- Switzerland

- /

- Banks

- /

- SWX:BCVN

3 Prominent Dividend Stocks For November 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by strong labor market data and geopolitical tensions, U.S. stock indexes have approached record highs with broad-based gains, fueled by positive sentiment from declining jobless claims and steady home sales. In this environment of economic optimism and cautious anticipation of Federal Reserve policy decisions, dividend stocks stand out as an attractive option for investors seeking stability and income. A good dividend stock typically combines a reliable payout history with the potential for capital appreciation, making it a compelling choice in today's dynamic market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.57% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.32% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.81% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

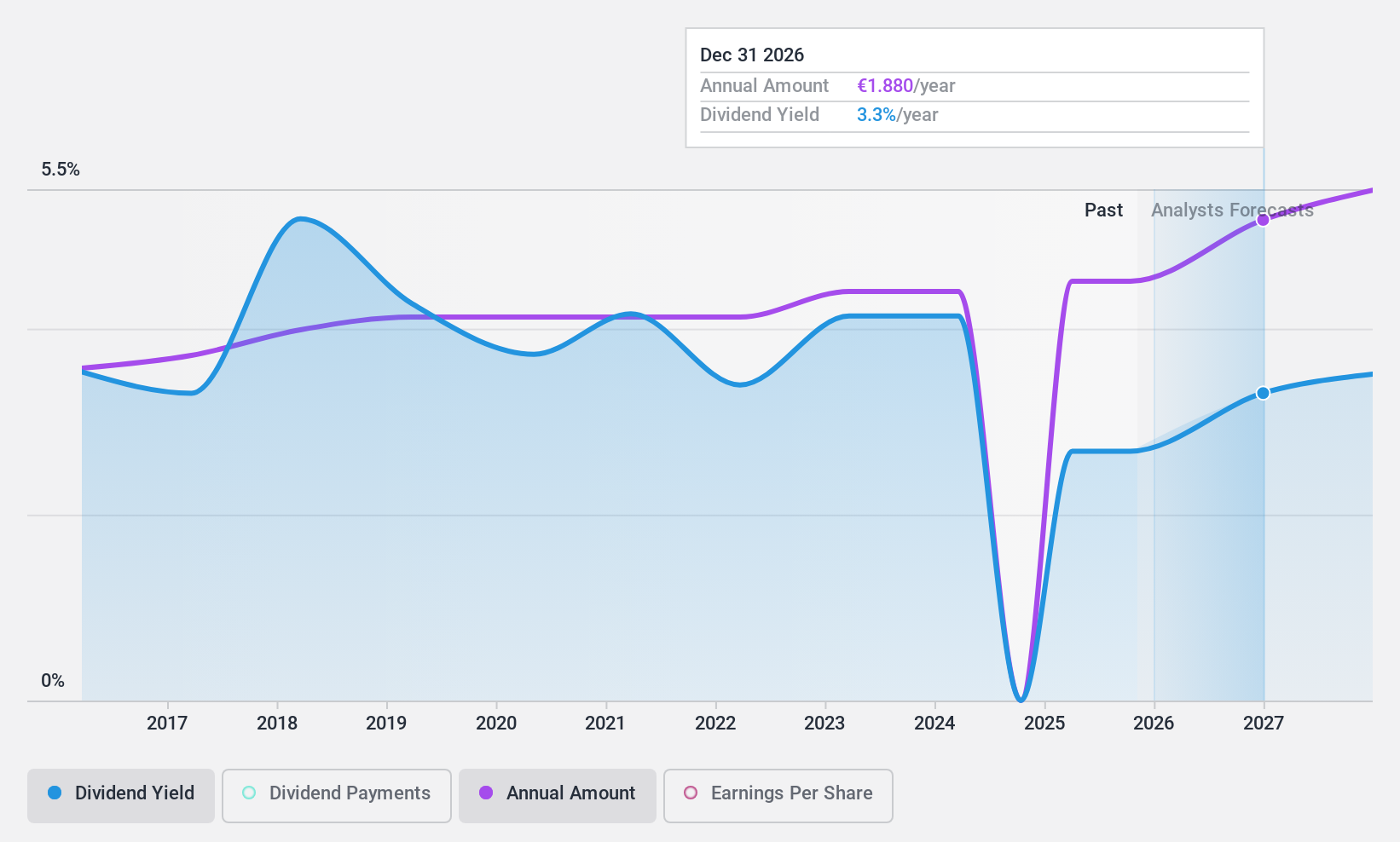

Orion Oyj (HLSE:ORNBV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orion Oyj is a company that develops, manufactures, and markets human and veterinary pharmaceuticals as well as active pharmaceutical ingredients (APIs) across Finland, Scandinavia, Europe, North America, and internationally with a market cap of €6.40 billion.

Operations: Orion Oyj's revenue from its Pharmaceuticals segment is €1.43 billion.

Dividend Yield: 3.6%

Orion Oyj has demonstrated reliable and stable dividend payments over the past decade, with dividends growing consistently. However, its current dividend yield of 3.55% is lower than the top quartile in Finland and is not well covered by free cash flows, with a high cash payout ratio of 132.9%. Despite this, earnings have surged significantly recently, supporting a reasonable payout ratio of 68.6%. The company reaffirmed its earnings guidance for 2024 amidst strong third-quarter results.

- Dive into the specifics of Orion Oyj here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Orion Oyj shares in the market.

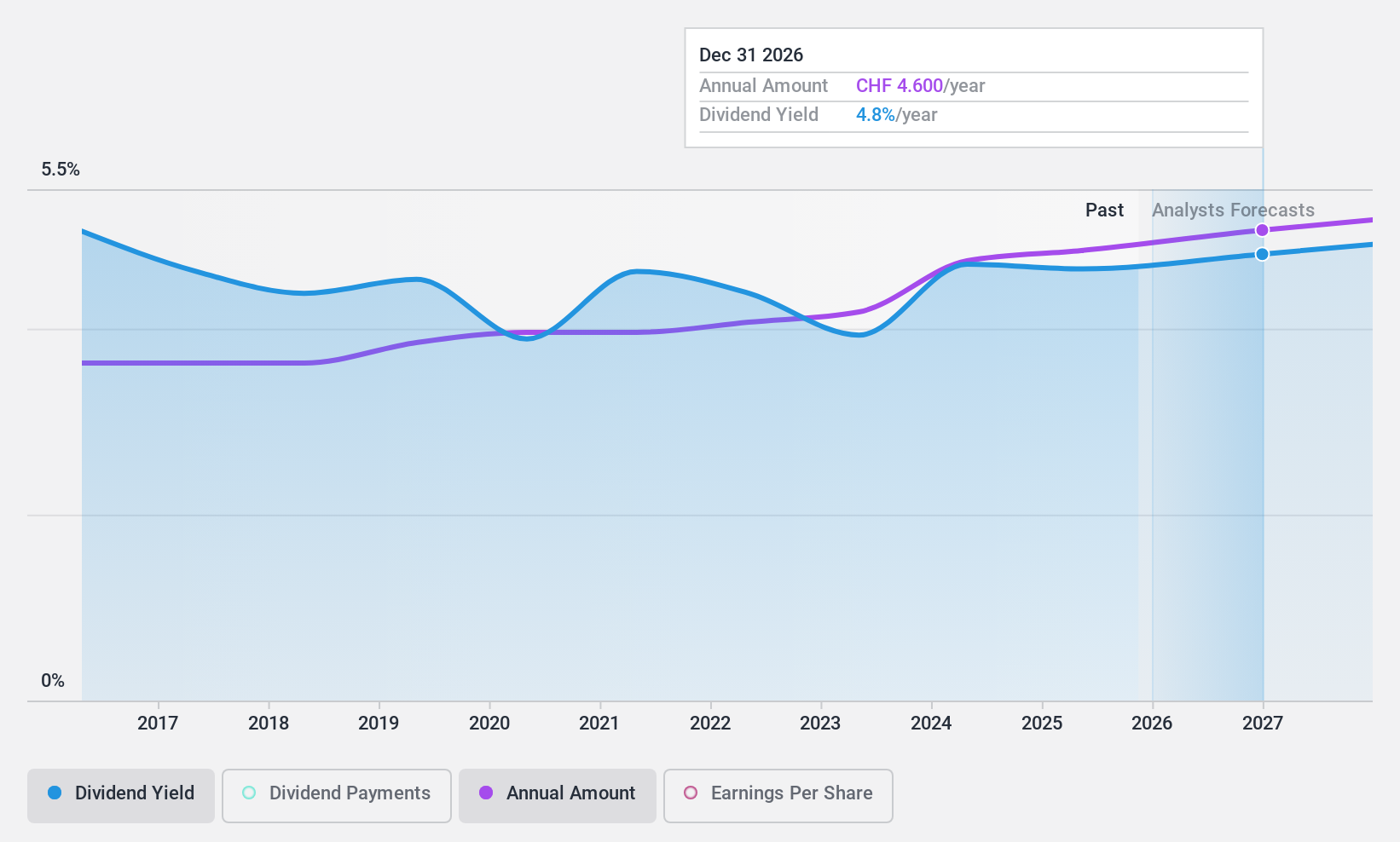

Banque Cantonale Vaudoise (SWX:BCVN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Banque Cantonale Vaudoise provides a range of financial services in Vaud Canton, Switzerland, the European Union, North America, and internationally with a market cap of CHF7.74 billion.

Operations: Banque Cantonale Vaudoise generates its revenue through diverse financial services offered across Switzerland, the European Union, North America, and other international markets.

Dividend Yield: 4.8%

Banque Cantonale Vaudoise offers a stable and reliable dividend yield of 4.77%, placing it in the top quartile among Swiss dividend payers. Over the past decade, its dividends have grown with minimal volatility, supported by a sustainable payout ratio of 78.7%. While earnings growth is modest at 0.47% annually, the price-to-earnings ratio of 17.2x indicates good value compared to the Swiss market average of 19.9x, enhancing its appeal for dividend investors.

- Take a closer look at Banque Cantonale Vaudoise's potential here in our dividend report.

- The valuation report we've compiled suggests that Banque Cantonale Vaudoise's current price could be inflated.

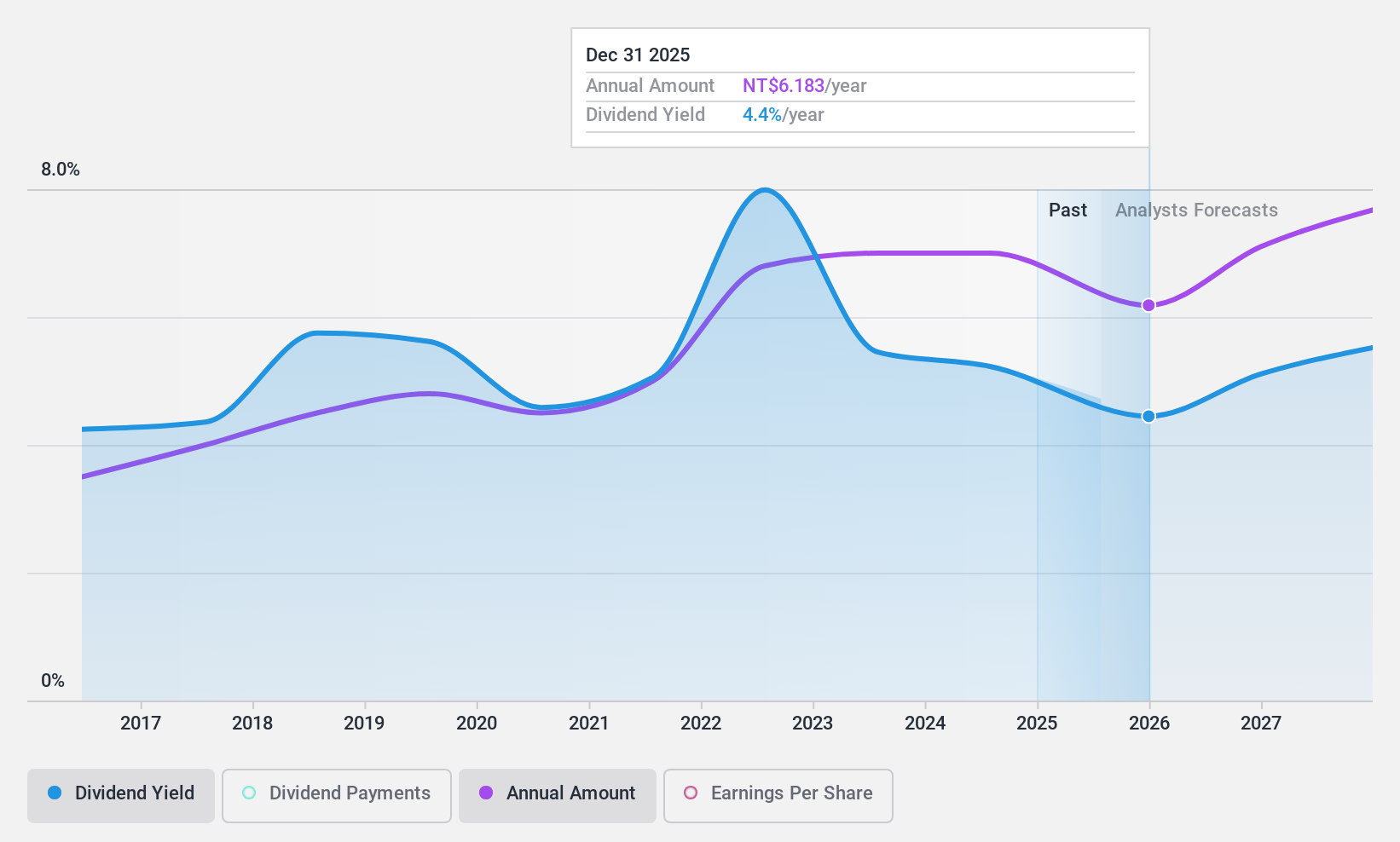

Powertech Technology (TWSE:6239)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Powertech Technology Inc. is engaged in the research, design, development, assembly, manufacturing, packaging, testing, and sales of integrated circuit (IC) products across Taiwan and various international markets with a market cap of approximately NT$94.54 billion.

Operations: Powertech Technology Inc. generates revenue from its Semiconductors segment, amounting to NT$75.25 billion.

Dividend Yield: 5.5%

Powertech Technology offers a compelling dividend yield of 5.53%, ranking in the top 25% of Taiwanese dividend payers. Its dividends are well-supported by earnings and cash flows, with payout ratios of 56.7% and 43.1%, respectively, ensuring sustainability. Recent earnings growth is notable, with net income for the first nine months reaching TWD 5.27 billion, up from TWD 4.04 billion last year. The price-to-earnings ratio of 10.2x suggests good value relative to the market average.

- Unlock comprehensive insights into our analysis of Powertech Technology stock in this dividend report.

- Our expertly prepared valuation report Powertech Technology implies its share price may be lower than expected.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1944 Top Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Banque Cantonale Vaudoise, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Banque Cantonale Vaudoise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BCVN

Banque Cantonale Vaudoise

Engages in the provision of various financial services in Vaud Canton and rest of Switzerland, the European Union, North America, and internationally.

6 star dividend payer with excellent balance sheet.