- Netherlands

- /

- Capital Markets

- /

- ENXTAM:VLK

Discovering Hidden Opportunities In Three Promising Small Caps

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, small-cap stocks have shown resilience with indices like the Russell 2000 posting gains. In this environment, identifying promising small-cap opportunities requires a keen eye for companies that demonstrate strong fundamentals, adaptability to market shifts, and potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Van Lanschot Kempen (ENXTAM:VLK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Van Lanschot Kempen NV is a financial services company offering a range of services in the Netherlands and internationally, with a market cap of approximately €1.90 billion.

Operations: Van Lanschot Kempen NV generates revenue primarily from its investment banking clients, amounting to €46.60 million.

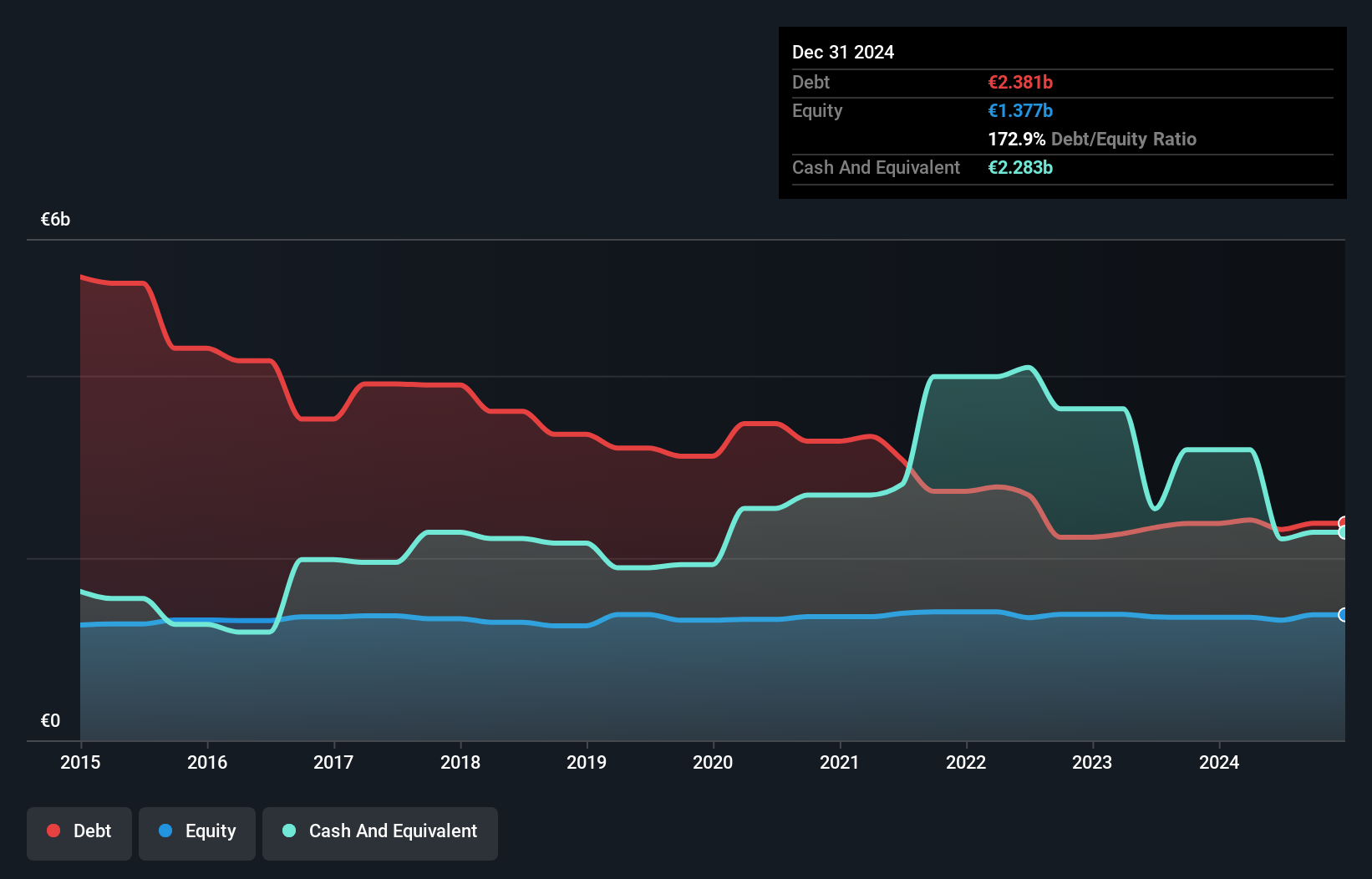

Van Lanschot Kempen, a financial firm with total assets of €16.4 billion and equity of €1.3 billion, is gaining attention for its robust performance in the past year, boasting a 71% earnings growth that outpaced the industry average of 24%. The company has an appropriate level of bad loans at 1.4%, although its allowance for bad loans remains low at 30%. With total deposits reaching €12.5 billion and loans amounting to €9.1 billion, it relies heavily on customer deposits for funding—83% to be precise—which suggests stability in its financial structure.

- Click here to discover the nuances of Van Lanschot Kempen with our detailed analytical health report.

Gain insights into Van Lanschot Kempen's past trends and performance with our Past report.

Aksa Enerji Üretim (IBSE:AKSEN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aksa Enerji Üretim A.S. is an independent power producer that generates and sells electricity across Turkey, Asia, and Africa with a market capitalization of TRY50.33 billion.

Operations: Aksa Enerji Üretim's primary revenue stream is from its non-regulated utility segment, generating TRY18.23 billion. The company operates across multiple regions, including Turkey, Asia, and Africa.

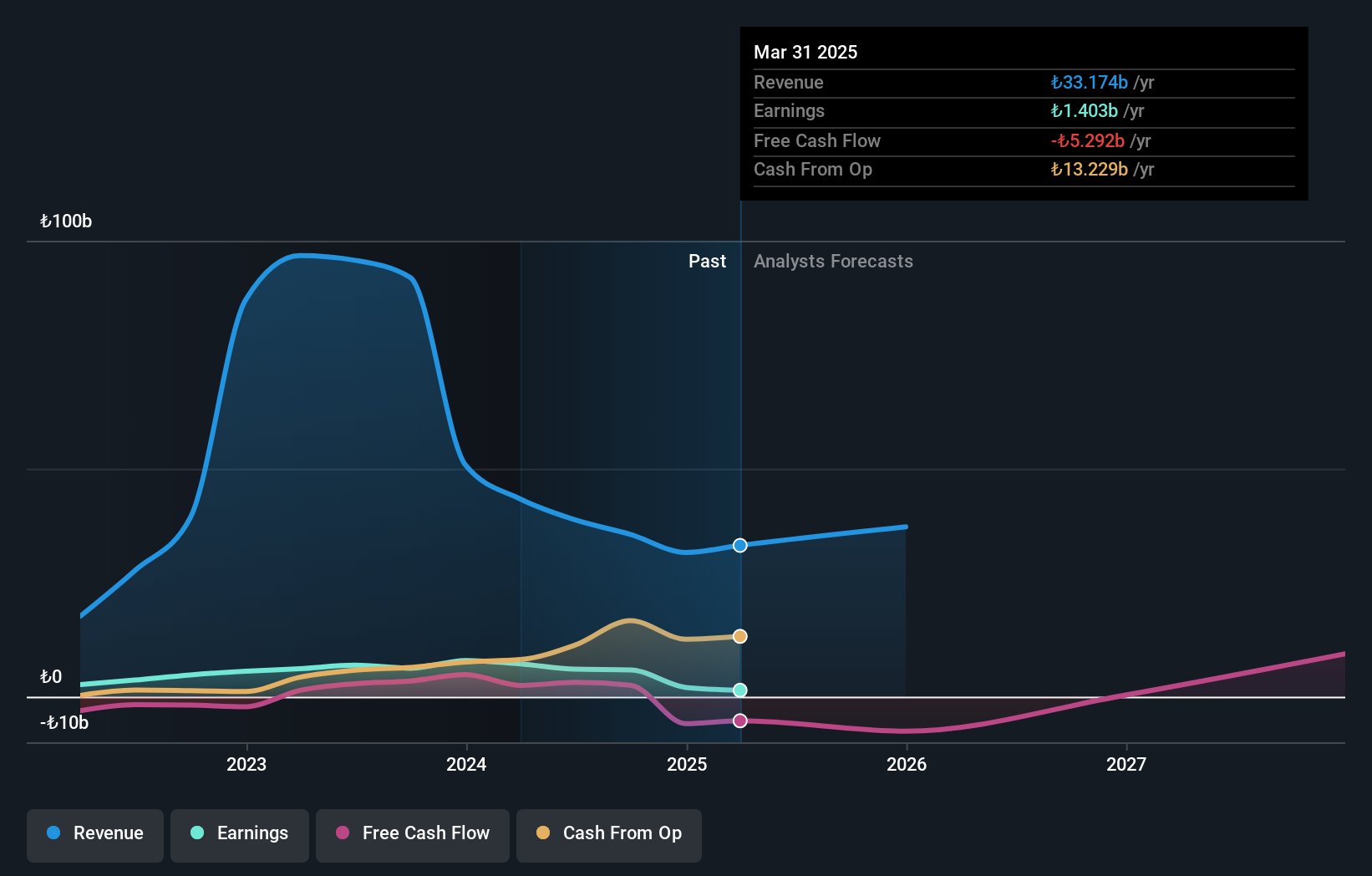

Aksa Enerji Üretim, a notable player in the energy sector, showcases a mixed financial landscape. Despite high-quality earnings and well-covered interest payments with an EBIT coverage of 3.6 times, its net debt to equity ratio stands at 55.6%, which is considered high but has improved from 158.5% over five years. Recent earnings reveal a decrease in sales to TRY 8.20 billion for Q3 compared to TRY 11.39 billion last year, alongside net income dropping to TRY 660 million from TRY 805 million previously; however, basic EPS rose to TRY 1.29 from TRY 0.66 due to operational efficiency gains despite revenue challenges.

Topco ScientificLtd (TWSE:5434)

Simply Wall St Value Rating: ★★★★★☆

Overview: Topco Scientific Co., Ltd. is involved in the provision of precision materials, manufacturing equipment, and components for the semiconductor, LCD, and LED industries across Taiwan, China, and international markets with a market cap of approximately NT$55.97 billion.

Operations: The Semiconductor and Electronic Materials Business Department is the primary revenue stream for Topco Scientific, generating NT$45.70 billion. The Environmental Engineering Division contributes NT$6.85 billion to the company's revenue.

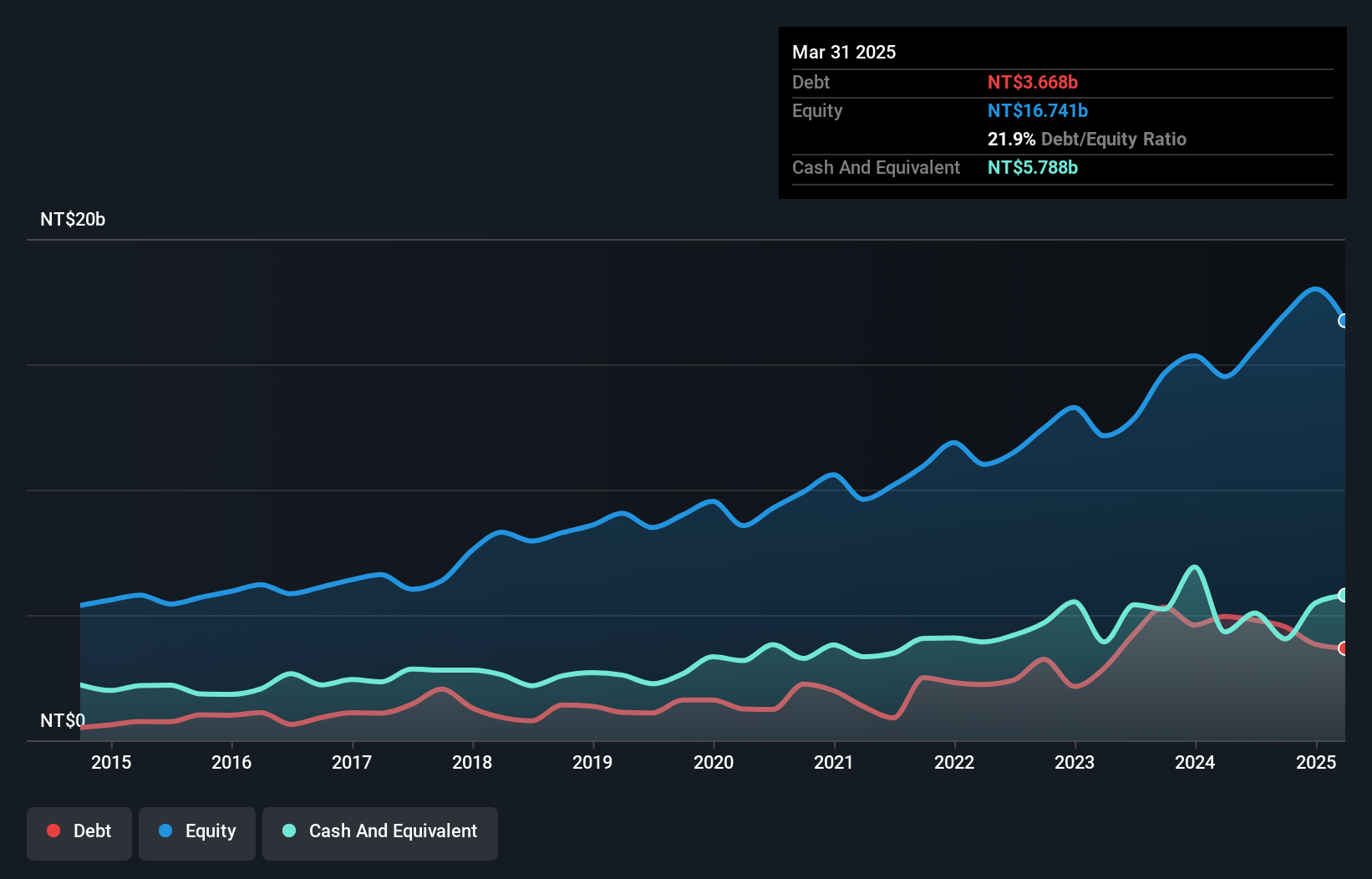

Topco Scientific has shown promising growth, with earnings rising by 21.7% over the past year, outpacing the Semiconductor industry's 5.9%. The company's price-to-earnings ratio stands at 16.6x, which is favorable compared to the Taiwan market average of 21x. Despite an increase in its debt-to-equity ratio from 17.8% to 26.6% over five years, Topco's net debt to equity remains satisfactory at 2.8%. Recent earnings reports reveal a net income of TWD 936 million for Q3 and TWD 2,732 million for nine months ended September, reflecting solid financial health and robust growth prospects in its sector.

- Click here and access our complete health analysis report to understand the dynamics of Topco ScientificLtd.

Explore historical data to track Topco ScientificLtd's performance over time in our Past section.

Next Steps

- Unlock our comprehensive list of 4668 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:VLK

Van Lanschot Kempen

Provides various financial services in the Netherlands, Belgium, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives