- Taiwan

- /

- Semiconductors

- /

- TWSE:4968

Market Participants Recognise RichWave Technology Corporation's (TWSE:4968) Revenues Pushing Shares 28% Higher

RichWave Technology Corporation (TWSE:4968) shares have had a really impressive month, gaining 28% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 37%.

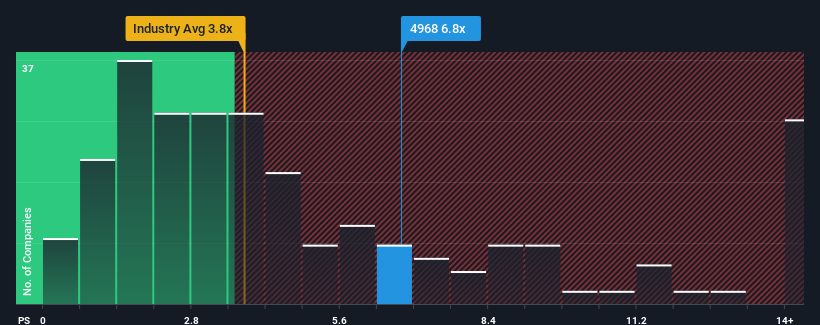

Following the firm bounce in price, you could be forgiven for thinking RichWave Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.8x, considering almost half the companies in Taiwan's Semiconductor industry have P/S ratios below 3.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for RichWave Technology

What Does RichWave Technology's P/S Mean For Shareholders?

Recent times have been pleasing for RichWave Technology as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on RichWave Technology.Is There Enough Revenue Growth Forecasted For RichWave Technology?

The only time you'd be truly comfortable seeing a P/S as steep as RichWave Technology's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 49% decline in revenue over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 33% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

In light of this, it's understandable that RichWave Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From RichWave Technology's P/S?

The strong share price surge has lead to RichWave Technology's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of RichWave Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 1 warning sign for RichWave Technology you should be aware of.

If these risks are making you reconsider your opinion on RichWave Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4968

RichWave Technology

Designs, develops, and sells radio frequency (RF) integrated circuits in Taiwan, China, Korea, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives