- Taiwan

- /

- Semiconductors

- /

- TWSE:6415

Top Growth Companies With Strong Insider Ownership December 2024

Reviewed by Simply Wall St

As global markets navigate a period of cautious optimism following the Federal Reserve's recent rate cuts and ongoing economic uncertainties, investors are keenly observing how these developments impact growth stocks. In this environment, companies with high insider ownership can offer additional confidence to investors, as significant insider stakes often signal strong belief in the company’s long-term potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here we highlight a subset of our preferred stocks from the screener.

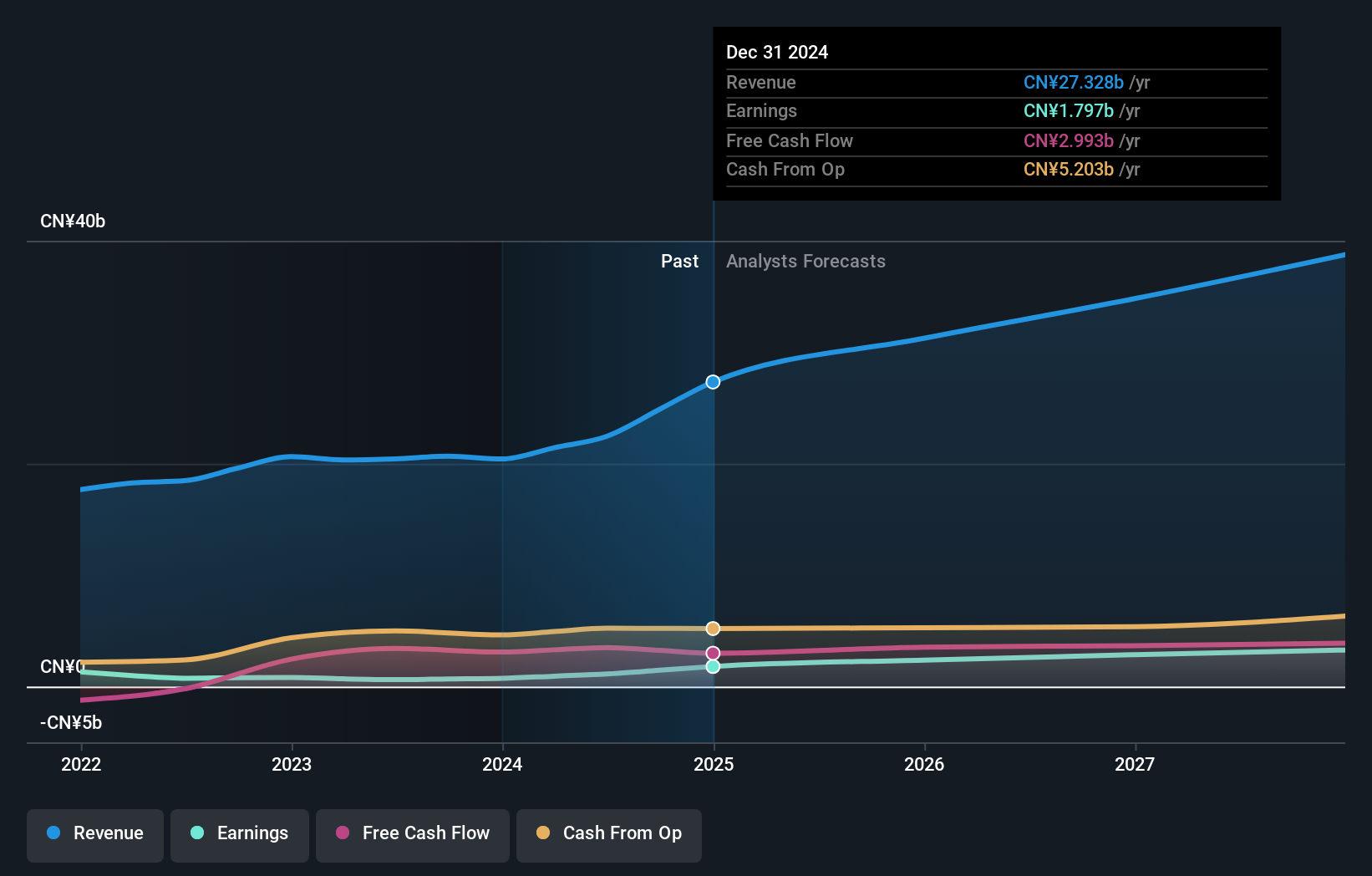

AAC Technologies Holdings (SEHK:2018)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AAC Technologies Holdings Inc. is an investment holding company offering solutions for smart devices across various regions including Mainland China, Hong Kong, Taiwan, other Asian countries, the United States, and Europe with a market cap of HK$44.34 billion.

Operations: The company's revenue segments include CN¥4.07 billion from Optics Products, CN¥7.64 billion from Acoustics Products, CN¥0.92 billion from Sensor and Semiconductor Products, and CN¥8.28 billion from Electromagnetic Drives and Precision Mechanics.

Insider Ownership: 36.7%

Revenue Growth Forecast: 12.7% p.a.

AAC Technologies Holdings is undertaking a share repurchase program of up to HK$778 million, aimed at enhancing net asset value and earnings per share. The company's revenue and earnings are forecasted to grow faster than the Hong Kong market, with expected annual profit growth significantly above 20%. Despite these positive growth forecasts, the return on equity is projected to remain low at 9.8% in three years. No substantial insider trading activity has been reported recently.

- Get an in-depth perspective on AAC Technologies Holdings' performance by reading our analyst estimates report here.

- The analysis detailed in our AAC Technologies Holdings valuation report hints at an inflated share price compared to its estimated value.

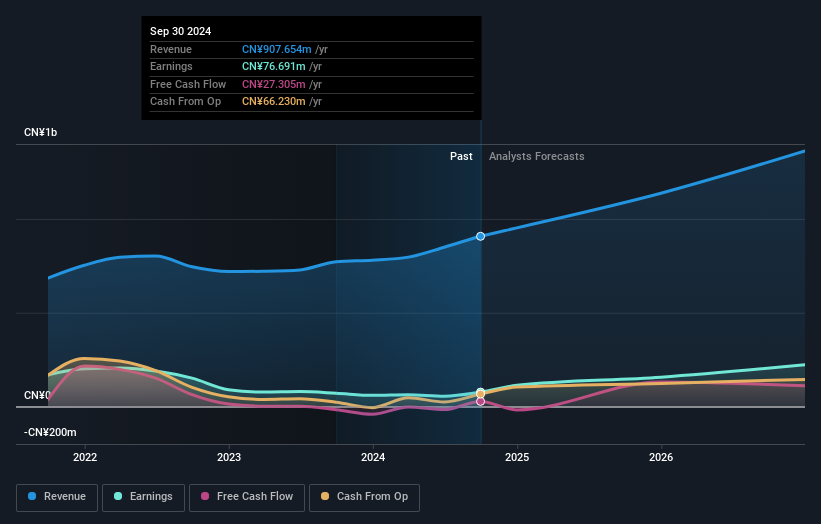

Wuxi Chipown Micro-electronics (SHSE:688508)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuxi Chipown Micro-electronics Limited focuses on the research, development, design, and supply of analog and mixed signal integrated circuits in China with a market cap of CN¥5.88 billion.

Operations: The company's revenue primarily comes from its integrated circuit segment, which generated CN¥907.65 million.

Insider Ownership: 34.9%

Revenue Growth Forecast: 18.5% p.a.

Wuxi Chipown Micro-electronics is projected to achieve earnings growth of 42.4% annually, surpassing the CN market's average. Revenue is expected to grow at 18.5% per year, outpacing the market yet not exceeding 20%. Recent financials show a rise in sales to CNY 707.23 million and net income to CNY 77.24 million for the first nine months of 2024, reflecting solid performance despite a forecasted low return on equity of 7.4%.

- Delve into the full analysis future growth report here for a deeper understanding of Wuxi Chipown Micro-electronics.

- According our valuation report, there's an indication that Wuxi Chipown Micro-electronics' share price might be on the expensive side.

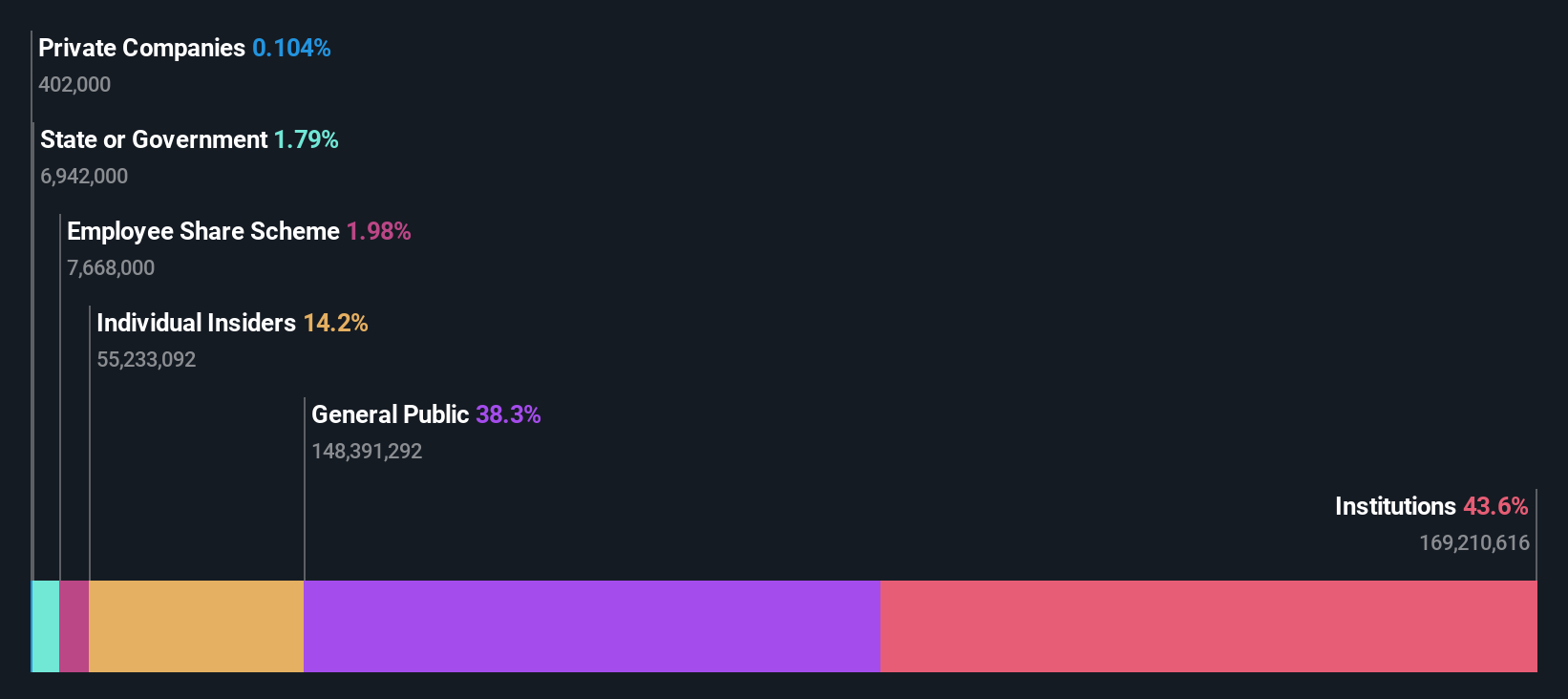

Silergy (TWSE:6415)

Simply Wall St Growth Rating: ★★★★★★

Overview: Silergy Corp. engages in the design, manufacture, and sale of integrated circuit products and related technical services both in China and internationally, with a market cap of NT$153.53 billion.

Operations: The company generates revenue of NT$17.63 billion from its semiconductor segment.

Insider Ownership: 14.3%

Revenue Growth Forecast: 20% p.a.

Silergy's earnings are forecast to grow significantly at 40.66% annually, outpacing the TW market's average of 19.2%. Recent financials reveal a rise in third-quarter sales to TWD 4.89 billion and net income to TWD 752.64 million, demonstrating robust growth despite high share price volatility and large one-off items affecting results. Revenue is projected to increase by over 20% annually, indicating strong potential for sustained expansion in the coming years.

- Click here and access our complete growth analysis report to understand the dynamics of Silergy.

- Our comprehensive valuation report raises the possibility that Silergy is priced higher than what may be justified by its financials.

Key Takeaways

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1512 more companies for you to explore.Click here to unveil our expertly curated list of 1515 Fast Growing Companies With High Insider Ownership.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6415

Silergy

Designs, manufactures, and sales of various integrated circuit products and related technical services in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives