- Taiwan

- /

- Semiconductors

- /

- TWSE:6415

Silergy Corp.'s (TWSE:6415) Shares Climb 32% But Its Business Is Yet to Catch Up

Silergy Corp. (TWSE:6415) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.8% in the last twelve months.

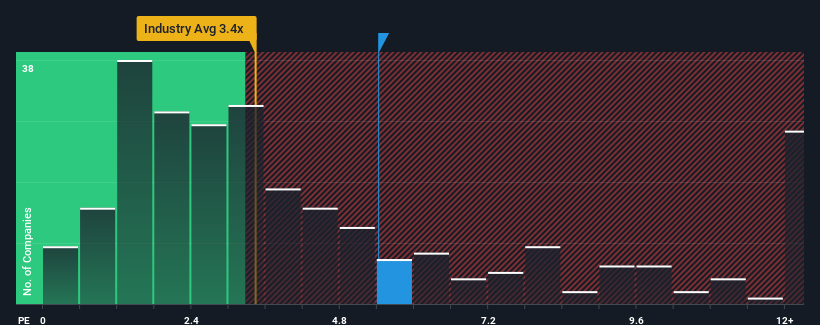

After such a large jump in price, you could be forgiven for thinking Silergy is a stock not worth researching with a price-to-sales ratios (or "P/S") of 5.4x, considering almost half the companies in Taiwan's Semiconductor industry have P/S ratios below 3.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Silergy

How Silergy Has Been Performing

With revenue that's retreating more than the industry's average of late, Silergy has been very sluggish. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Silergy will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Silergy would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's top line. Still, the latest three year period has seen an excellent 122% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 1.2% each year as estimated by the analysts watching the company. Meanwhile, the broader industry is forecast to expand by 18% per year, which paints a poor picture.

In light of this, it's alarming that Silergy's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What Does Silergy's P/S Mean For Investors?

The large bounce in Silergy's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Silergy currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Silergy you should know about.

If you're unsure about the strength of Silergy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6415

Silergy

Designs, manufactures, and sales of various integrated circuit products and related technical services in China and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives