a very reasonable 2.3 times its EBITDA, while its EBIT covered its interest expense just 4.2 times last year. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. Shareholders should be aware that Phoenix Silicon International's EBIT was down 38% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Phoenix Silicon International will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Phoenix Silicon International burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Phoenix Silicon International's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least its level of total liabilities is not so bad. Looking at the bigger picture, it seems clear to us that Phoenix Silicon International's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 3 warning signs we've spotted with Phoenix Silicon International .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8028

Phoenix Silicon International

Engages in the research, development, manufacture, export, import, and sale of wafers in Taiwan.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives