- Taiwan

- /

- Semiconductors

- /

- TWSE:3034

Novatek Microelectronics (TWSE:3034) Anticipates Q4 Revenue Decline Amid Emerging Market Expansion

Reviewed by Simply Wall St

Novatek Microelectronics (TWSE:3034) is navigating a complex financial environment, marked by a forecasted revenue decline in the fourth quarter of 2024 to TWD 24-25 billion, due to off-peak demand and rising material costs. The company remains a significant player in the OLED sector, supported by strategic alliances and a strong financial profile, including a high return on equity and debt-free status. Readers can expect insights into Novatek's strategic responses to operational inefficiencies, emerging market opportunities, and the impact of global economic uncertainties on its future performance.

Take a closer look at Novatek Microelectronics's potential here.

Innovative Factors Supporting Novatek Microelectronics

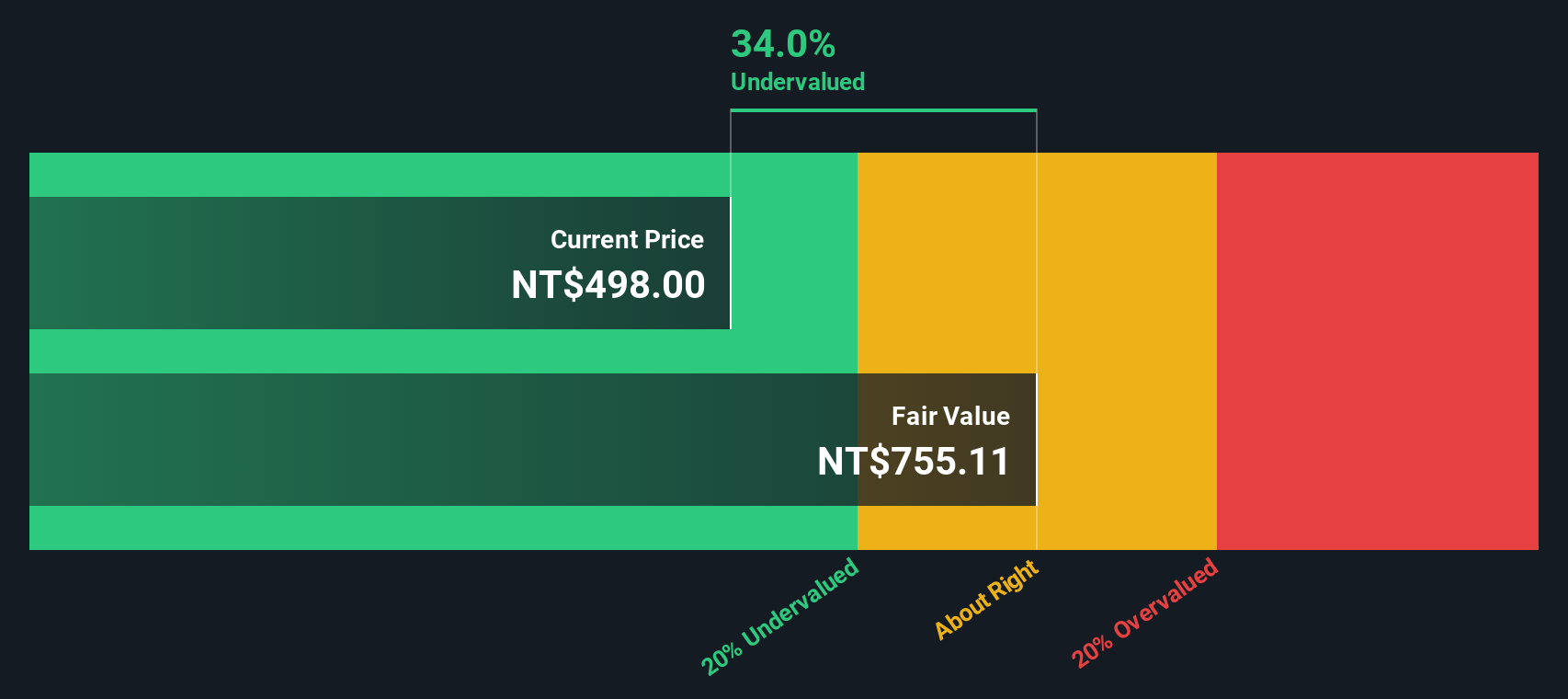

Novatek Microelectronics showcases a strong financial profile, highlighted by a high return on equity of 32.9% and a debt-free status, indicating solid financial health. The company has consistently delivered positive earnings growth over the past five years at 15% annually, underscoring its profitability and operational efficiency. Strategic alliances with major tech firms have fortified its supply chain and enhanced product offerings, particularly in the OLED sector, as noted by Tony Tseng in the latest earnings call. Furthermore, the company is trading below its estimated fair value of NT$481.5 compared to NT$598.62, suggesting a favorable SWS fair ratio that aligns well with industry standards.

Challenges Constraining Novatek Microelectronics's Potential

Novatek faces challenges such as a 5.3% decline in earnings growth over the past year, impacting its net profit margins, which now stand at 19.9%, down from 20.8%. The company has also struggled with operational inefficiencies, as some production lines have experienced delays, affecting its ability to meet demand. Rising material costs have pressured margins, a concern highlighted by David Chen, which the company is actively addressing. Moreover, the volatility in dividend payments, with a high payout ratio of 93.3%, reflects financial challenges in maintaining consistent shareholder returns.

Emerging Markets or Trends for Novatek Microelectronics

Novatek is poised to capitalize on emerging opportunities through new product lines and technological investments. David Chen announced plans to launch several products next year targeting emerging market needs, which could enhance market position. Investments in AI and automation are expected to boost production efficiency and reduce costs, potentially improving future margins. The company is also exploring geographical expansion into Southeast Asia, where demand is rapidly growing, offering a promising avenue for revenue growth.

Key Risks and Challenges That Could Impact Novatek Microelectronics's Success

Novatek is not immune to external threats, including economic headwinds and regulatory hurdles. Global economic uncertainties may affect consumer spending, a risk acknowledged by Tony Tseng. Additionally, changes in trade policies could pose challenges to supply chain logistics, potentially disrupting operations. The company is also managing supply chain vulnerabilities due to geopolitical tensions, which could impact production and delivery timelines.

To learn about how Novatek Microelectronics's valuation metrics are shaping its market position, check out our detailed analysis of Novatek Microelectronics's Valuation. See what the latest analyst reports say about Novatek Microelectronics's future prospects and potential market movements.Conclusion

Novatek Microelectronics demonstrates impressive financial health with a high return on equity of 32.9% and a debt-free status, which supports its ability to weather financial challenges and capitalize on growth opportunities. Recent declines in earnings growth and margin pressures are concerning, but the company's strategic alliances and investments in emerging technologies like AI and automation position it well for future efficiency gains and market expansion, particularly in Southeast Asia. The current trading price below its estimated fair value of NT$481.5 compared to NT$598.62, along with a favorable Price-To-Earnings Ratio, indicates a potential for appreciation, making it an attractive proposition for investors considering its strategic initiatives and strong market positioning. However, Novatek must navigate operational inefficiencies, rising material costs, and external threats such as economic uncertainties and geopolitical tensions to maintain its trajectory of sustainable growth and shareholder value.

Next Steps

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Novatek Microelectronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TWSE:3034

Novatek Microelectronics

Engages in research and development, manufacture, and sale of integrated circuit chips for speech, communication, computer peripheral, LCD driver IC system, embedded MCU, DSP, and system applications in Taiwan, Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives