- Taiwan

- /

- Semiconductors

- /

- TWSE:4968

Why We're Not Concerned Yet About RichWave Technology Corporation's (TWSE:4968) 28% Share Price Plunge

RichWave Technology Corporation (TWSE:4968) shares have had a horrible month, losing 28% after a relatively good period beforehand. Longer-term shareholders would now have taken a real hit with the stock declining 8.9% in the last year.

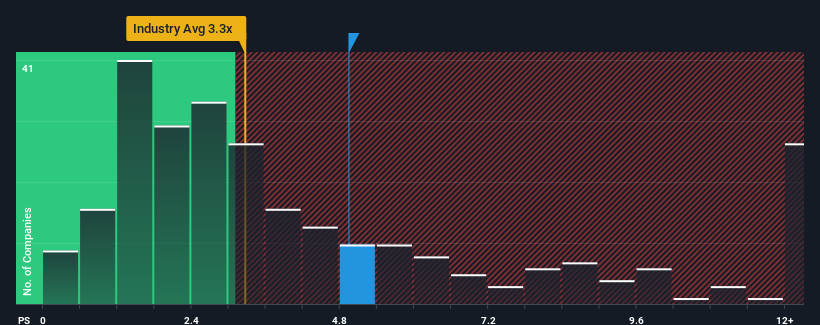

Although its price has dipped substantially, given close to half the companies operating in Taiwan's Semiconductor industry have price-to-sales ratios (or "P/S") below 3.3x, you may still consider RichWave Technology as a stock to potentially avoid with its 4.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for RichWave Technology

How Has RichWave Technology Performed Recently?

RichWave Technology has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on RichWave Technology.How Is RichWave Technology's Revenue Growth Trending?

In order to justify its P/S ratio, RichWave Technology would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. This means it has also seen a slide in revenue over the longer-term as revenue is down 44% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 47% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 25%, which is noticeably less attractive.

With this in mind, it's not hard to understand why RichWave Technology's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On RichWave Technology's P/S

There's still some elevation in RichWave Technology's P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that RichWave Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for RichWave Technology that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:4968

RichWave Technology

Designs, develops, and sells radio frequency (RF) integrated circuits in Taiwan, China, Korea, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives