- China

- /

- Construction

- /

- SHSE:600039

Cheil Worldwide And 2 Other High-Quality Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with the S&P 500 Index marking its best two-year stretch in 25 years, investors are keenly observing economic indicators like the Chicago PMI and GDP forecasts for signs of future direction. Amidst these dynamics, dividend stocks continue to attract attention as they offer potential income stability; high-quality dividend stocks like Cheil Worldwide can be particularly appealing in such an environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.09% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.97% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.15% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.99% | ★★★★★★ |

Click here to see the full list of 1985 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

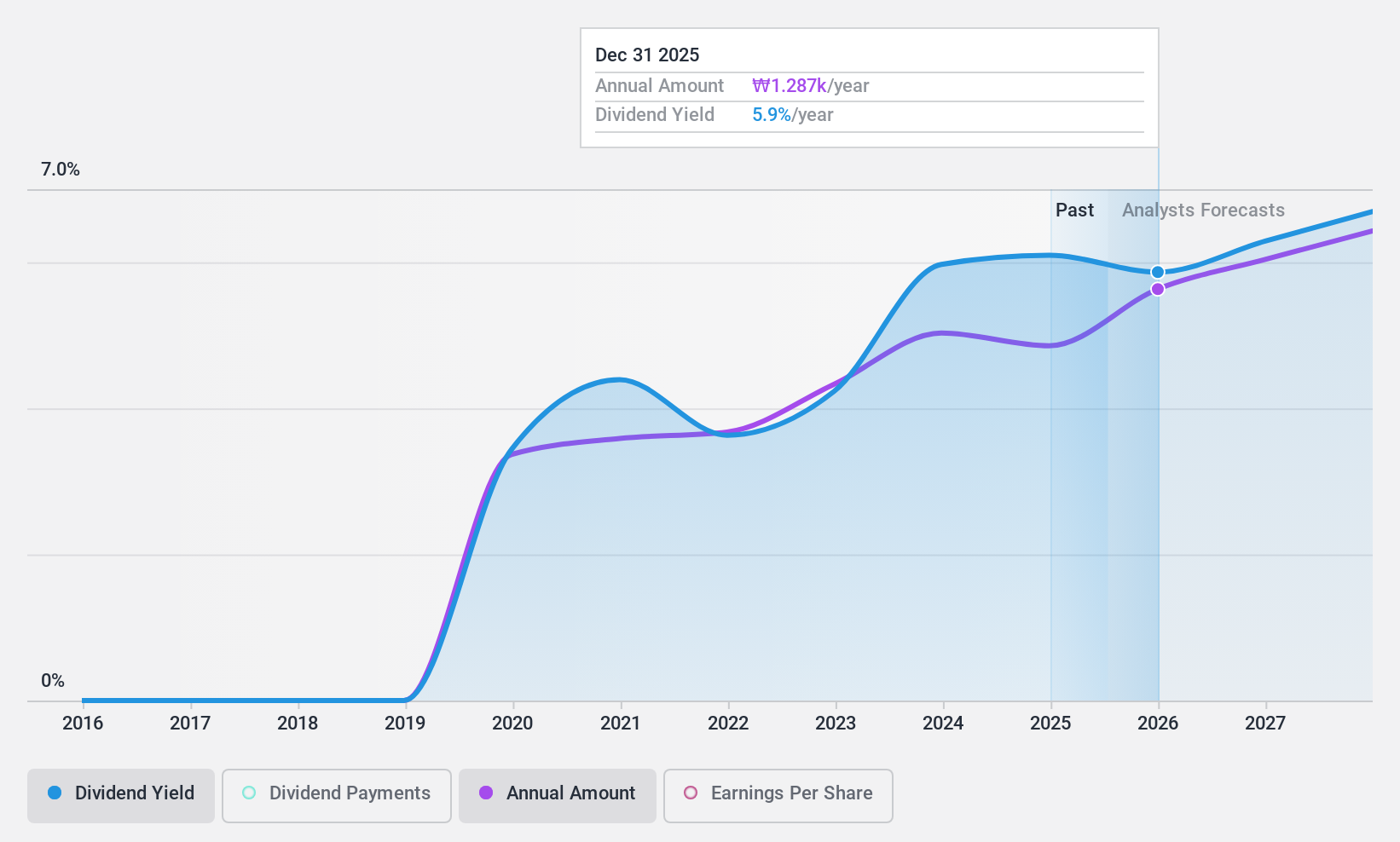

Cheil Worldwide (KOSE:A030000)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cheil Worldwide Inc. offers a range of marketing solutions globally and has a market cap of ₩1.73 trillion.

Operations: Cheil Worldwide Inc.'s revenue from advertising amounts to approximately ₩4.33 billion.

Dividend Yield: 6.5%

Cheil Worldwide's dividends are well-supported by earnings and cash flows, with a payout ratio of 60.2% and a cash payout ratio of 81.4%. Despite only five years of dividend history, payments have been reliable and stable. The dividend yield stands at 6.48%, placing it in the top quartile in the Korean market. Analysts expect significant stock price appreciation, suggesting undervaluation relative to its fair value estimate and peers.

- Click here to discover the nuances of Cheil Worldwide with our detailed analytical dividend report.

- The analysis detailed in our Cheil Worldwide valuation report hints at an deflated share price compared to its estimated value.

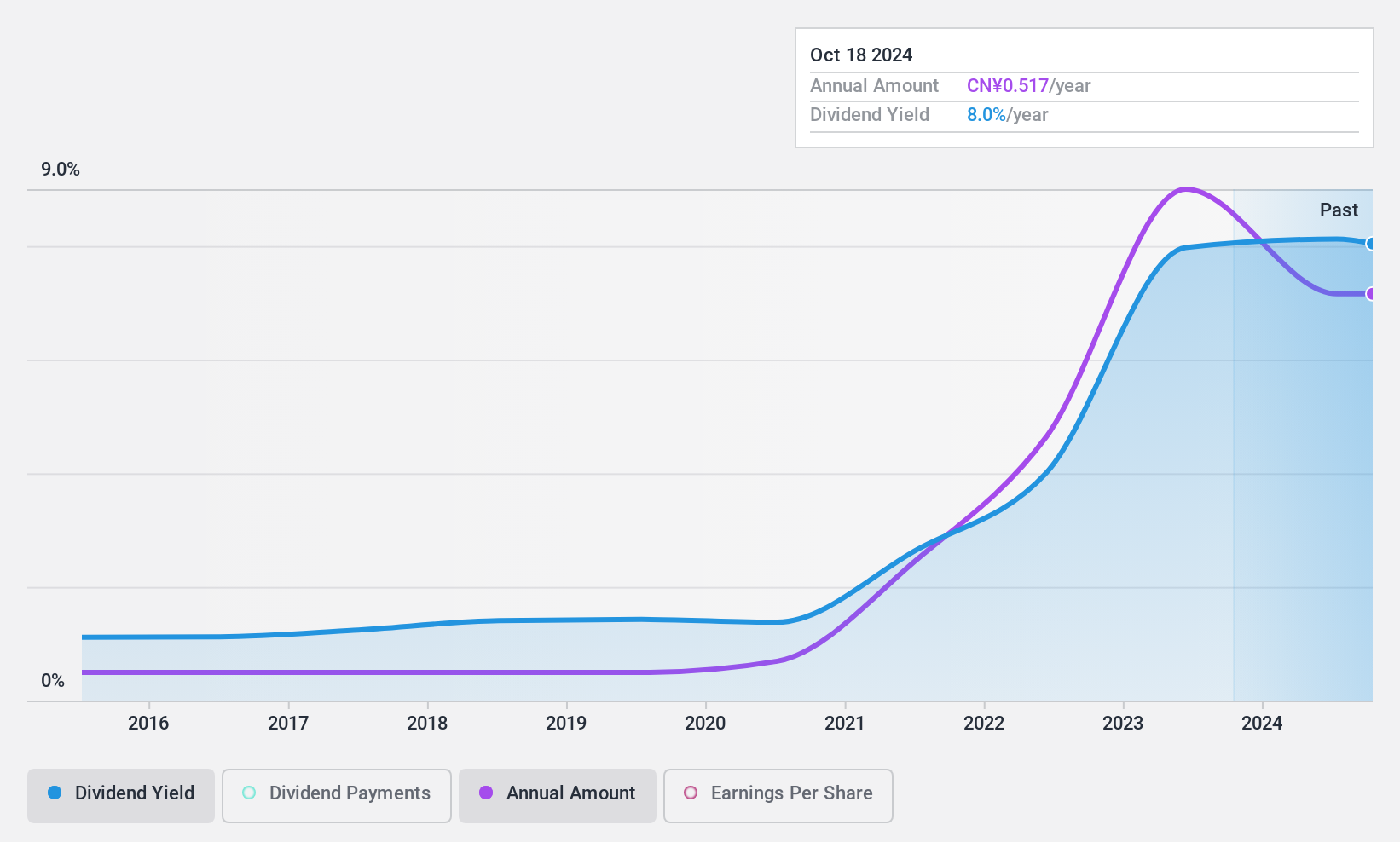

Sichuan Road & Bridge GroupLtd (SHSE:600039)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sichuan Road & Bridge Group Co., Ltd operates in the investment, development, construction, and operation of engineering construction, mining, clean energy, and new materials both in China and internationally with a market cap of CN¥62.82 billion.

Operations: Sichuan Road & Bridge Group Co., Ltd generates revenue through its activities in engineering construction, mining, clean energy, and new materials across both domestic and international markets.

Dividend Yield: 7.0%

Sichuan Road & Bridge Group's dividend yield of 7.02% ranks in the top 25% in China, with stable and growing dividends over the past decade. However, dividends are not covered by free cash flows, raising sustainability concerns despite a payout ratio of 79.4%. Recent inclusion in the SSE 180 Index highlights its market significance. Earnings have declined recently, impacting financial stability and potentially affecting future dividend reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Sichuan Road & Bridge GroupLtd.

- The valuation report we've compiled suggests that Sichuan Road & Bridge GroupLtd's current price could be quite moderate.

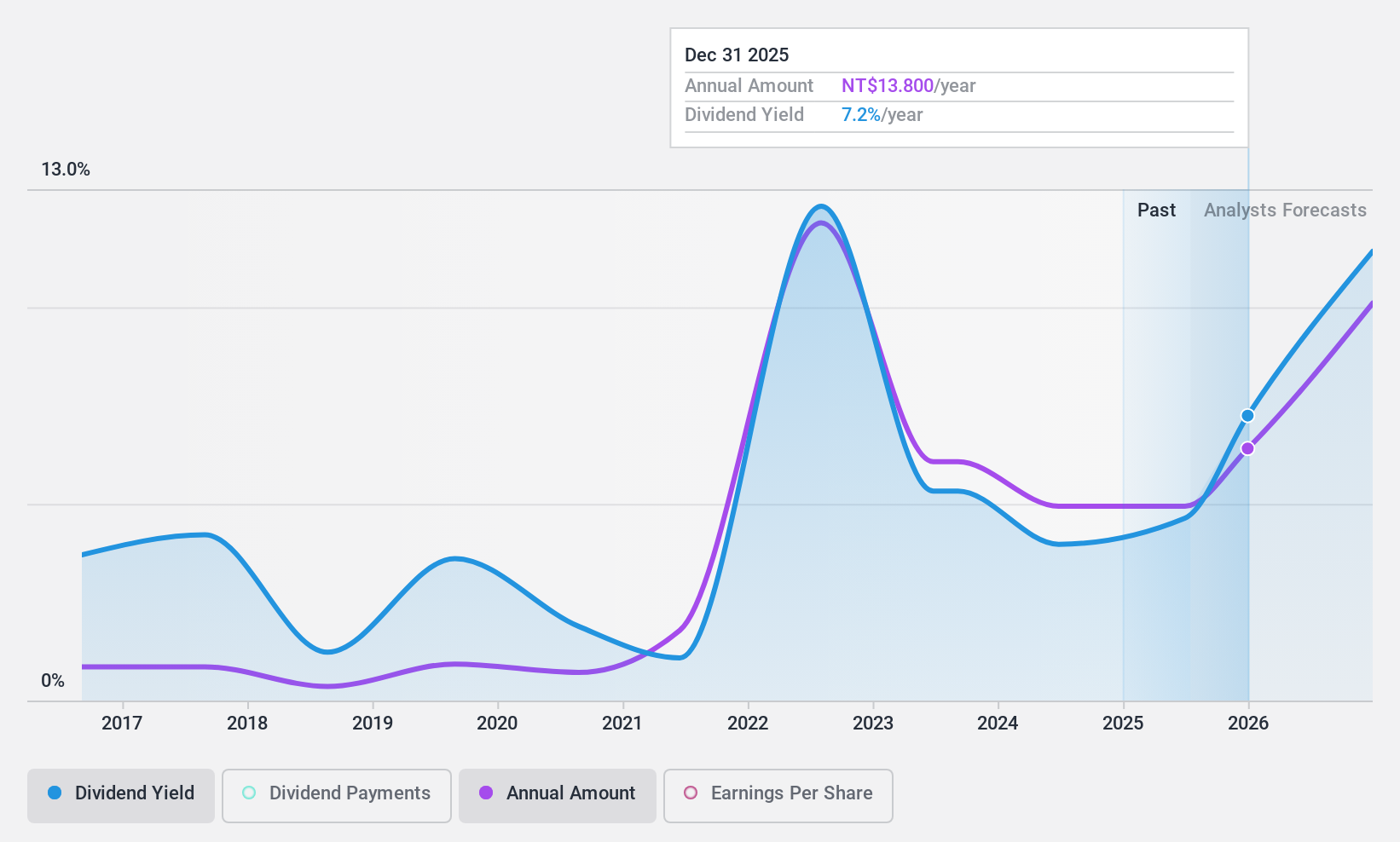

Fitipower Integrated Technology (TWSE:4961)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fitipower Integrated Technology Inc. is a Taiwan-based company specializing in the research, design, development, production, and sale of display screen integrated circuits (ICs) and power management ICs, with a market cap of NT$28.26 billion.

Operations: Fitipower Integrated Technology Inc. generates its revenue primarily from the R&D, production, and sales of integrated circuits, amounting to NT$17.82 billion.

Dividend Yield: 4.5%

Fitipower Integrated Technology's dividend yield of 4.53% places it in the top 25% of Taiwan's market, but sustainability is a concern as dividends are not well covered by free cash flows, indicated by a high cash payout ratio of 239.8%. Despite earnings coverage with a reasonable payout ratio of 63.7%, past dividend volatility and unreliability raise caution for investors seeking stable income streams. Recent earnings growth and an attractive P/E ratio suggest potential value amidst these challenges.

- Take a closer look at Fitipower Integrated Technology's potential here in our dividend report.

- The analysis detailed in our Fitipower Integrated Technology valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Click here to access our complete index of 1985 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600039

Sichuan Road & Bridge GroupLtd

Engages in the investment, development, construction, and operation of engineering construction, mining, clean energy, and new materials in China and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives