- Japan

- /

- Basic Materials

- /

- TSE:5288

Three Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets experience a rebound with U.S. stocks climbing higher amid cooling inflation and strong bank earnings, investors are increasingly looking for stability in the form of dividend stocks. In an environment where value stocks are outperforming growth shares, a good dividend stock is often characterized by its ability to provide consistent income and potential capital appreciation, making it an attractive option for those seeking to navigate current market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.50% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.02% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

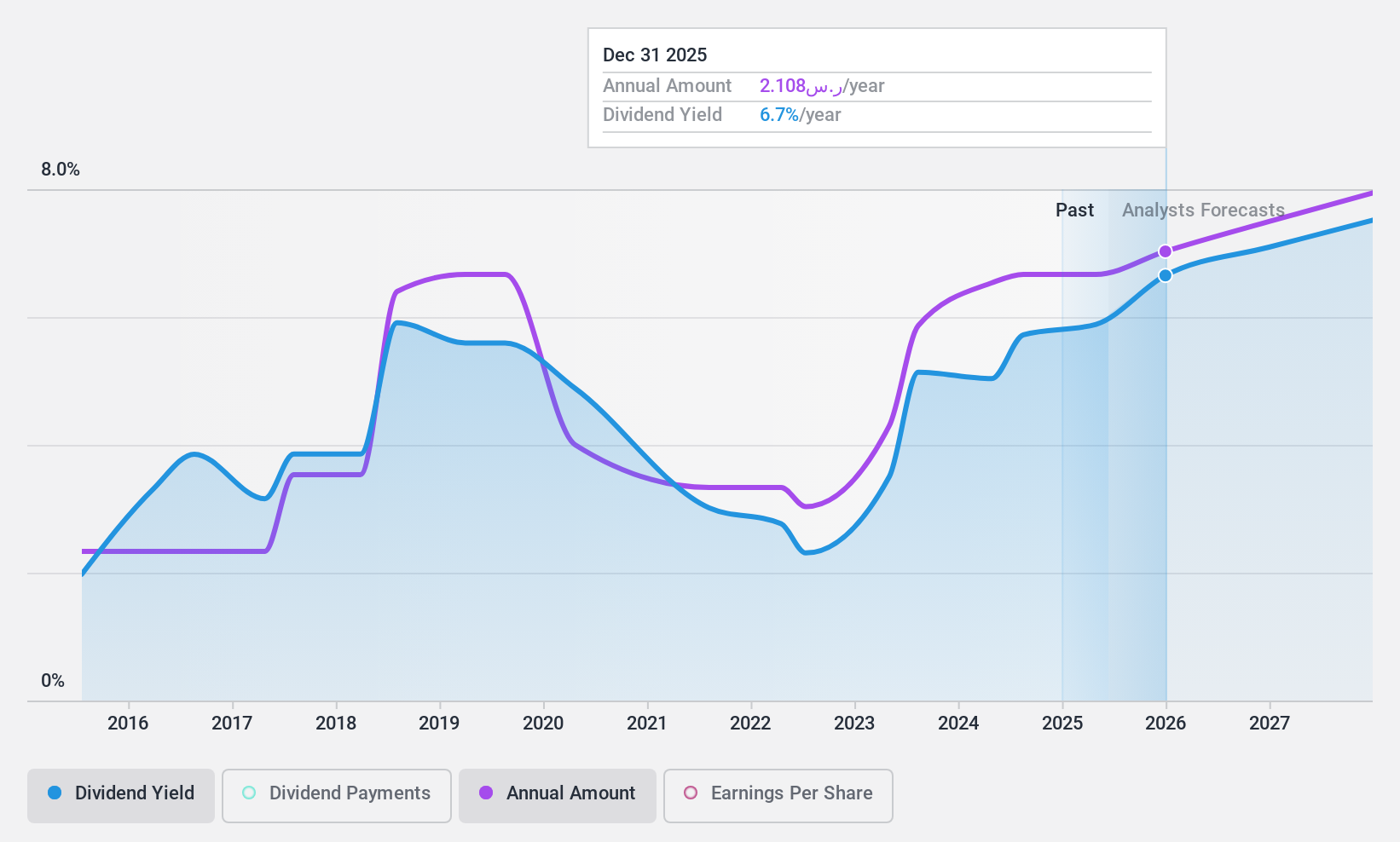

Saudi Awwal Bank (SASE:1060)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Saudi Awwal Bank, along with its subsidiaries, offers banking and financial services in the Kingdom of Saudi Arabia, with a market cap of SAR73.56 billion.

Operations: Saudi Awwal Bank's revenue segments include Treasury services at SAR1.91 billion, Capital Markets at SAR445.65 million, Wealth & Personal Banking at SAR3.70 billion, and Corporate and Institutional Banking at SAR7.02 billion.

Dividend Yield: 5.6%

Saudi Awwal Bank's dividend payments are covered by earnings with a payout ratio of 53.7%, and its current dividend yield is among the top 25% in the Saudi Arabian market. Despite this, dividends have been volatile over the past decade. Recent earnings show growth, with net income rising to SAR 5.94 billion for the first nine months of 2024. The bank's strategic alliance with Swvl Holdings aims to enhance urban mobility in Riyadh, potentially impacting future operations positively.

- Click here to discover the nuances of Saudi Awwal Bank with our detailed analytical dividend report.

- Our valuation report here indicates Saudi Awwal Bank may be undervalued.

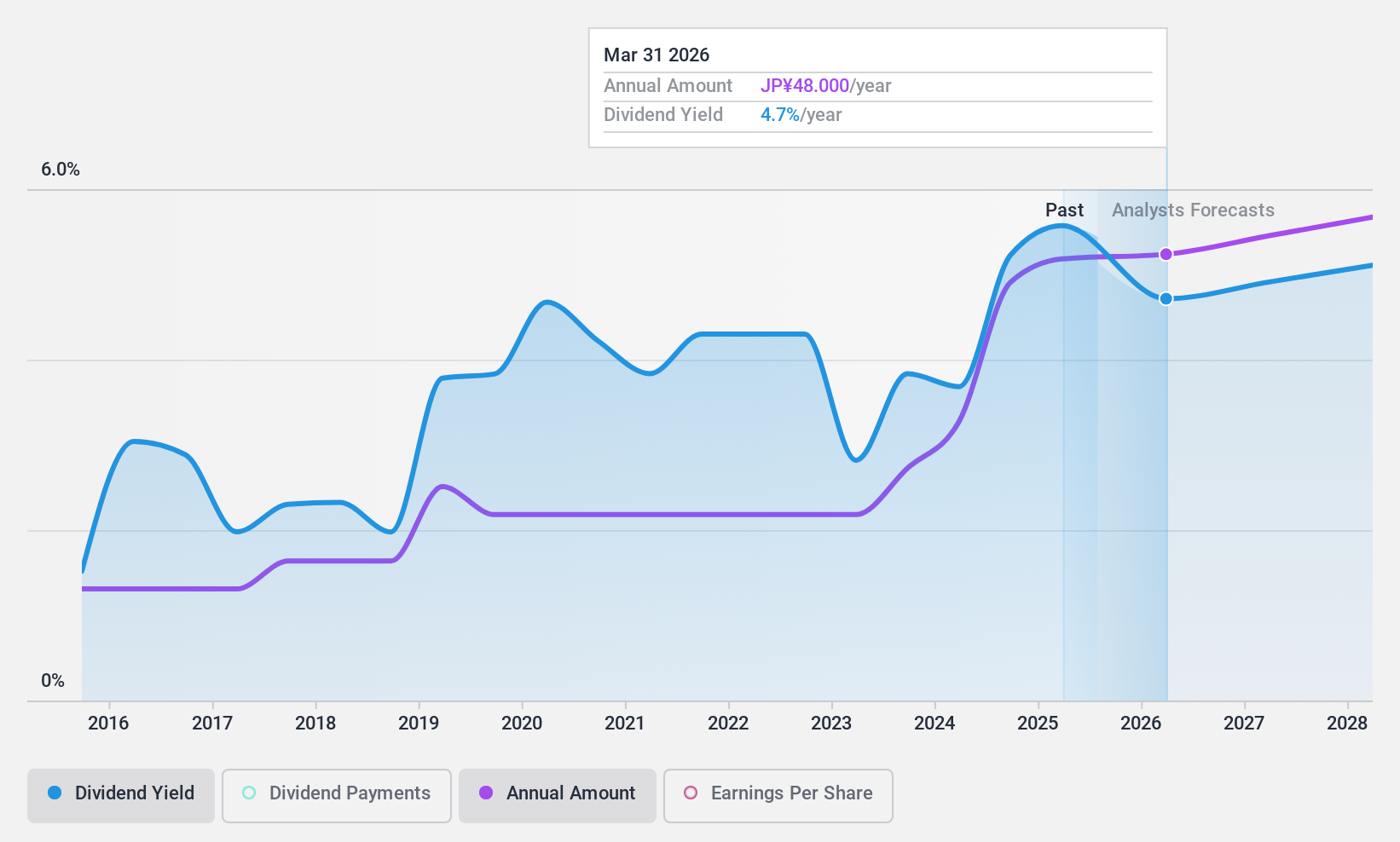

Asia Pile Holdings (TSE:5288)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Asia Pile Holdings Corporation, with a market cap of ¥31.61 billion, operates in the foundation construction industry through its subsidiaries in Japan and Vietnam.

Operations: Asia Pile Holdings Corporation generates revenue primarily from its Domestic Business segment, amounting to ¥81.60 billion, and its Foreign Operation segment, which contributes ¥17.96 billion.

Dividend Yield: 5.7%

Asia Pile Holdings offers a compelling dividend profile with a yield of 5.72%, ranking in the top 25% of Japanese dividend payers. The company's dividends are well-supported by earnings and cash flows, evidenced by payout ratios of 61.5% and 45.5%, respectively. Over the past decade, Asia Pile has maintained stable and growing dividends, reflecting reliability for income investors. Furthermore, it trades at a significant discount to its estimated fair value, enhancing its investment appeal.

- Take a closer look at Asia Pile Holdings' potential here in our dividend report.

- Our expertly prepared valuation report Asia Pile Holdings implies its share price may be lower than expected.

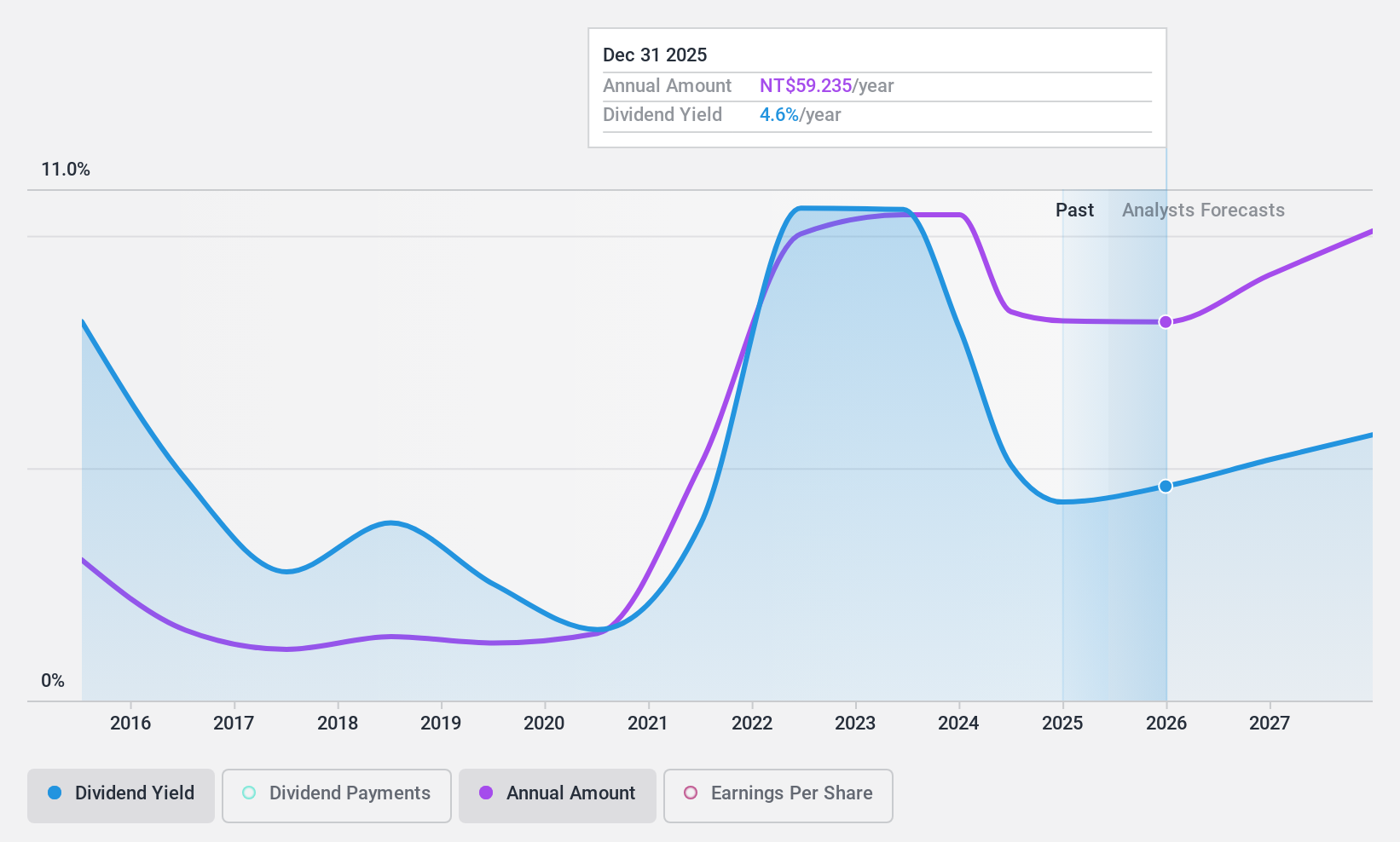

MediaTek (TWSE:2454)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MediaTek Inc. is involved in the research, development, production, manufacture, and marketing of multimedia integrated circuits (ICs) across Taiwan, the rest of Asia, and internationally with a market cap of NT$2.34 trillion.

Operations: MediaTek Inc.'s revenue primarily comes from its Multimedia and Mobile Phone Chips and Other Integrated Circuit Design Products segment, which generated NT$522.10 billion.

Dividend Yield: 4.1%

MediaTek's dividend yield of 4.06% is below the top tier in Taiwan, and its dividends have been volatile over the past decade. Despite this, payouts are covered by earnings (87.2% payout ratio) and cash flows (49.6% cash payout ratio). Recent earnings growth of 55.1% suggests potential for future stability, although recent sales declines could impact performance. The company's P/E ratio of 21.6x indicates it is valued below the industry average, adding investment appeal despite dividend unpredictability.

- Click to explore a detailed breakdown of our findings in MediaTek's dividend report.

- The valuation report we've compiled suggests that MediaTek's current price could be inflated.

Next Steps

- Navigate through the entire inventory of 1983 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5288

Asia Pile Holdings

Through its subsidiaries, engages in the foundation construction business in Japan and Vietnam.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives