Discover Teo Seng Capital Berhad And Two Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets experience fluctuations, with the S&P 500 Index advancing and European indices buoyed by interest rate cuts, investors are keenly observing economic indicators like consumer spending and industrial output. In this dynamic environment, dividend stocks remain attractive for their potential to provide steady income streams amidst market volatility. A good dividend stock often combines a reliable payout history with strong fundamentals, making it a valuable consideration for those seeking stability in uncertain times. This article will explore Teo Seng Capital Berhad alongside two other leading dividend stocks that exemplify these qualities.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.23% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.08% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.74% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.85% | ★★★★★★ |

| Innotech (TSE:9880) | 4.77% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.81% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.56% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.81% | ★★★★★★ |

Click here to see the full list of 2042 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

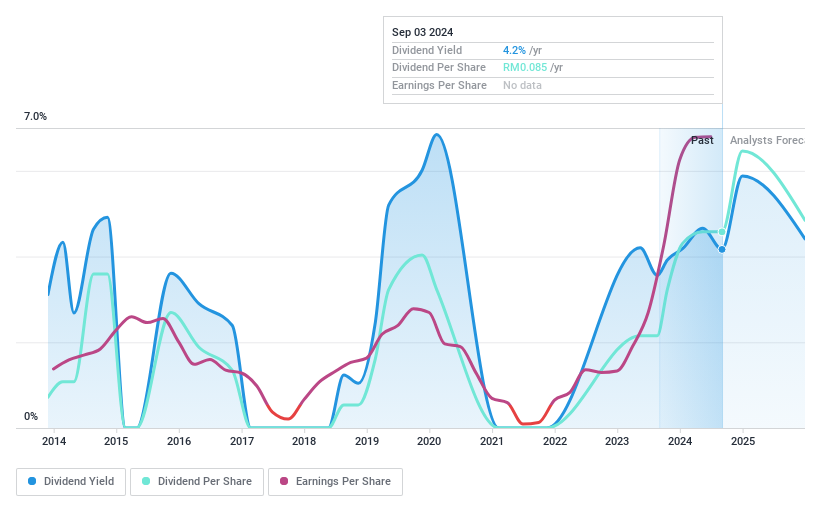

Teo Seng Capital Berhad (KLSE:TEOSENG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teo Seng Capital Berhad is an investment holding company that primarily operates in the poultry farming business across Malaysia, Singapore, and internationally, with a market capitalization of MYR770.88 million.

Operations: Teo Seng Capital Berhad generates its revenue primarily from the poultry segment, contributing MYR670.39 million, and from trading activities amounting to MYR221.71 million.

Dividend Yield: 3.2%

Teo Seng Capital Berhad's dividend payments are well covered by earnings and cash flows, with a low payout ratio of 19.8% and a cash payout ratio of 15.4%. However, the dividend yield of 3.24% is below the top tier in Malaysia, and the company has an unstable dividend track record over the past decade. Recent earnings show growth, with net income for six months at MYR 60.41 million compared to MYR 45.08 million last year.

- Unlock comprehensive insights into our analysis of Teo Seng Capital Berhad stock in this dividend report.

- According our valuation report, there's an indication that Teo Seng Capital Berhad's share price might be on the cheaper side.

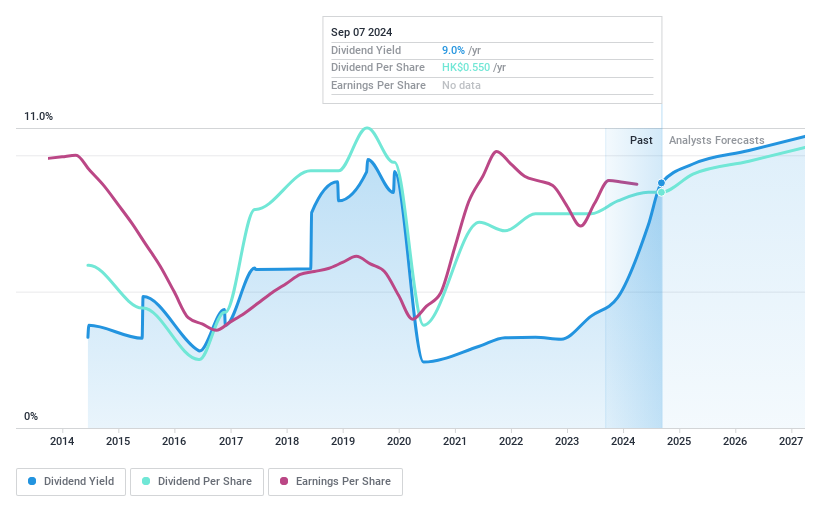

Chow Tai Fook Jewellery Group (SEHK:1929)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chow Tai Fook Jewellery Group Limited is an investment holding company that manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally, with a market cap of approximately HK$72.71 billion.

Operations: Chow Tai Fook Jewellery Group Limited generates revenue primarily from Mainland China, contributing HK$89.70 billion, and from Hong Kong, Macau, and other markets with HK$19.92 billion.

Dividend Yield: 7.0%

Chow Tai Fook Jewellery Group's dividend yield of 7.01% is lower than the top tier in Hong Kong, and its payout ratio is high at 84.6%, though covered by earnings and cash flows (42.7%). Despite a volatile dividend history, payments have grown over the past decade. Recent sales figures show declines across key markets, impacting retail performance. The company continues to innovate with new concept stores to enhance customer experience and brand presence amid challenging market conditions.

- Click here to discover the nuances of Chow Tai Fook Jewellery Group with our detailed analytical dividend report.

- Our expertly prepared valuation report Chow Tai Fook Jewellery Group implies its share price may be lower than expected.

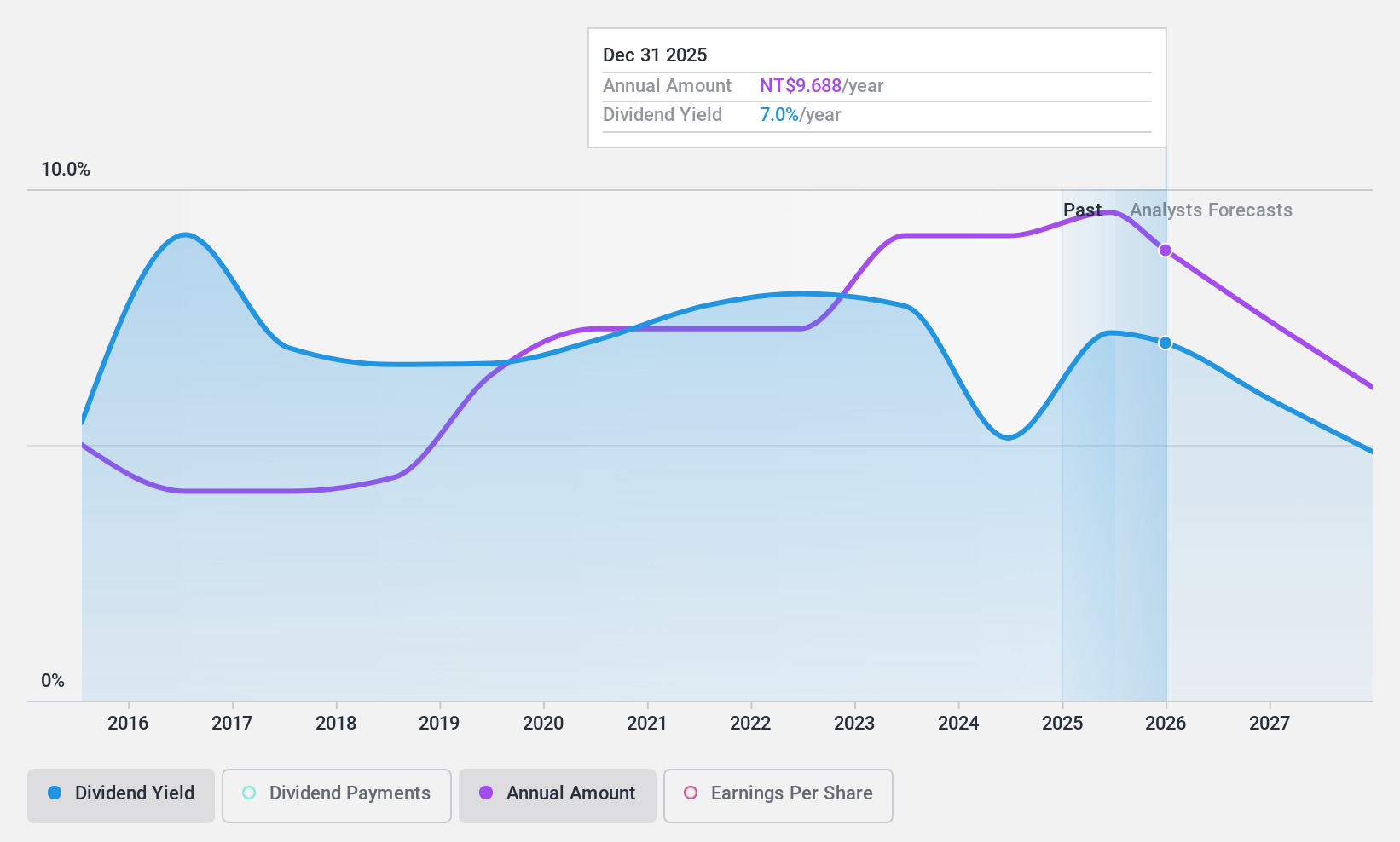

Radiant Opto-Electronics (TWSE:6176)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Radiant Opto-Electronics Corporation manufactures and sells backlight modules and light guide plates for LCD panels across Asia, Europe, and the United States, with a market cap of NT$98.59 billion.

Operations: Radiant Opto-Electronics Corporation's revenue is derived from its Taiwan Regional segment, contributing NT$25.80 billion, and the Mainland District segment, contributing NT$34.20 billion.

Dividend Yield: 4.7%

Radiant Opto-Electronics offers a dividend yield of 4.71%, placing it in the top 25% of Taiwan's market, with a payout ratio of 76.8% covered by earnings and cash flows at 63.9%. Despite an unstable dividend track record, payments have increased over the past decade. Recent earnings show modest growth with sales reaching TWD 11.95 billion for Q2 2024, though net income decreased compared to last year amidst strategic shifts into the Meta-Optics market.

- Navigate through the intricacies of Radiant Opto-Electronics with our comprehensive dividend report here.

- Our expertly prepared valuation report Radiant Opto-Electronics implies its share price may be too high.

Next Steps

- Unlock our comprehensive list of 2042 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Teo Seng Capital Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teo Seng Capital Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:TEOSENG

Teo Seng Capital Berhad

An investment holding company, engages in poultry farming business in Malaysia, Singapore, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives