Discovering Beijing Bewinner Communications And Two Other Promising Small Caps

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and shifting monetary policies, small-cap stocks have shown mixed performance, with indices like the Russell 2000 lagging behind larger benchmarks. In this environment, identifying promising small-cap companies can be challenging yet rewarding, as these "undiscovered gems" often possess unique growth potential that may not be immediately apparent.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Beijing Bewinner Communications (SZSE:002148)

Simply Wall St Value Rating: ★★★★★★

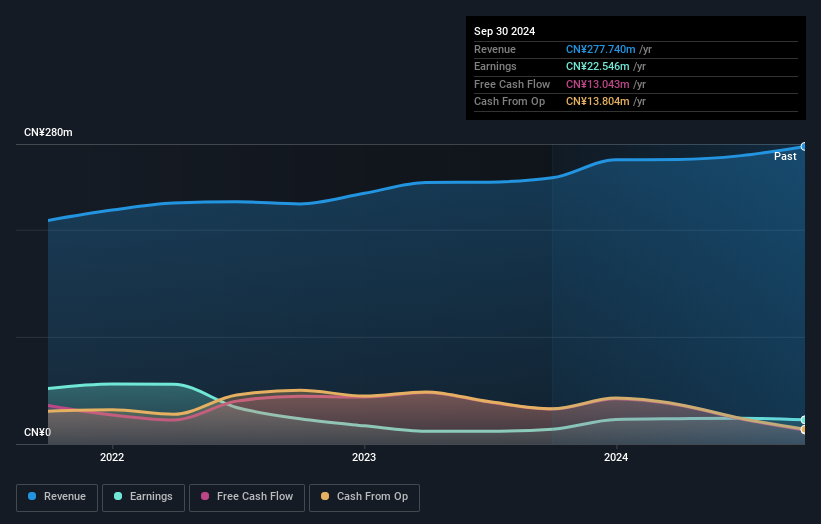

Overview: Beijing Bewinner Communications Co., Ltd. operates in the telecommunications sector and has a market capitalization of CN¥4.54 billion.

Operations: The company's revenue from telecommunications services amounts to CN¥277.74 million.

In the vibrant world of small-cap stocks, Beijing Bewinner Communications stands out with a notable earnings growth of 63.6% over the past year, surpassing the Wireless Telecom industry average of 10.4%. The company enjoys a debt-free status for the last five years, which likely contributes to its robust financial health and positive free cash flow. However, recent results were significantly affected by a one-off gain of CN¥11M in September 2024. While its share price has been highly volatile recently, this dynamic environment could present both opportunities and challenges for investors eyeing potential growth in this sector.

MITSUI E&S (TSE:7003)

Simply Wall St Value Rating: ★★★★☆☆

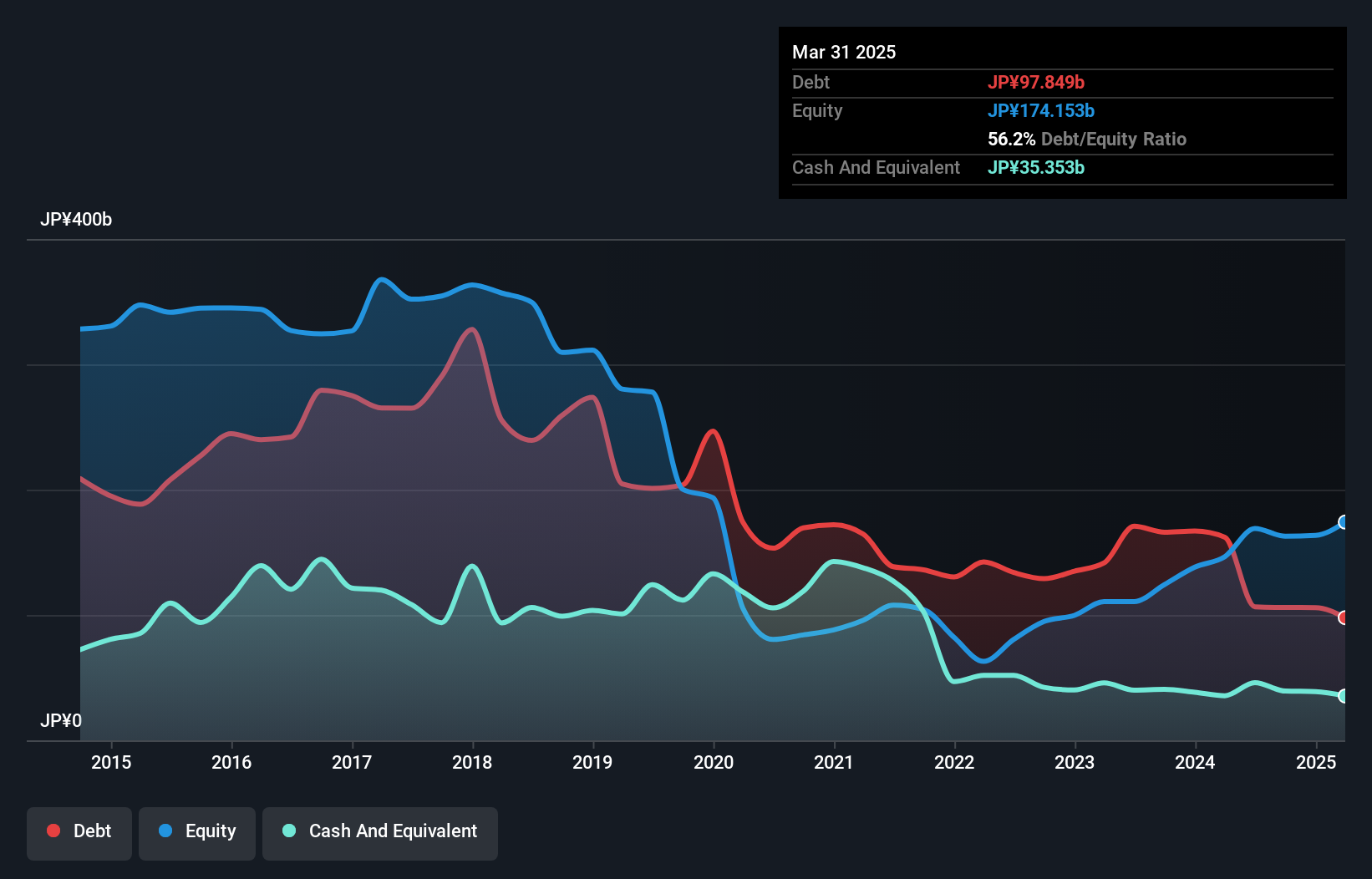

Overview: MITSUI E&S Co., Ltd. operates globally, offering marine propulsion systems and engaging in various business segments with a market capitalization of ¥176.76 billion.

Operations: The primary revenue stream for the company comes from its Marine Propulsion Systems segment, generating ¥133.82 billion. Other significant contributions include Peripheral Businesses at ¥85.66 billion and Logistics Systems at ¥58.79 billion. The New Business Development segment adds ¥39.75 billion to the total revenue, reflecting diversification efforts within its operations.

Mitsui E&S, a notable player in the machinery sector, has seen its debt to equity ratio significantly improve from 127.4% to 64.8% over five years, suggesting better financial health. The company experienced a substantial one-off gain of ¥19.5 billion in its recent fiscal year, boosting earnings by 99.6%, far outpacing the industry's average growth of 4%. Despite high volatility in share price recently, Mitsui E&S's interest payments are well-covered with an EBIT coverage of 8x and it trades at a value below estimated fair market value by about 5%. Recent announcements include an increased dividend forecast to ¥20 per share and revised profit expectations for March 2025 at ¥38 billion or ¥374 per share due to upward profit revisions.

- Click here to discover the nuances of MITSUI E&S with our detailed analytical health report.

Understand MITSUI E&S' track record by examining our Past report.

Sigurd Microelectronics (TWSE:6257)

Simply Wall St Value Rating: ★★★★★☆

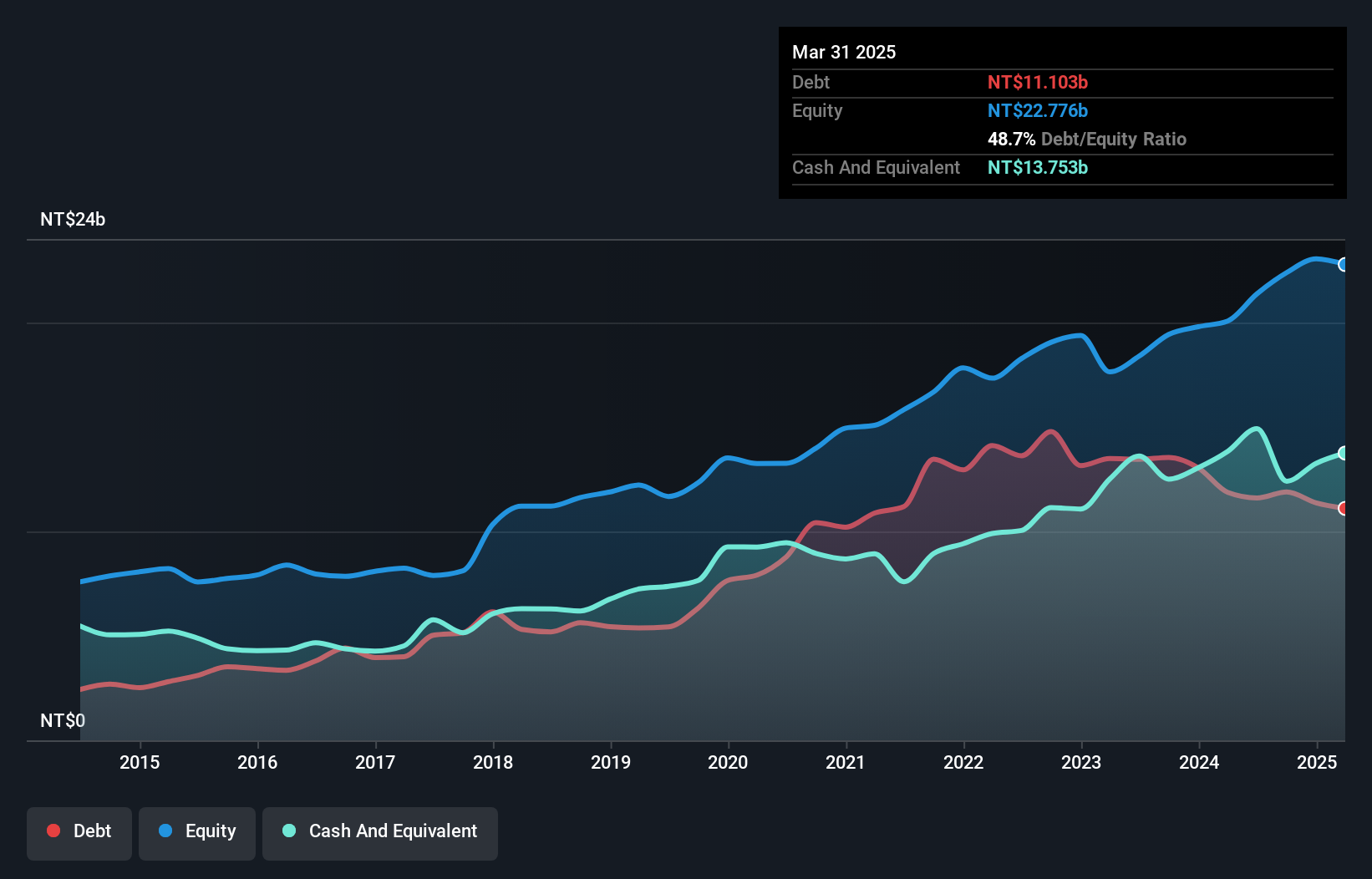

Overview: Sigurd Microelectronics Corporation, along with its subsidiaries, specializes in the design, processing, testing, burn-in treatment, manufacture, and trading of integrated circuits across Taiwan, Singapore, America, China and other international markets; it has a market capitalization of approximately NT$38.04 billion.

Operations: Sigurd Microelectronics generates revenue primarily from its Packaging and Testing Business, which accounts for NT$17.27 billion, and Trading activities, contributing NT$42.64 million. The company exhibits a focus on integrated circuit services across multiple international markets.

Sigurd Microelectronics, with its nimble stature in the semiconductor space, showcases impressive earnings growth at 30.6%, outpacing the industry's 5.9%. Its price-to-earnings ratio of 16.9x offers a compelling value compared to the TW market's 21.6x, hinting at potential undervaluation. Despite an increase in its debt-to-equity ratio from 51.3% to 53.1% over five years, Sigurd maintains more cash than total debt and enjoys high-quality earnings that cover interest payments comfortably. The company is profitable with positive free cash flow, suggesting a stable financial footing and promising trajectory for future growth within its industry niche.

- Click here and access our complete health analysis report to understand the dynamics of Sigurd Microelectronics.

Evaluate Sigurd Microelectronics' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4730 more companies for you to explore.Click here to unveil our expertly curated list of 4733 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7003

MITSUI E&S

Provides marine propulsion systems in Japan, rest of Asia, Europe, North America, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion